No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

New Mexico Acceptance of Claim and Report of Past Experience with Debtor

Description

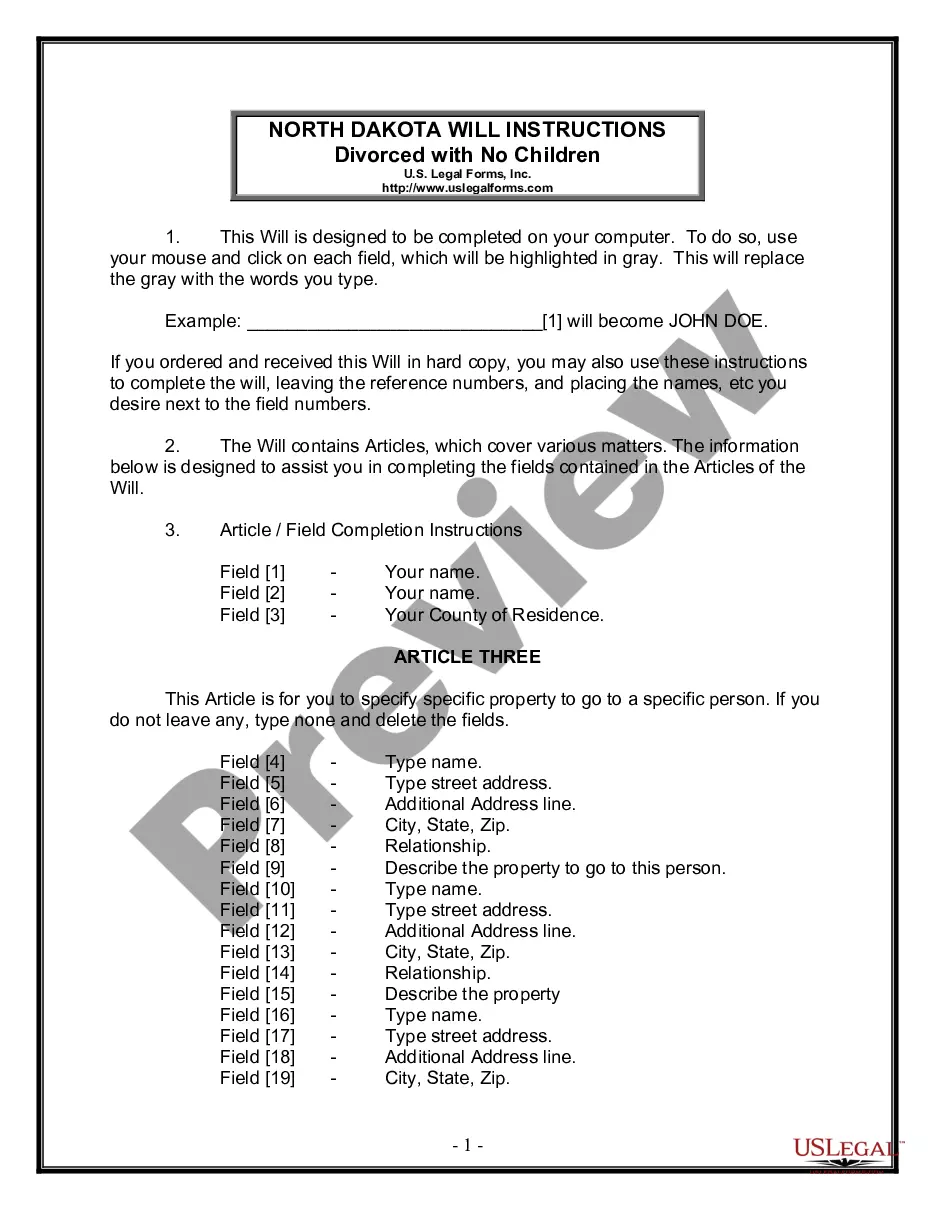

How to fill out Acceptance Of Claim And Report Of Past Experience With Debtor?

It is feasible to invest hours on the internet searching for the authentic document template that conforms to the state and federal requirements you desire.

US Legal Forms offers a vast array of legitimate documents which can be reviewed by professionals.

It is easy to download or print the New Mexico Acceptance of Claim and Report of Past Experience with Debtor from our platform.

If available, take advantage of the Preview button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Get button.

- After that, you can complete, modify, print, or sign the New Mexico Acceptance of Claim and Report of Past Experience with Debtor.

- Each legitimate document template you buy is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the right document template for the county/city that you choose.

- Review the form description to verify you have selected the correct form as well.

Form popularity

FAQ

To respond to a debt claim, it is crucial to review the claim thoroughly and determine whether you agree with the amount owed. A prompt and clear written response is essential, stating your position and any defenses you have. Engaging with tools such as the New Mexico Acceptance of Claim and Report of Past Experience with Debtor can streamline your response process and give you confidence.

Debt collectors in New Mexico can pursue collections for up to six years after a debt becomes due. However, this time frame may vary based on the kind of debt involved. Familiarizing yourself with resources like the New Mexico Acceptance of Claim and Report of Past Experience with Debtor can help you understand your rights against outdated debt claims.

Responding to a summons in New Mexico is vital to protect your rights. To respond, you typically have 20 or 30 days, depending on the type of case, to submit your Answer in writing. You may find that the New Mexico Acceptance of Claim and Report of Past Experience with Debtor offers insights and forms that can facilitate your response.

In New Mexico, creditors typically have six years to collect most types of debts, as dictated by the statute of limitations. This timeframe is crucial for both creditors and debtors to understand. If you are dealing with collections, the New Mexico Acceptance of Claim and Report of Past Experience with Debtor provides the necessary framework to navigate your situation effectively.

When you receive a credit card lawsuit in New Mexico, your answer should specifically address the claims made against you. You must clearly state your defenses, whether you dispute the debt or believe other relevant factors should be considered. Utilizing the New Mexico Acceptance of Claim and Report of Past Experience with Debtor can guide you in crafting a clear and effective response.

In New Mexico, a debt that is 10 years old may still be collected, but it depends on several factors, including the type of debt and whether the statute of limitations has expired. The statute in New Mexico generally allows creditors to collect debts for up to six years. If you face collection efforts for a debt this old, reviewing the New Mexico Acceptance of Claim and Report of Past Experience with Debtor can help you understand your rights.

New Mexico Rule of Civil Procedure 1-026 governs the disclosure of information during the discovery process in civil cases. It mandates that parties exchange certain information before trial, enhancing the transparency of proceedings. Familiarity with this rule can significantly assist individuals involved in matters concerning the New Mexico Acceptance of Claim and Report of Past Experience with Debtor. Utilize USLegalForms to access templates and tools tailored to your legal needs.

New Mexico Rule of Civil Procedure 1-045 addresses the requirements for issuing subpoenas in civil litigation. It outlines who can issue a subpoena, how it should be served, and the responsibilities of those who receive them. Knowing this rule is valuable for understanding legal processes, especially in relation to documents like the New Mexico Acceptance of Claim and Report of Past Experience with Debtor. For comprehensive resources related to this rule, check out the relevant templates on USLegalForms.

Debt collectors in New Mexico can attempt to collect on a debt for up to six years, similar to the statute of limitations regarding debt collection. After this period, the debt ceases to be legally enforceable, and creditors cannot pursue legal action. This information is essential for anyone involved in the New Mexico Acceptance of Claim and Report of Past Experience with Debtor process. USLegalForms offers helpful insights and documents for navigating these collection proceedings effectively.

In New Mexico, a debt may generally become uncollectible after six years. This timeframe starts from the date of the last payment or acknowledgment of the debt by the debtor. Understanding the statute of limitations is crucial for both debtors and creditors, especially when dealing with processes like the New Mexico Acceptance of Claim and Report of Past Experience with Debtor. For guidance on managing debts, refer to resources available at USLegalForms.