New Mexico Revocable Trust for Lottery Winnings is a legal instrument specifically designed to manage and protect assets received through lottery winnings in the state of New Mexico. It creates a trust where the lottery prize can be deposited, ensuring proper management, preservation, and distribution of the funds for the designated beneficiaries. A revocable trust, also known as a living trust, allows the creator (granter) to maintain control over the assets during their lifetime while also providing flexibility to make changes or revoke the trust if required. In the case of lottery winnings, setting up a revocable trust can offer various benefits such as privacy, asset protection, and efficient management of funds. By opting to establish a New Mexico Revocable Trust for Lottery Winnings, lottery winners can protect their privacy by keeping the details of their winnings and distribution private. Unlike a public record, the trust agreement and its terms are kept confidential, preventing public scrutiny and potential challenges from opportunistic individuals. Moreover, a trust structure can offer asset protection by shielding the winnings from possible creditors or lawsuits. Assets held in the trust can be safeguarded against potential claims, ensuring the funds are used according to the granter's wishes and benefiting only the intended beneficiaries. One type of New Mexico Revocable Trust for Lottery Winnings is an Individual Trust. In this case, a single lottery winner establishes a trust to hold and manage their winnings according to their preferences, determining when and how the funds will be distributed. Another type is a Family Trust, which is suitable for multiple lottery winners within the same family or for those who wish to manage their lottery winnings collectively. A Family Trust allows for coordinated asset management, distribution planning, and potential tax benefits. It is essential for individuals considering a New Mexico Revocable Trust for Lottery Winnings to consult with an experienced attorney knowledgeable in trust and estate planning. They can guide the granter through the various legal requirements, help identify tax implications, and ensure that the trust aligns with their specific needs and goals. Overall, a New Mexico Revocable Trust for Lottery Winnings provides lottery winners with a secure and efficient means to manage and preserve their newfound wealth, protecting their privacy, ensuring proper asset distribution, and potentially offering tax advantages.

Mega Millions Nm

Description can a trust claim a lottery prize in new mexico

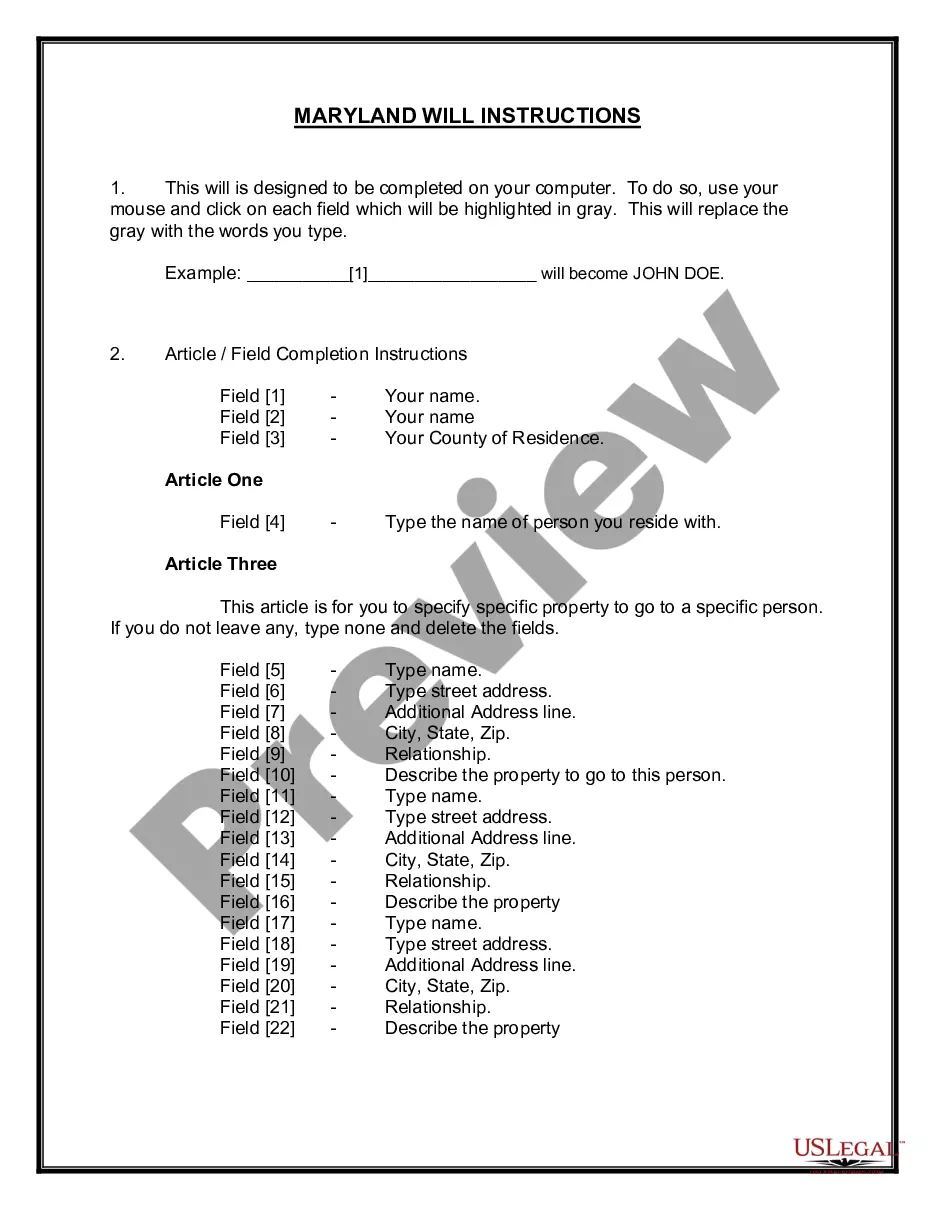

How to fill out New Mexico Revocable Trust For Lottery Winnings?

Have you ever been in a situation where you need documentation for both business or personal purposes almost every single day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, such as the New Mexico Revocable Trust for Lottery Winnings, which are crafted to comply with state and federal regulations.

Once you obtain the appropriate form, click Get now.

Select the pricing plan you desire, fill out the required information to create your account, and make the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess your account, simply Log In.

- Then, you can download the New Mexico Revocable Trust for Lottery Winnings template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it aligns with the correct region/state.

- Utilize the Review button to examine the form.

- Check the details to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that matches your needs.

Form popularity

FAQ

To file a trust in New Mexico, you must first draft a trust document that outlines the terms, beneficiaries, and trustee. Once completed, you will need to fund the trust with your assets, including your lottery winnings, to activate it. Resources like uslegalforms can provide templates and guidance for creating a New Mexico Revocable Trust for Lottery Winnings, ensuring your interests are protected.

One common loophole for gift tax is the annual gift tax exclusion, which allows you to give a certain amount to each recipient per year without triggering tax. At present, this limit stands at $17,000 per individual. By strategically gifting amounts below this threshold and utilizing a New Mexico Revocable Trust for Lottery Winnings, you can effectively transfer wealth to your family while minimizing tax exposure.

A trust, specifically a New Mexico Revocable Trust for Lottery Winnings, allows you to hold and manage your winnings while dictating how they will be distributed. This flexibility can protect your assets, simplify the transfer of wealth, and potentially reduce tax liabilities. By placing your winnings in a trust, you can ensure that your financial legacy aligns with your wishes.

Generally, all lottery winnings are subject to federal and state taxes regardless of the amount. However, exceptions may apply for certain types of charitable lottery winnings or specific state exemptions. If you set up a New Mexico Revocable Trust for Lottery Winnings, you may also discover strategies to manage these winnings in a tax-efficient manner.

To share your lottery winnings with family without paying taxes, you can utilize the annual gift tax exclusion, which allows you to gift up to $17,000 per recipient. For larger amounts, establishing a New Mexico Revocable Trust for Lottery Winnings provides a structured way to distribute funds while potentially reducing tax liabilities. It’s advisable to consult a tax professional for personalized guidance.

When you win the lottery, you can give up to $17,000 per person annually without incurring gift tax. This amount allows you to share your winnings and support your loved ones financially. If you're considering a more substantial gift, a New Mexico Revocable Trust for Lottery Winnings can help you manage these gifts more efficiently while minimizing tax implications.

Having a financial advisor after winning the lottery can be extremely beneficial. They help you navigate financial decisions, manage your assets, and develop a sustainable spending plan. Setting up a New Mexico Revocable Trust for Lottery Winnings with a trusted advisor can further enhance your financial security and peace of mind.

The biggest mistake a lottery winner can make is failing to plan for the future. Without proper financial advice, you may mismanage your winnings, leading to rapid depletion of funds. Establishing a New Mexico Revocable Trust for Lottery Winnings allows you to secure your assets and organize your financial strategy. This way, you can enjoy your winnings while ensuring long-term benefits.

Claiming lottery winnings anonymously is possible in some jurisdictions, including New Mexico. By establishing a New Mexico Revocable Trust for Lottery Winnings, you can collect your prize without publicly revealing your identity. This approach not only protects your privacy but also effectively manages your winnings through the trust.

To set up a revocable living trust in New Mexico, you need to follow a few simple steps. Begin by creating a trust document that outlines how you want your assets managed. Then, fund your trust by transferring your assets into it. Using a New Mexico Revocable Trust for Lottery Winnings can help ensure that your earnings are distributed according to your wishes without unnecessary delays.

Interesting Questions

More info

Sized All Categories 1 – 10 Acura Alfa Romeo AMC Aston Martin Audi Badly Misha Bee minder Best Buy Big Lots BMW M2 BMW M3 Cadillac Chevelle Chevrolet Chrysler Cisco DAI Daihatsu Daimler Chrysler Dodge Ferrari Fiat Ford Honda Civic Hummer Hyundai Infinite Isuzu Jeep Liberty Jeep Patriot Lady Lexus Lotus Maserati Mazda MGB Mazda MPV Mercedes-Benz S-Class MG MINI Mitsubishi Outlander Mitsuki Mormon Maybach Mazda MPS Mazda RX Nissan Mustang Opel Pontiac Porsche Ram Rolls-Royce Saab Saturn Scion smart Subaru Suzuki Tesla Toyota Volkswagen Volta Winnebago Paris.