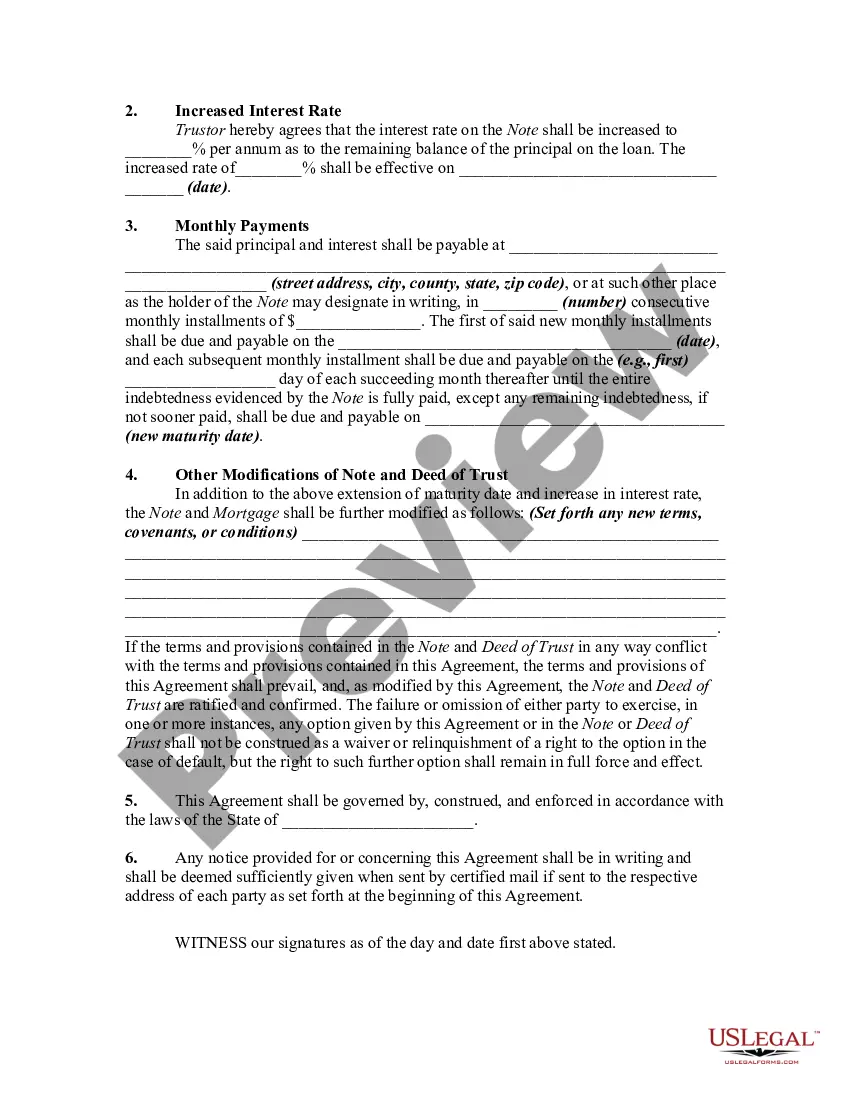

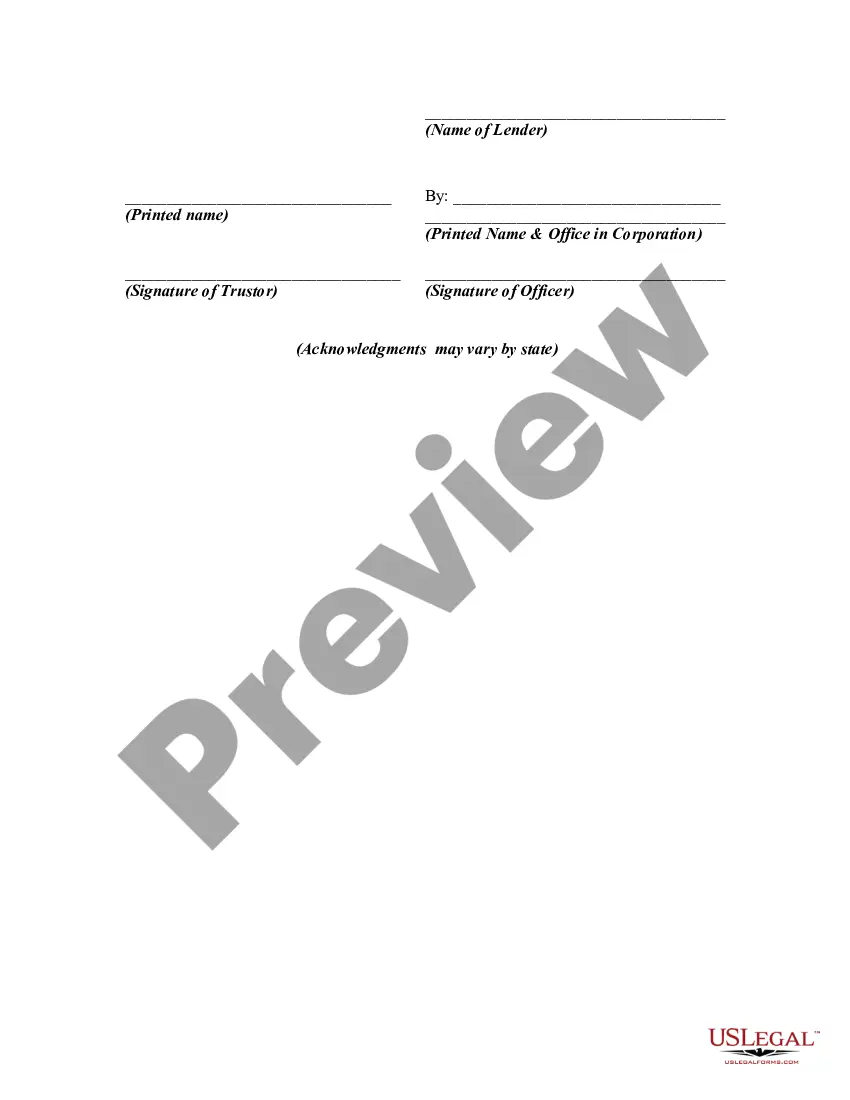

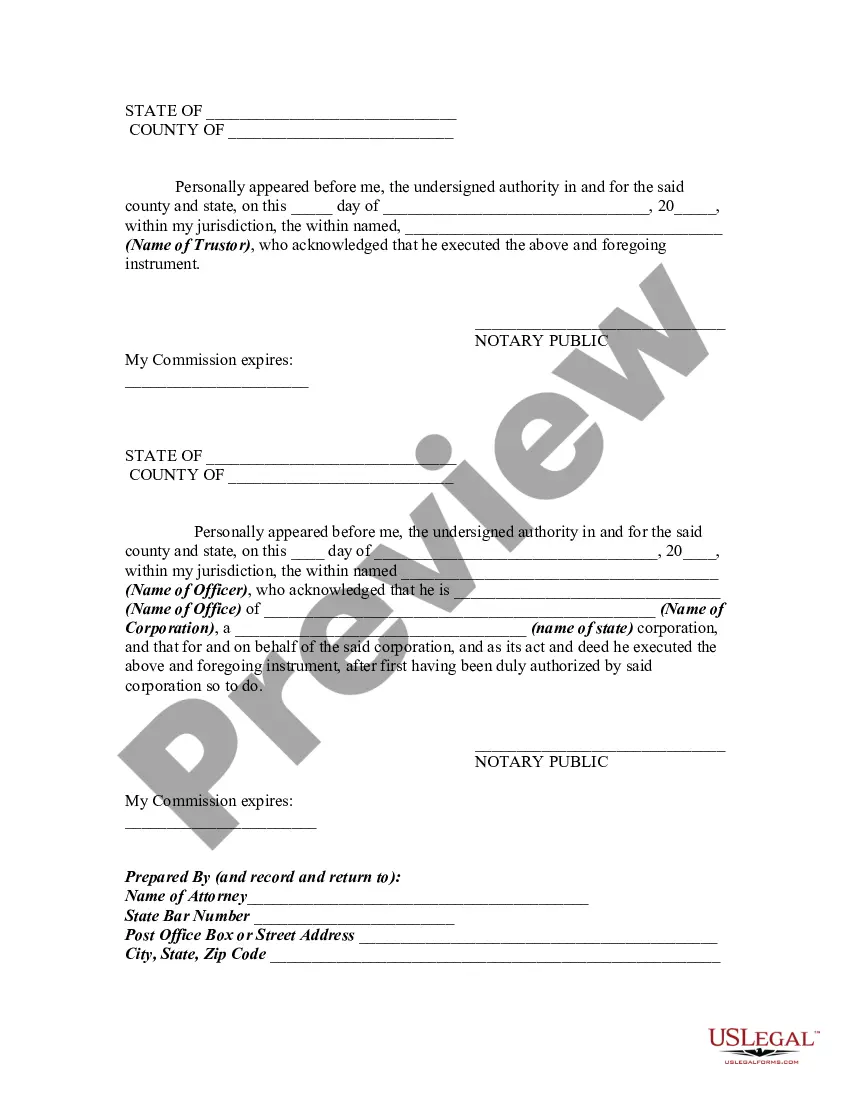

An agreement modifying a loan agreement and a deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and deeds of trust where the original deed of trust was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A New Mexico Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate refers to a legal document that allows borrowers in New Mexico to extend the term of their loan and modify the interest rate associated with it. This agreement is typically executed when the borrower is unable to fully repay the loan as scheduled and needs more time to fulfill their financial obligations. In such circumstances, the lender may agree to extend the loan's maturity date and adjust the interest rate to accommodate the borrower's needs. Keywords: New Mexico, Extension of Loan Agreement, Secured, Deed of Trust, Maturity Date, Increase in Interest Rate. There can be different types of New Mexico Extensions of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate, including: 1. Residential Mortgage Extension: This type of extension is commonly seen in the residential real estate market when homeowners face difficulties in meeting their mortgage obligations. By extending the maturity date and adjusting the interest rate, homeowners can repay their loans under revised terms, avoiding potential foreclosure or default. 2. Commercial Loan Modification: Businesses in New Mexico that have taken out loans secured by a deed of trust may encounter financial hardships. In such cases, lenders can offer loan extensions with maturity date adjustments and increased interest rates to support the business's recovery and enable it to fulfill its financial obligations. 3. Agricultural Loan Restructuring: Farmers and ranchers in New Mexico may require loan extensions due to factors like market fluctuations, natural disasters, or other unforeseen circumstances. Lenders can provide agricultural loan modifications, extending maturity dates and adjusting interest rates, helping farmers manage their debts while continuing their operations. 4. Personal Loan Extension: Individuals in New Mexico facing temporary financial setbacks or unexpected expenses can opt for personal loan extensions. By reaching an agreement with the lender, borrowers can extend their loan's maturity date and modify the interest rate, providing them with more flexibility in repaying their debts. In summary, a New Mexico Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate allows borrowers to renegotiate the terms of their loans when they are unable to meet their financial obligations. This agreement helps borrowers avoid default or foreclosure by extending the loan's maturity date and adjusting the interest rate to suit their current financial circumstances. Whether it's a residential, commercial, agricultural, or personal loan, this type of extension can provide borrowers in New Mexico with a lifeline during challenging times.