A New Mexico Triple Net Commercial Lease Agreement is a legally binding contract between a landlord and a tenant for the rental of commercial real estate. In this type of agreement, the tenant is responsible for paying for the property's ongoing operating expenses, including property taxes, insurance, and maintenance costs, in addition to the base rent. Keywords: New Mexico, Triple Net Commercial Lease Agreement, real estate rental, landlord, tenant, commercial real estate, operating expenses, property taxes, insurance, maintenance costs, base rent. There are several types of New Mexico Triple Net Commercial Lease Agreements that landlords and tenants can choose from based on their specific needs and preferences. These may include: 1. Single-Tenant Triple Net Lease Agreement: This agreement involves a single tenant who leases a standalone commercial property, such as a retail store, office building, or warehouse. The tenant is responsible for all operating expenses associated with the property. 2. Multi-Tenant Triple Net Lease Agreement: In this type of agreement, multiple tenants lease separate units within a larger commercial property, such as a shopping center or a business complex. Each tenant is responsible for their share of the property's operating expenses based on their occupied square footage. 3. Gross Lease Agreement with NNN Component: Some lease agreements might combine elements of both gross lease and triple net lease structures. In this case, the tenant pays a base rent that covers most operating expenses, while certain additional expenses, such as property taxes or insurance, are passed on to the tenant as an additional charge. When drafting a New Mexico Triple Net Commercial Lease Agreement, it is crucial to include specific details to protect the interests of both parties. Important provisions that might be included are lease term and renewal options, rent payment details, security deposit requirements, maintenance and repair responsibilities, specific permitted uses for the property, and dispute resolution procedures. Landlords may also want to address additional matters such as tenant improvements, assignment or subleasing of the property, insurance requirements, default and remedies, and exclusivity clauses. It is vital for both landlords and tenants to thoroughly review and understand all the terms and conditions of the agreement before signing. Seeking legal advice from a real estate attorney who specializes in lease agreements can ensure that all relevant laws and regulations in New Mexico are properly considered. In conclusion, a New Mexico Triple Net Commercial Lease Agreement is a comprehensive contract that outlines the responsibilities and rights of both the landlord and tenant in a commercial real estate rental. Choosing the appropriate type of agreement and including all necessary provisions will help ensure a successful and harmonious landlord-tenant relationship.

New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental?

If you require thorough, obtain, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Leverage the site’s simple and convenient search function to locate the documents you need. Various templates for business and personal purposes are classified by categories and jurisdictions, or by keywords.

Employ US Legal Forms to find the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental with just a few clicks.

Every legal document format you purchase is yours indefinitely. You can access all forms you saved in your account. Click the My documents section and select a form to print or download again.

Compete and acquire, and print the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental with US Legal Forms. There are numerous professional and jurisdiction-specific forms available to meet your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to obtain the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

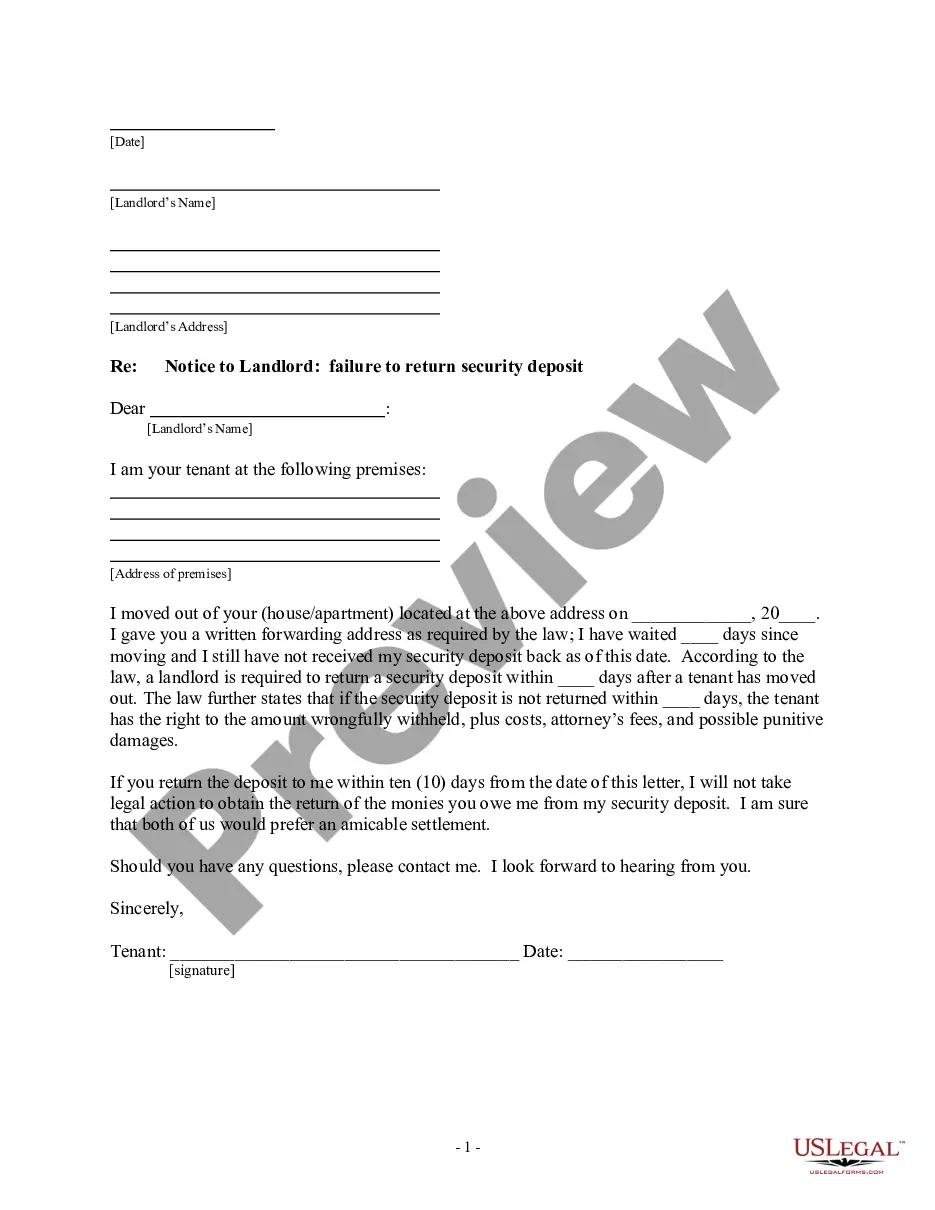

- Step 2. Use the Preview option to review the form’s information. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and provide your details to register for an account.

- Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify and print or sign the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental.

Form popularity

FAQ

The three main types of leases are gross leases, net leases, and modified gross leases. Gross leases involve the landlord covering most operating costs, while net leases shift these responsibilities to tenants, giving rise to the popular triple net lease. Considering the efficiency and potential benefits of a New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental can significantly enhance your real estate investment strategy.

The most common type of commercial lease is the net lease, particularly the triple net lease. This lease structure allows landlords to pass on property expenses to tenants, thereby securing a more stable financial return. By utilizing the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental, both parties can ensure a fair and transparent arrangement that protects their interests.

The most common type of leasehold is the estate for years, which is a rental agreement that has a fixed duration. This leasehold ensures that both landlord and tenant have a clear understanding of the property's use and payment terms. When formalizing this type of agreement, consider utilizing the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental for added clarity and security.

The most common lease used in commercial real estate is the net lease, specifically the triple net lease. This lease structure benefits landlords by shifting many financial responsibilities to tenants, ultimately promoting a more hands-off management approach. If you're considering commercial property in New Mexico, the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental can be an excellent option for both landlords and tenants.

The most common commercial lease agreement is the net lease, particularly the triple net lease. This arrangement requires the tenant to cover all operating expenses, such as property taxes, insurance, and maintenance, alongside rent. By opting for the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental, landlords can enjoy predictable income while offering tenants stability and control over their rental property.

The best triple net lease tenants are those with a stable financial history and a proven track record in their industry. Retail chains, certain healthcare providers, and fast-food restaurants often qualify as excellent candidates. They not only ensure timely payments but also often extend their lease terms, benefiting both the landlord and the tenant in the New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental.

Yes, a landlord can terminate a lease in New Mexico under certain conditions, such as non-payment of rent or violation of lease terms. To lawfully end the lease, the landlord must typically provide the tenant with a written notice. Understanding these rules helps protect both parties involved in a New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental.

Yes, Microsoft Word offers various templates for lease agreements, including those suitable for a New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental. These templates can be a helpful starting point, but it is crucial to customize them to comply with New Mexico’s specific laws and requirements. Therefore, you may also want to consider using platforms like US Legal Forms to access more tailored, legally compliant templates.

While a New Mexico Triple Net Commercial Lease Agreement - Real Estate Rental offers many benefits, there are potential disadvantages. For instance, if the tenant fails to fulfill their maintenance obligations, landlords may incur unexpected costs. Additionally, vacancies can lead to financial strain due to the reliance on tenant payments, which highlights the importance of careful tenant selection and due diligence.

net lease, similar to a triple net lease, requires the tenant to cover property taxes and insurance, but it may not include maintenance costs. This type of lease allows for a slightly lower base rent, while providing landlords with more predictable expenses. In the framework of a New Mexico Triple Net Commercial Lease Agreement Real Estate Rental, understanding the nuances of netnet leases can lead to informed decisions about investment opportunities.