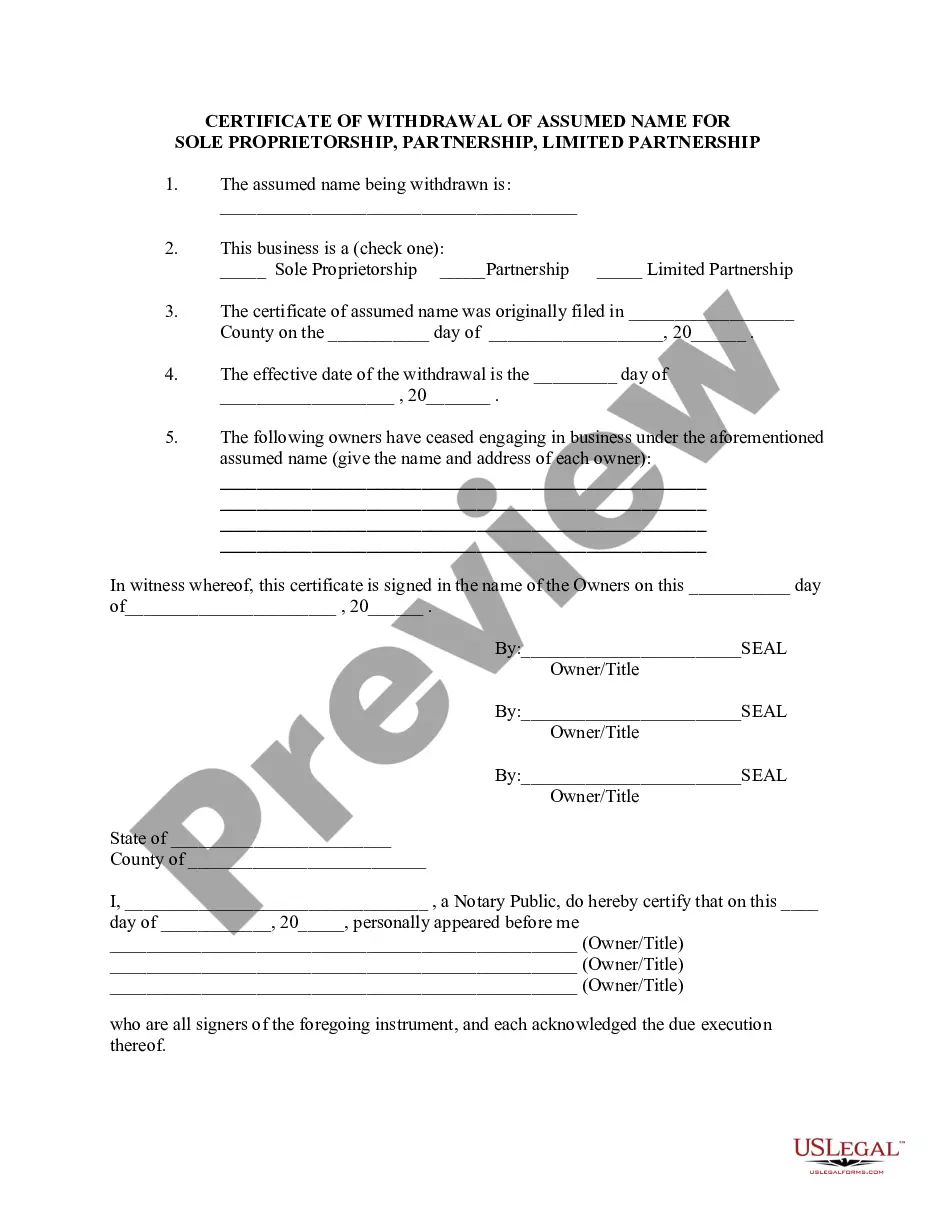

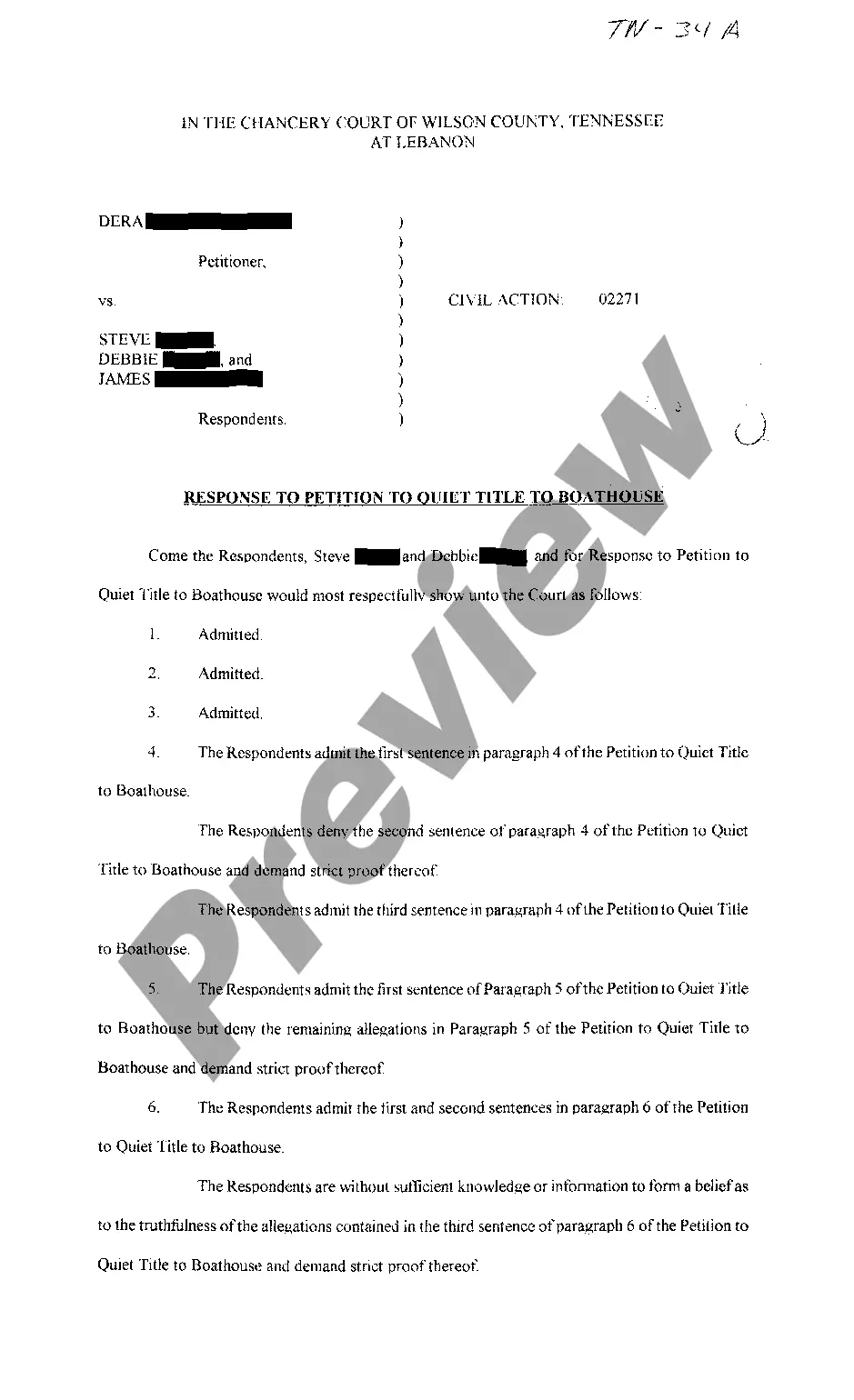

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. This form is a sample of a trustor amending the trust agreement in order to extend the term of the trust. It is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Agreement to Extend the Duration or Term of a Trust

Description

How to fill out Agreement To Extend The Duration Or Term Of A Trust?

Have you ever been in a situation where you require documents for either business or personal use nearly every day.

There are numerous legal document templates available online, but finding reliable ones isn't straightforward.

US Legal Forms offers thousands of template forms, including the New Mexico Agreement to Extend the Duration or Term of a Trust, which can be crafted to meet state and federal requirements.

If you obtain the correct form, simply click on Purchase now.

Select the pricing plan you prefer, fill in the required information to create your account, and make your payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Mexico Agreement to Extend the Duration or Term of a Trust template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to your specific city/state.

- Use the Preview button to check the document.

- Review the outline to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search box to locate the form that meets your requirements.

Form popularity

FAQ

Generally, a trustee cannot unilaterally change the terms of an irrevocable trust. However, there may be routes available through decanting or court modification if circumstances warrant. Consulting a New Mexico Agreement to Extend the Duration or Term of a Trust can help clarify options and guide the trustee in managing the trust effectively.

Section 417 of the Uniform Trust Code addresses the extension of trust durations and establishes guidelines for extending a trust's term. It provides a framework that can help trustees make informed decisions when managing the timing of distributions and maintaining the trust. Utilizing the New Mexico Agreement to Extend the Duration or Term of a Trust can further help in aligning with these legal provisions.

Correct, when a land trust expires, the trustee typically must make a decision to either extend the trust term or sell the real estate held in the trust. This decision can have significant implications for the beneficiaries and property ownership. To explore options for extending the trust duration, a New Mexico Agreement to Extend the Duration or Term of a Trust may provide valuable guidance.

Decanting a trust does carry certain risks, including the potential for upsetting beneficiaries or inadvertently violating the terms of the original trust. Additionally, tax implications may arise if not properly managed. It is wise to carefully review a New Mexico Agreement to Extend the Duration or Term of a Trust alongside legal counsel to minimize risks while achieving desired modifications.

Decanting an irrevocable trust involves moving assets from the existing trust into a new trust that may have different terms. This process can allow for adjustments to be made to better suit the needs of beneficiaries or to extend the duration of the trust. Understanding this concept is crucial, especially if you're contemplating utilizing a New Mexico Agreement to Extend the Duration or Term of a Trust.

Yes, land trusts do have expiration dates set forth in their defining documents. When the trust reaches its expiration, the assets must be handled according to the instructions laid out beforehand. A New Mexico Agreement to Extend the Duration or Term of a Trust becomes vital in such scenarios, allowing for extensions and continued asset management.

Decanting is a process that allows a trustee to transfer assets from an existing trust into a new trust with different terms. This can include an extension of the trust's duration, depending on state laws and the original trust's provisions. If you're considering this option, the New Mexico Agreement to Extend the Duration or Term of a Trust can serve as an essential tool in navigating your choices.

Yes, when a land trust expires, the trustee generally has a couple of options: either extend the trust or take steps to sell the real estate held in the trust. It is important for trustees to delve into the details of the New Mexico Agreement to Extend the Duration or Term of a Trust, as it can provide a legal pathway to prolong the trust's effectiveness and maintain control over the property.

When a trust expires, the assets within the trust are typically distributed according to the terms outlined in the trust document. If the trust does not specify distribution instructions, state law will generally dictate what happens next. In many cases, beneficiaries might receive their inheritance, but it's crucial to understand the implications of a New Mexico Agreement to Extend the Duration or Term of a Trust to avoid premature distributions.

A significant mistake parents make when setting up a trust fund is failing to clearly define the beneficiaries and their roles. Ambiguities in the trust can lead to disputes and confusion later on. While this question pertains to the UK, similar principles apply to a New Mexico Agreement to Extend the Duration or Term of a Trust. It is crucial to make precise designations and communicate intentions clearly to avoid future conflicts.