New Mexico Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

You could spend hours online searching for the legal document template that fulfills the federal and state standards you require.

US Legal Forms offers a vast array of legal documents that have been vetted by experts.

You can effortlessly download or print the New Mexico Security Agreement concerning Sale of Collateral by Debtor from your service.

If available, use the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the New Mexico Security Agreement regarding Sale of Collateral by Debtor.

- Each legal document template you obtain is yours indefinitely.

- To get another copy of any downloaded form, navigate to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city you choose.

- Review the document description to confirm you have chosen the right template.

Form popularity

FAQ

In a security agreement, the debtor is the party that borrows funds and pledges collateral to the lender. In the context of a New Mexico Security Agreement involving Sale of Collateral by Debtor, the debtor's assets provide security for repayment. Understanding the role of the debtor is crucial, as they are responsible for fulfilling the terms set in the agreement.

The purpose of the collateral description in a New Mexico Security Agreement involving Sale of Collateral by Debtor is to create transparency about what assets are secured. This clarity prevents misunderstandings and disputes during the lifespan of the agreement. Ultimately, the collateral description acts as a protective measure for both the debtor and lender.

The right to take hold or sell a debtor's property as security for a debt is known as a lien. In a New Mexico Security Agreement involving Sale of Collateral by Debtor, a lien provides the lender a legal claim over the collateral. This right ensures that if the debtor defaults, the lender has a way to recover owed amounts through the sale of the collateral.

The standard for collateral description in a New Mexico Security Agreement involving Sale of Collateral by Debtor requires clarity and specificity. The Uniform Commercial Code (UCC) suggests that a collateral description must reasonably identify what is secured. By providing clear information, parties can ensure that they minimize disputes and understand their rights.

In a New Mexico Security Agreement involving Sale of Collateral by Debtor, an example of a collateral description could be specific assets like machinery, vehicles, or inventory. For instance, 'All inventory located at 123 Main St, Albuquerque, NM.' This clear description helps to avoid confusion in the event of a default. Accurate collateral descriptions ensure that both parties understand what is being secured.

To file a New Mexico Security Agreement involving Sale of Collateral by Debtor, you typically file the agreement with the New Mexico Secretary of State or through the local county clerk’s office. This filing provides public notice of the creditor's interest in the collateral and protects it against other creditors. Utilizing platforms like US Legal Forms simplifies this process, guiding you through the necessary steps and ensuring that your filing meets all legal requirements.

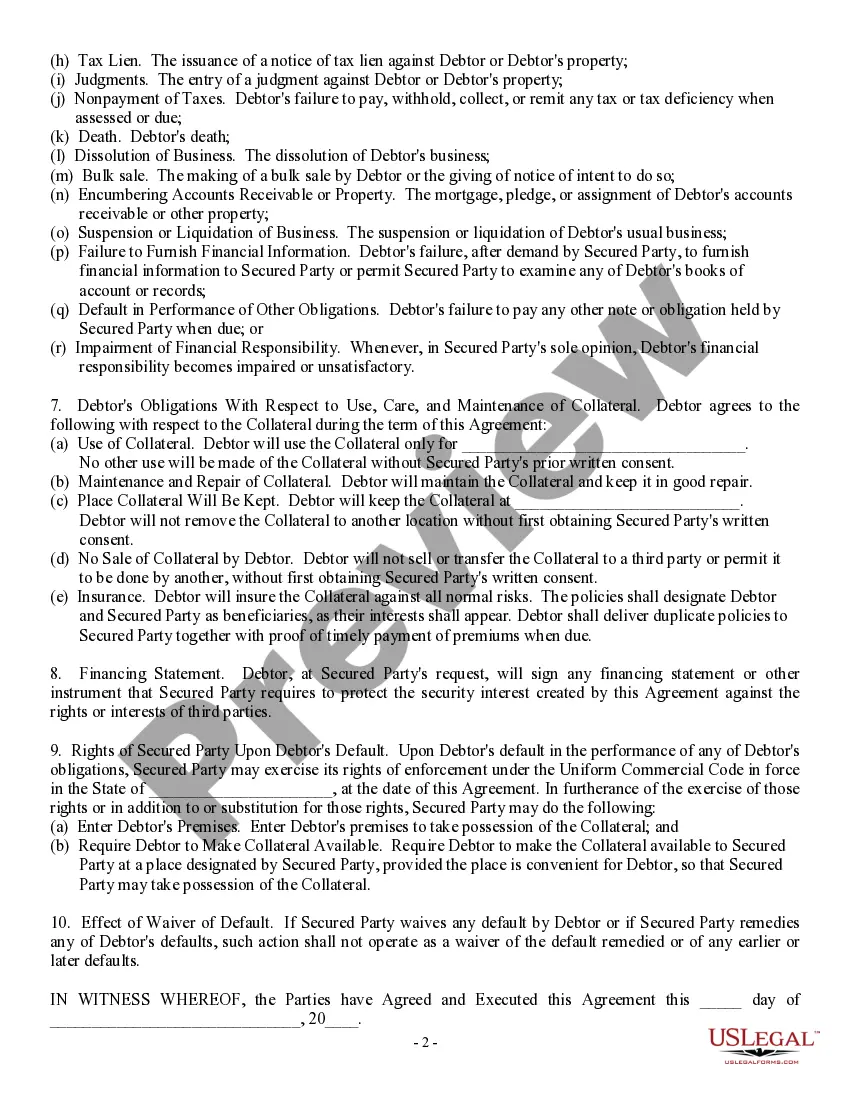

For a creditor to establish an enforceable security interest under a New Mexico Security Agreement involving Sale of Collateral by Debtor, three critical requirements must be met. First, there must be a valid security agreement between the creditor and debtor. Second, the creditor must have possession of the collateral or have the debtor’s rights to the collateral formally attached. Finally, the security interest must be properly perfected, typically through filing with the appropriate state authorities.

A secured creditor holds significant rights under a New Mexico Security Agreement involving Sale of Collateral by Debtor. They have the right to enforce their security interest and repossess collateral in case of default by the debtor. Additionally, they can take appropriate legal action to recover outstanding debts, ensuring their financial interests are safeguarded. It is essential for secured creditors to familiarize themselves with these rights to operate within legal boundaries.

Under a New Mexico Security Agreement involving Sale of Collateral by Debtor, the debtor retains specific rights even after pledging collateral. The debtor has the right to continue using the collateral as long as they adhere to the repayment schedule. Furthermore, they can redeem the collateral by fulfilling their obligations before any sale occurs. Recognizing these rights empowers debtors to manage their responsibilities effectively.

Collateral rights refer to the secured party's legal entitlements related to the collateral pledged under a New Mexico Security Agreement involving Sale of Collateral by Debtor. These rights allow the secured party to seize or sell the collateral in the event of a debtor's default. This mechanism ensures protection for the lender while offering assurance to the debtor about their structured repayment plan. It is crucial for both parties to clearly understand these rights to avoid disputes.