New Mexico Sample Letter for Tax Deeds

Description

How to fill out Sample Letter For Tax Deeds?

If you need to acquire thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, which is accessible online.

Utilize the site's straightforward and user-friendly search to find the documents you need. Various templates for business and specific purposes are organized by categories and states, or keywords.

Leverage US Legal Forms to locate the New Mexico Sample Letter for Tax Deeds in just a few clicks.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded within your account. Visit the My documents section and select a form to print or download again.

Compete and obtain, and print the New Mexico Sample Letter for Tax Deeds with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to get the New Mexico Sample Letter for Tax Deeds.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

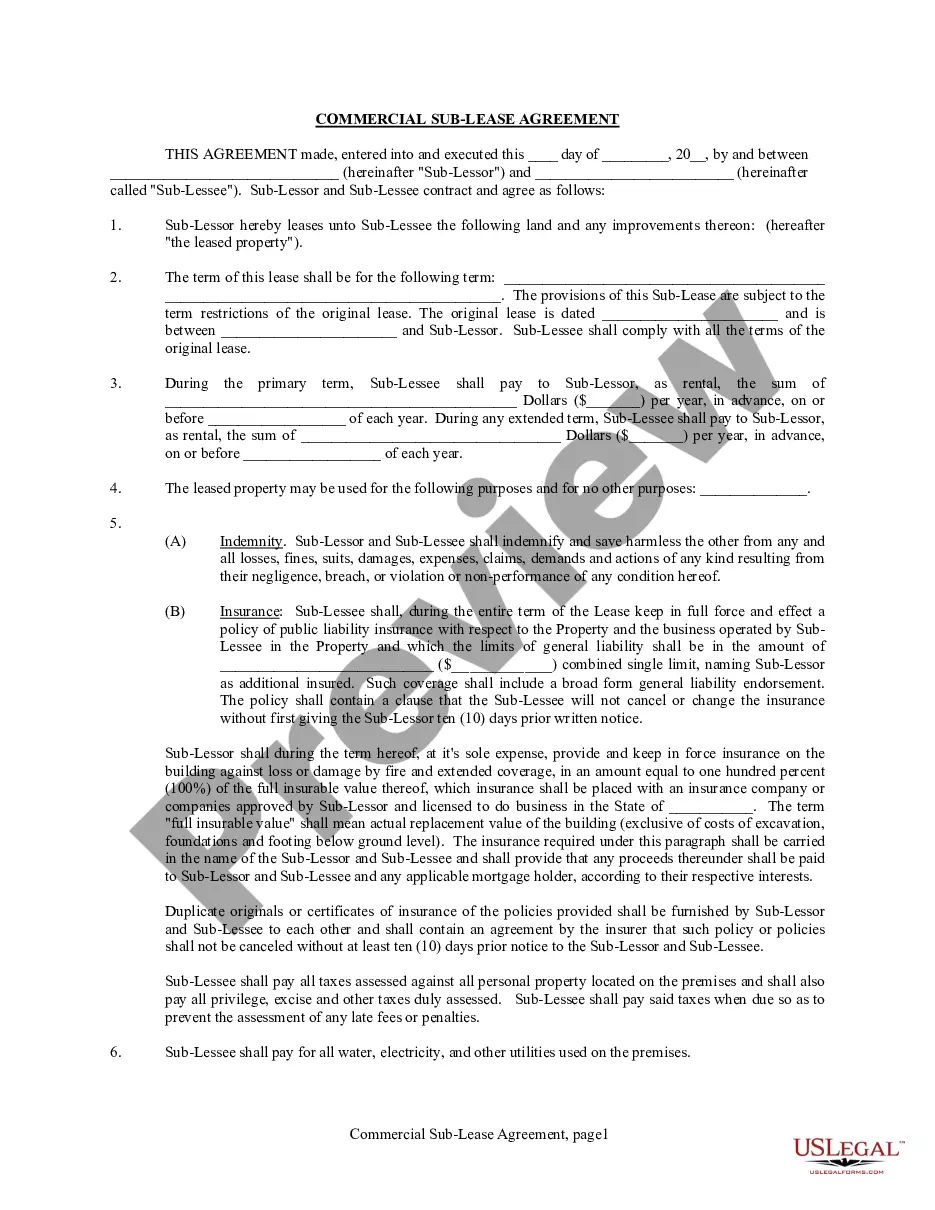

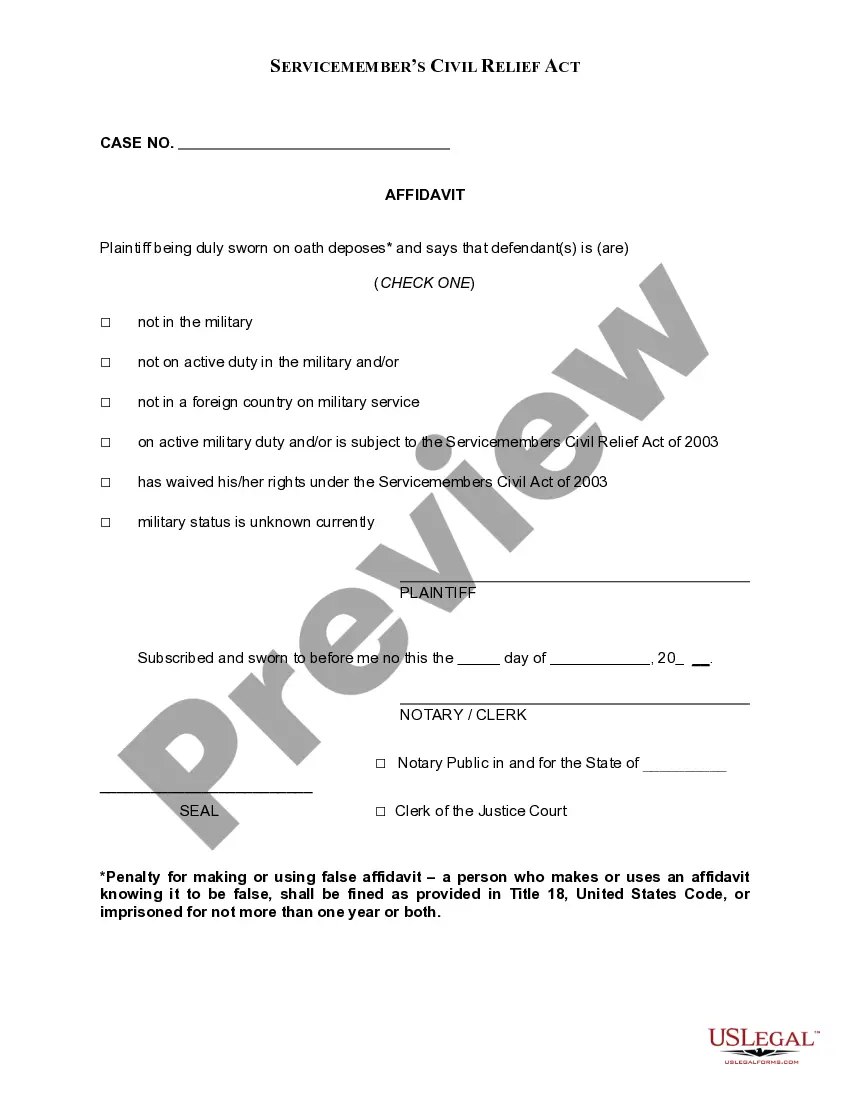

- Step 2. Use the Preview option to examine the form’s details. Remember to read through the information.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form.

- Step 4. Once you have found the form you need, select the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, review, and print or sign the New Mexico Sample Letter for Tax Deeds.

Form popularity

FAQ

The only redemption period in New Mexico is a 120-day federal IRS redemption.

Except as otherwise provided in this section, no assessment of tax may be made by the department after three years from the end of the calendar year in which payment of the tax was due, and no proceeding in court for the collection of such tax without the prior assessment thereof shall be begun after the expiration of ...

In all cases when a notice of lien for taxes, penalties and interest has been filed under Section 7-1-38 NMSA 1978 and a period of ten years has passed from the date the lien was filed, as shown on the notice of lien, the taxes, penalties and interest for which the lien is claimed shall be conclusively presumed to have ...

The State of New Mexico, including all counties, does not conduct tax deed, tax certificate and tax lien sales. The only property sales conducted by the State are public auctions due to two or more years of delinquent property taxes.

The notice of lien shall identify the taxpayer whose liability for taxes is sought to be enforced and the date or approximate date on which the tax became due and shall state that New Mexico claims a lien for the entire amount of tax asserted to be due, including applicable interest and penalties.

If your New Mexico property taxes are delinquent for more than two years, your home will be added to a "tax delinquency list." (N.M. Stat. § 7-38-61.) Three years after the first delinquent date shown on the list, the Taxation and Revenue Department will schedule a sale to sell your home to pay off the tax debt.