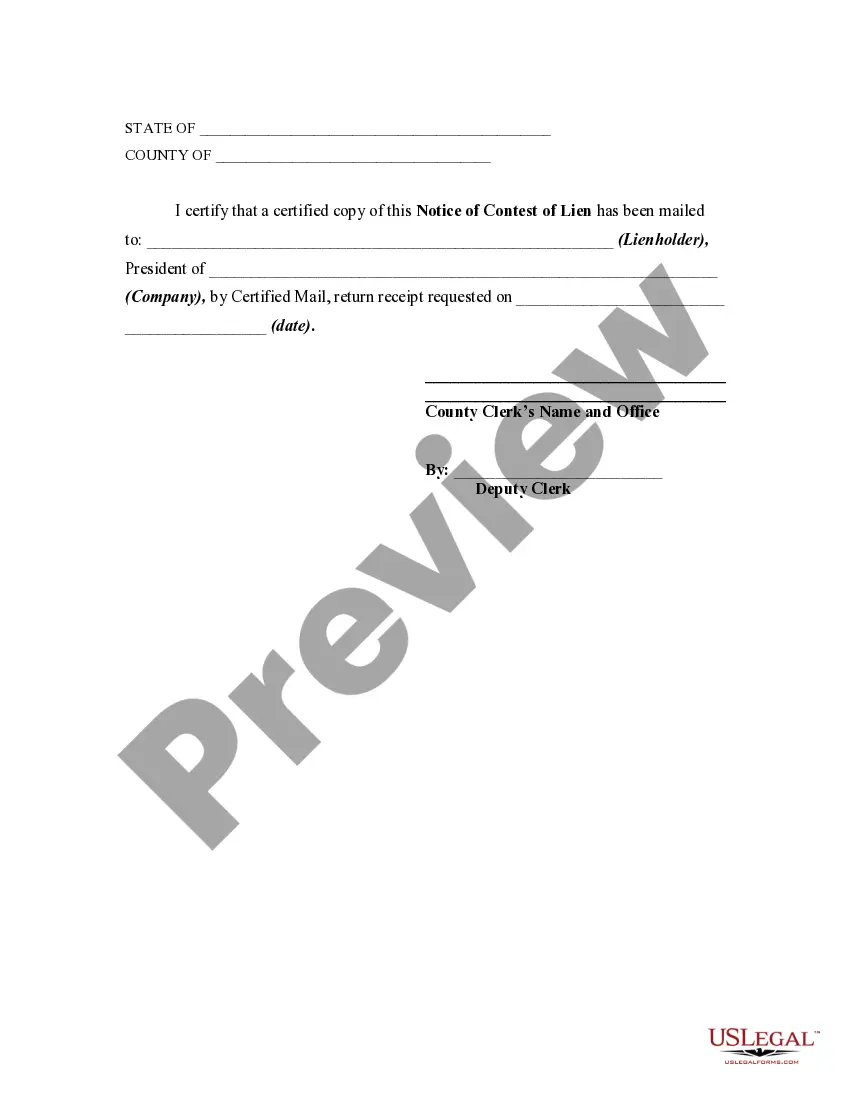

This form is a sample of a notice contesting a lien that has been recorded in the office of the appropriate county official.This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Notice of Contest of Lien

Description

How to fill out Notice Of Contest Of Lien?

If you wish to total, obtain, or printing lawful papers templates, use US Legal Forms, the most important selection of lawful kinds, that can be found on-line. Use the site`s basic and convenient look for to discover the paperwork you want. Various templates for business and personal functions are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to discover the New Mexico Notice of Contest of Lien in a number of click throughs.

When you are currently a US Legal Forms client, log in for your accounts and then click the Obtain button to obtain the New Mexico Notice of Contest of Lien. You can even entry kinds you earlier saved in the My Forms tab of your accounts.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the form for that correct metropolis/country.

- Step 2. Make use of the Review solution to look over the form`s information. Never forget to learn the information.

- Step 3. When you are not satisfied with the develop, make use of the Look for discipline towards the top of the display to get other models in the lawful develop template.

- Step 4. After you have found the form you want, go through the Buy now button. Opt for the rates program you choose and put your references to register on an accounts.

- Step 5. Method the purchase. You can use your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Pick the file format in the lawful develop and obtain it on your device.

- Step 7. Complete, edit and printing or signal the New Mexico Notice of Contest of Lien.

Each and every lawful papers template you get is the one you have for a long time. You possess acces to each develop you saved in your acccount. Select the My Forms portion and select a develop to printing or obtain yet again.

Be competitive and obtain, and printing the New Mexico Notice of Contest of Lien with US Legal Forms. There are many specialist and condition-particular kinds you may use for the business or personal requires.

Form popularity

FAQ

In New Mexico, a mechanics lien filed by any party remains an encumbrance on the property for a period of two years. If an action to enforce the lien has not been initiated within two years from the date on which the lien was filed, the lien is extinguished.

The purpose of the Lien Protection Efficiency Act is to provide for the efficient filing and recording of documents and the protection of public officials and employees and the citizens of the state against nonconsensual common law liens by imposing limitations on the circumstances in which nonconsensual common law ...

In all cases when a notice of lien for taxes, penalties and interest has been filed under Section 7-1-38 NMSA 1978 and a period of ten years has passed from the date the lien was filed, as shown on the notice of lien, the taxes, penalties and interest for which the lien is claimed shall be conclusively presumed to have ...

NEW MEXICO A judgment is a lien on the real estate of the judgment debtor and expires after fourteen years. N.M. Stat. § 39-1-6.

Once entered, a judgment is enforceable in New Mexico for fourteen years and cannot be renewed.

About New Mexico Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

A lienholder will only remove a lien after the loan debt has been paid off. After the loan has been paid off, the lienholder will send you one of the following: A completed ?Release of Lien? form, on Motor Vehicle Division (?MVD?) of New Mexico letterhead. A completed ?Release of Lien? section on the vehicle title.

New Mexico mechanics liens are perfected by filing the claim in the county clerk's office where the property is physically located. If the property is situated in more than one county, the claim should be filed in the clerk's office of all counties it is located in.