Under the Uniform Commercial Code, the rights of the parties to a sales transaction, or the rights of third persons, are not generally resolved by the question of who has title to the goods. In lieu of title being a consideration, separate Code provisions enunciate policies and remedies for the parties under a variety of circumstances. Where the Code fails to make specific provisions for a particular situation, then the question of title must be resolved. Where situations are not covered elsewhere, and title is considered, title cannot pass until the goods are identified to the sales agreement. The seller can reserve no more than a security interest in the title to the goods once the goods are shipped or delivered. The parties may stipulate conditions of delivery within the provisions of the Code.

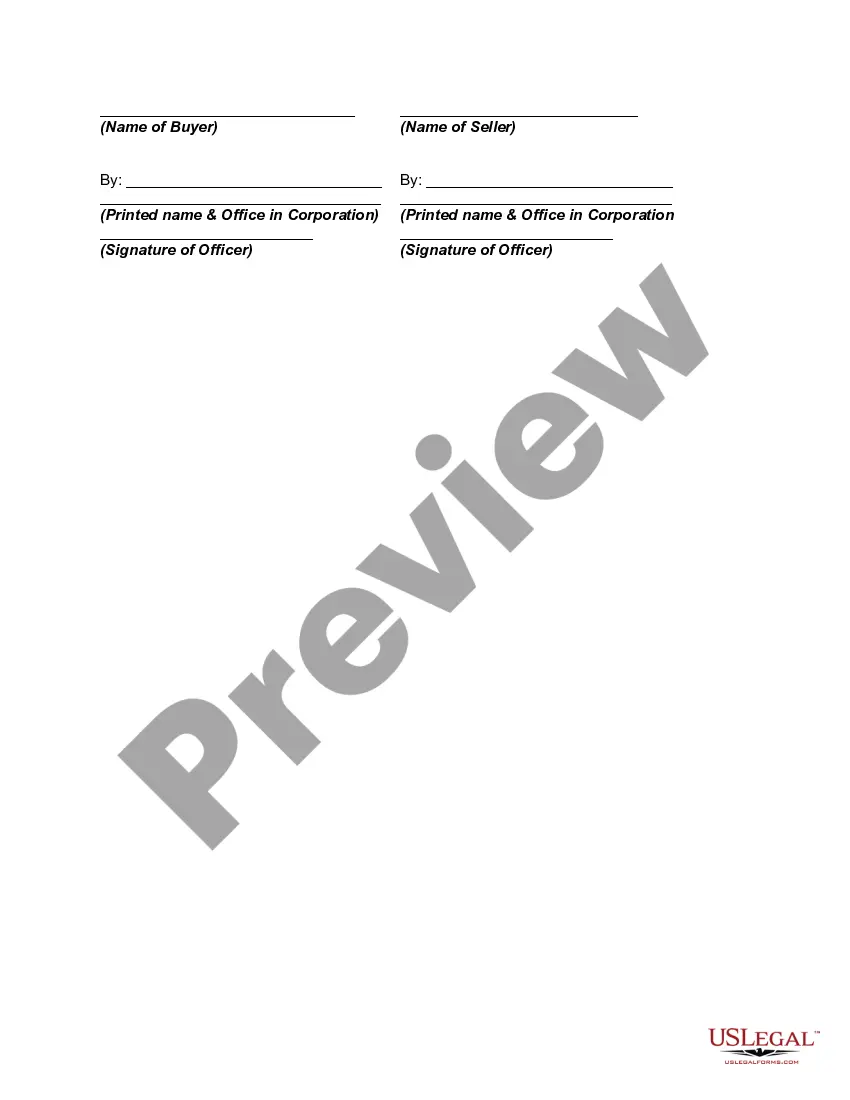

The New Mexico Agreement for Sale of Goods on an Ongoing Basis is a legally binding contract that governs the ongoing sale and purchase of goods between two parties in the state of New Mexico. This agreement outlines the terms and conditions under which the goods will be sold, including the quantity, price, delivery schedule, payment terms, and other relevant provisions. This agreement is designed to ensure a smooth and mutually beneficial relationship between the parties involved in the sale of goods. It provides a clear framework for both parties to understand their rights and responsibilities and helps to mitigate any potential misunderstandings or disputes that may arise during the course of the ongoing sale. Some of the key provisions that may be included in the New Mexico Agreement for Sale of Goods on an Ongoing Basis include: 1. Identification of the parties: The agreement clearly identifies the seller and the buyer, providing their names, addresses, and contact information. 2. Description of goods: The agreement provides a detailed description of the goods being sold, including any specifications, quality standards, or special requirements. 3. Quantity and price: The agreement specifies the quantity of goods to be sold and the agreed upon price per unit or total price for the ongoing transactions. It may also outline any changes in price or quantity that may occur over time. 4. Delivery terms: The agreement outlines the method of delivery, including who is responsible for transportation costs and any potential delivery timelines or schedules. 5. Payment terms: The agreement details the payment terms, including the due date, invoicing procedures, any applicable taxes, and any penalties for late payments. 6. Warranties and disclaimers: The agreement may include any warranties provided by the seller regarding the quality, fitness, or performance of the goods, as well as any disclaimers of liability. 7. Termination or modification: The agreement may outline the conditions under which either party can terminate the ongoing sale or modify the terms of the agreement. In addition to the standard New Mexico Agreement for Sale of Goods on an Ongoing Basis, there may be various types or variations of this agreement tailored to specific industries or circumstances. Some examples include: 1. Ongoing supply agreement: This type of agreement is specifically designed for suppliers and vendors to establish an ongoing supply relationship, where goods are regularly provided over an extended period of time. 2. Consignment agreement: This agreement is commonly used in the retail industry, where a consignor supplies goods to a consignee on an ongoing basis, but the title and ownership of the goods remain with the consignor until they are sold. 3. Distribution agreement: This agreement governs the ongoing sale and distribution of goods between a manufacturer or supplier and a distributor, outlining the roles and responsibilities of each party in the distribution process. It is important for parties entering into a New Mexico Agreement for Sale of Goods on an Ongoing Basis to consult with legal professionals to ensure that the agreement meets their specific needs and complies with New Mexico state laws and regulations.