Generally, a debtor may demand a receipt for payment of an obligation. No particular form is necessary for a valid receipt. However, a receipt should recite all facts necessary to substantiate the tender and acceptance of payment.

New Mexico Receipt for Payment of Salary or Wages

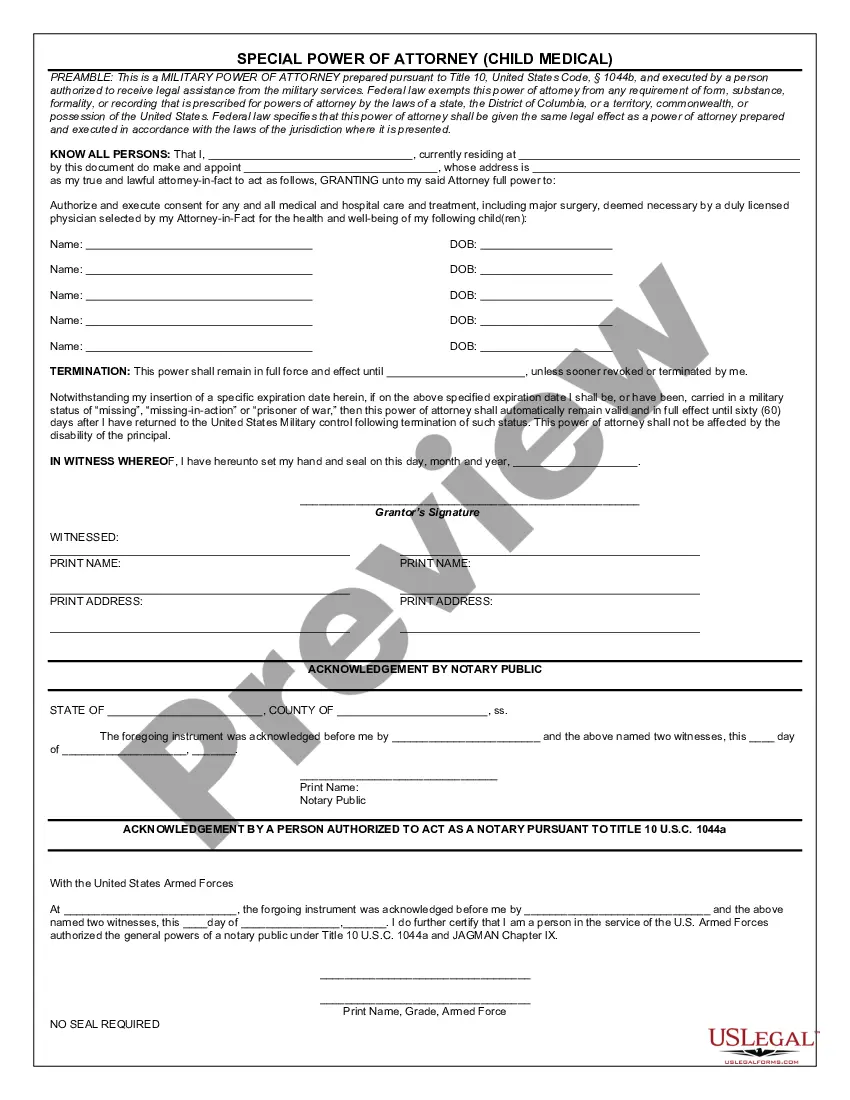

Description

How to fill out Receipt For Payment Of Salary Or Wages?

If you wish to finish, obtain, or create legal document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Utilize the site`s straightforward and user-friendly search to find the forms you need.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You will have access to all forms you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and obtain, and print the New Mexico Receipt for Payment of Salary or Wages with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to find the New Mexico Receipt for Payment of Salary or Wages in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to locate the New Mexico Receipt for Payment of Salary or Wages.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your relevant city/state.

- Step 2. Utilize the Preview option to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the page to find other forms from the legal document template.

- Step 4. After you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the New Mexico Receipt for Payment of Salary or Wages.

Form popularity

FAQ

GRT, or Gross Receipts Tax, is a tax imposed on the total revenue a business earns from its activities in New Mexico. The tax rate can vary depending on the location and type of transaction, so it’s important for businesses to stay informed. Properly handling GRT is essential when issuing a New Mexico Receipt for Payment of Salary or Wages, as it affects overall taxation. To navigate these complexities, consider utilizing USLegalForms for reliable guidance and resources.

New Mexico gross receipts refer to the total revenue earned by a business from selling goods and services, which is subject to gross receipts tax. This tax applies to nearly all business transactions in the state, making it vital for businesses to track their receipts accurately. When generating a New Mexico Receipt for Payment of Salary or Wages, ensuring compliance with gross receipts regulations helps in avoiding penalties. For clarity on requirements, you can explore tools available at USLegalForms.

Yes, New Mexico does have payroll taxes, which are essential for funding various state programs. Employers in New Mexico must withhold state income tax from their employees' wages, as well as contribute to unemployment insurance. Understanding these requirements is crucial for issuing a New Mexico Receipt for Payment of Salary or Wages. Utilizing resources like USLegalForms can help simplify the payroll process for employers.

The number for NM gross receipts encompasses various tax-related identifiers and transaction reports you must file. Businesses must keep accurate records and report their gross receipts to comply with state regulations. UsLegalForms provides helpful templates and guides, including the New Mexico Receipt for Payment of Salary or Wages, to support business compliance.

To obtain your 1099-G from New Mexico, you should contact the New Mexico Taxation and Revenue Department to request a copy. This document reflects income received that may need to be reported on your tax return. Having your 1099-G handy is beneficial when managing your records, including the New Mexico Receipt for Payment of Salary or Wages.

Total gross receipts refer to the complete income a business receives from its sales and services before any deductions. This figure serves as the basis for calculating gross receipts tax in New Mexico. Knowing how to report total gross receipts becomes all the more important when completing the New Mexico Receipt for Payment of Salary or Wages.

You can find your New Mexico CRS number by checking your business registration documents or the last tax return you filed. If you are unsure, you may contact the New Mexico Taxation and Revenue Department directly for assistance. Having your CRS number is important, especially when preparing documents like the New Mexico Receipt for Payment of Salary or Wages.

Yes, New Mexico imposes a gross receipts tax on the sale of goods and services. This tax applies to most transactions and is a vital part of the state's revenue system. For businesses, understanding this tax and how it relates to the New Mexico Receipt for Payment of Salary or Wages is crucial for accurate financial reporting.

To calculate the gross receipts tax in New Mexico, total your gross receipts from sales and services. Multiply that amount by the applicable tax rate, which may vary by locality. Utilizing UsLegalForms can streamline this process, especially when managing documents like the New Mexico Receipt for Payment of Salary or Wages.

The New Mexico gross receipts tax number is essential for businesses operating in the state. It identifies your company in tax matters and includes registration with the New Mexico Taxation and Revenue Department. If you need assistance navigating tax regulations, UsLegalForms offers comprehensive resources, including the New Mexico Receipt for Payment of Salary or Wages to help ensure compliance.