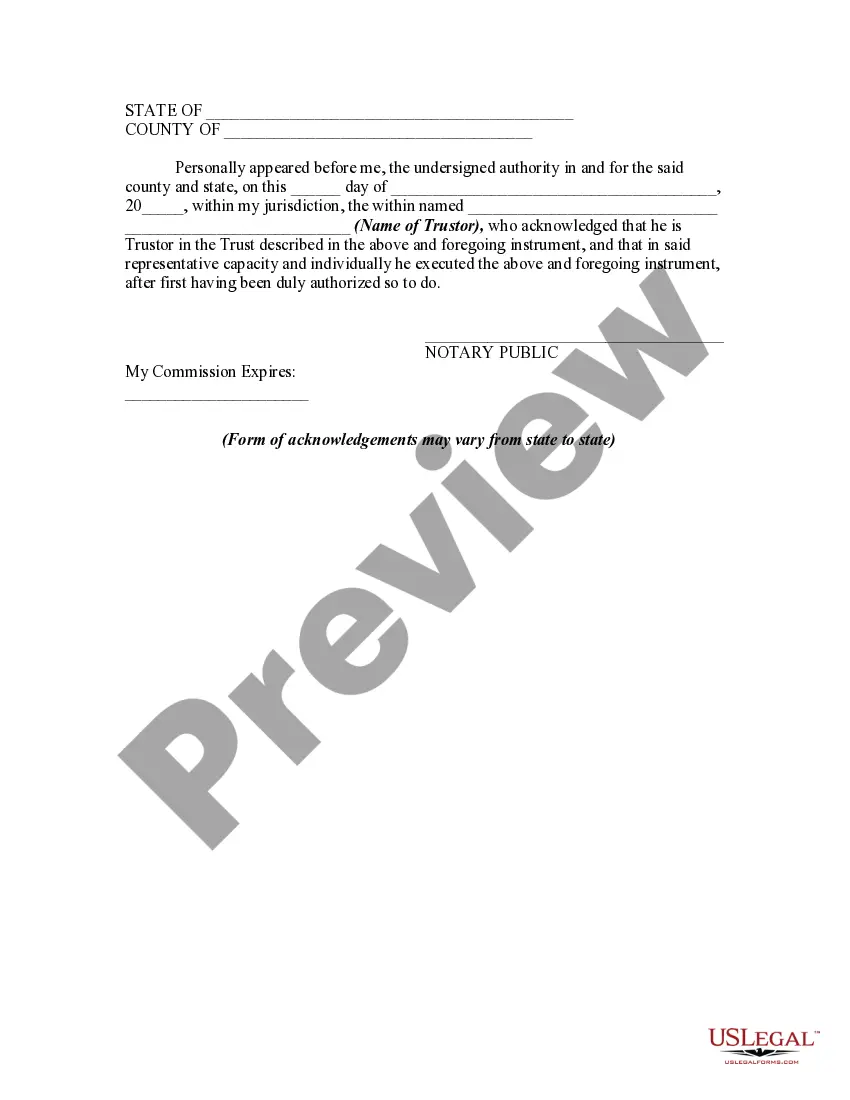

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

How to fill out Receipt By Trustor For Trust Property Upon Revocation Of Trust?

You may spend numerous hours online attempting to locate the appropriate legal document template that complies with the state and federal requirements you need.

US Legal Forms offers an extensive collection of legal forms that can be reviewed by experts.

You can easily download or print the New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust from our service.

If available, use the Preview button to browse the document template as well. If you want to find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have identified the template you wish to obtain, click Purchase now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for a free account on US Legal Forms. Complete the transaction. You may use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make adjustments to your document if applicable. You can complete, alter, sign, and print the New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust. Download and print a vast array of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or individual requirements.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Following that, you can complete, modify, print, or sign the New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/region of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

A trust can be terminated in three primary ways: revocation by the trustor, expiration of the trust term, or through a court order. In the case of revocation, the trustor must create a New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust to document the return of assets. Understanding these termination methods will empower you to manage your trust effectively. Utilizing platforms like uslegalforms can simplify the process and ensure you meet all legal requirements.

When you revoke a trust, the tax implications depend on the nature of the trust's assets and how they are handled afterward. Generally, the trust income may be considered personal income for tax purposes once the trust is revoked. You should report any earnings generated by trust assets after revocation on your personal tax return. Consulting with tax professionals can help you navigate this area effectively.

Revoking a trust means that the trust creator, known as the trustor, has decided to terminate the trust and retrieve its assets. This process involves creating a New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust, which formally documents the return of property. Once a trust is revoked, the assets revert to the trustor’s ownership and can be managed or distributed as desired. It is crucial to follow the legal process to avoid future complications.

In New Mexico, a nursing home cannot directly take your revocable trust. However, if you later require long-term care, the assets in your trust may be evaluated when determining your financial eligibility for Medicaid. It is important to understand the rules surrounding asset protection. Regularly reviewing your trust can help you address these concerns effectively.

Trusts generally must file tax returns annually, particularly if they generate income or have taxable events. In connection with a New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust, ensuring that your trust complies with tax filing requirements is crucial for proper administration. If your trust is revocable, it may be reported under your personal tax return. Engaging a tax expert can provide clarity on your specific situation and ensure compliance.

Yes, the 5-year rule can apply to certain trusts in New Mexico, especially regarding tax implications and asset transfers. When you utilize a New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust, be mindful of how this rule could affect asset valuation and distribution. It's essential to consult with a tax professional to ensure compliance and to understand how this may impact your trust's management. Awareness of these rules can lead to more effective trust planning.

In New Mexico, trusts are not required to be recorded like real estate. However, when executing a New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust, it's crucial to keep a record of this document for personal files. This documentation serves as evidence of the trust's revocation and protects your interests. Knowing that trusts don't need to be recorded might simplify your process.

Section 107 of the Uniform Trust Code discusses the principles of trust validity and the criteria for creating a legal trust. Understanding this section ensures that your trust meets all necessary legal standards. Utilizing platforms like uslegalforms can assist in navigating these principles successfully, ensuring that you can confidently prepare a New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust.

Section 417 of the Uniform Trust Code defines the formal requirements for the revocation of a trust. This section ensures that all actions taken by the trustor are documented and legally binding. By adhering to Section 417, individuals can properly issue a New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust, protecting their interests.

When a trust is revoked, the assets within the trust typically revert to the trustor. This process requires careful documentation to ensure all parties acknowledge the revocation and transfer of property. By obtaining a New Mexico Receipt by Trustor for Trust Property Upon Revocation of Trust, you create a clear record of this transfer, providing peace of mind and legal clarity.