Content: Dear [Recipient's Name], I am writing to inform you that a judgment confirming tax title has been granted in favor of [Your Name/ Entity] for the property located in [County], New Mexico. The purpose of this letter is to provide you with the necessary information and documentation regarding the tax title and to request your cooperation in transferring the property's ownership. In accordance with New Mexico tax laws, the tax title has been issued due to the property owner's failure to pay property taxes for a consecutive period of [number of years]. As a result, [Your Name/ Entity] has acquired the tax title through proper legal procedures and has been bestowed with the rights of ownership. Enclosed in this letter, you will find the following essential documents: 1. Judgment Confirmation Order: This document serves as proof of the court's ruling, confirming that the tax title has been awarded to [Your Name/ Entity]. It outlines the legal authority regarding the transfer of ownership of the property to the tax titleholder. 2. Property Description: This document outlines the specific details of the property, including its address, parcel number, and boundary description. The property is situated in [County], New Mexico, and is described in detail to avoid any confusion. 3. Tax Title Certificate: This certificate attests to the fact that [Your Name/ Entity] is the rightful owner of the tax title for the aforementioned property. It provides legal evidence of the transfer of ownership and can be used for future reference. 4. Payment Instructions: To complete the transfer of ownership, it is necessary to fulfil the financial obligations associated with the tax title. The enclosed document provides detailed instructions on how to make payment for outstanding taxes, fees, and any other relevant charges. We kindly request that you review the enclosed documents carefully and take immediate action based on our instructions. Upon receiving the payment, [Your Name/ Entity] will proceed with the necessary paperwork to officially transfer the property's ownership to you. If you have any questions or require further clarification regarding the tax title or the documents provided, please do not hesitate to contact our office. We are here to assist you throughout the process and ensure a smooth transition of ownership. Please note that failure to respond or take appropriate action within the specified timeline may result in further legal consequences. It is in your best interest to address this matter promptly. Thank you for your cooperation in this matter, and we look forward to finalizing the transfer of ownership. Sincerely, [Your Name/ Entity] Keywords: New Mexico, sample letter, judgment, confirming, tax title, property, ownership, tax laws, tax title certificate, payment instructions, transfer of ownership, legal procedures, property description, outstanding taxes, fees, court ruling. Different types of New Mexico Sample Letters for Judgment Confirming Tax Title: 1. New Mexico Sample Letter for Judgment Confirming Tax Title — Residential Property 2. New Mexico Sample Letter for Judgment Confirming Tax Title — Commercial Property 3. New Mexico Sample Letter for Judgment Confirming Tax Title — VacanPropertyttttttttty.ty

New Mexico Sample Letter for Judgment Confirming Tax Title

Description

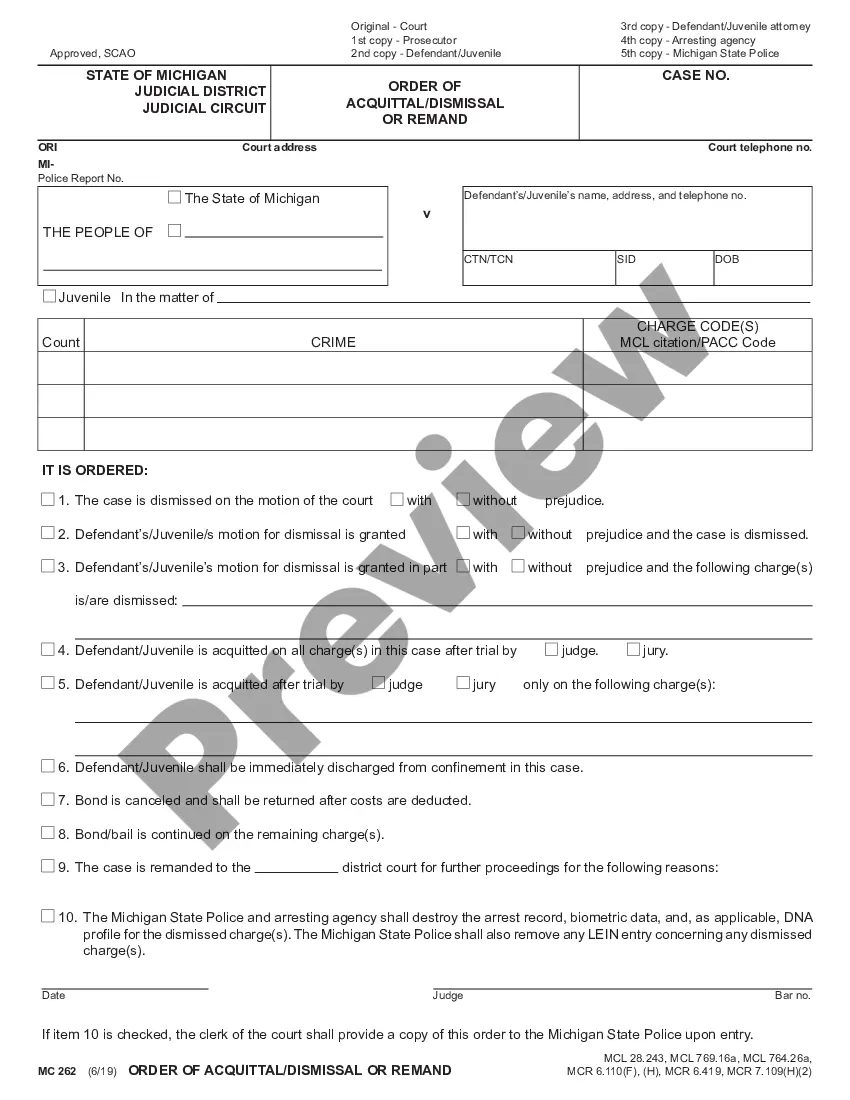

How to fill out New Mexico Sample Letter For Judgment Confirming Tax Title?

You may devote time on-line attempting to find the lawful record template that suits the state and federal needs you need. US Legal Forms gives thousands of lawful kinds which can be reviewed by experts. You can actually acquire or print the New Mexico Sample Letter for Judgment Confirming Tax Title from your services.

If you currently have a US Legal Forms account, you may log in and click on the Acquire key. Following that, you may full, revise, print, or indicator the New Mexico Sample Letter for Judgment Confirming Tax Title. Each lawful record template you buy is the one you have for a long time. To have yet another duplicate for any obtained kind, go to the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms site the very first time, adhere to the straightforward instructions under:

- First, make certain you have chosen the correct record template for that region/area of your liking. Read the kind information to make sure you have picked the proper kind. If offered, use the Preview key to check with the record template as well.

- If you would like get yet another version of your kind, use the Search area to discover the template that suits you and needs.

- After you have located the template you desire, simply click Acquire now to proceed.

- Select the rates strategy you desire, key in your qualifications, and register for a free account on US Legal Forms.

- Total the deal. You may use your credit card or PayPal account to cover the lawful kind.

- Select the format of your record and acquire it to the product.

- Make modifications to the record if possible. You may full, revise and indicator and print New Mexico Sample Letter for Judgment Confirming Tax Title.

Acquire and print thousands of record layouts making use of the US Legal Forms site, that offers the greatest selection of lawful kinds. Use professional and state-distinct layouts to deal with your company or specific demands.

Form popularity

FAQ

Filing Motions A motion must be in writing and must specifically state the grounds for the motion and the relief sought. The party filing the motion (the ?movant?) must request concurrence of each party at least three working days before filing the motion.

Generally, no assessment of tax (or start of court proceedings without a prior assessment) may be made after three years from the end of the calendar year in which the tax payment was due.

If your New Mexico property taxes are delinquent for more than two years, your home will be added to a "tax delinquency list." (N.M. Stat. § 7-38-61.) Three years after the first delinquent date shown on the list, the Taxation and Revenue Department will schedule a sale to sell your home to pay off the tax debt.

Lien. When any person neglects or refuses to pay taxes after assessment and demand for payment has been made, a lien automatically exists, and we may file a notice of the lien in favor of the state on all taxpayer property under Section 7-1-37 NMSA 1978.

NEW MEXICO A judgment is a lien on the real estate of the judgment debtor and expires after fourteen years. N.M. Stat. § 39-1-6.

The notice of lien shall identify the taxpayer whose liability for taxes is sought to be enforced and the date or approximate date on which the tax became due and shall state that New Mexico claims a lien for the entire amount of tax asserted to be due, including applicable interest and penalties.

In all cases when a notice of lien for taxes, penalties and interest has been filed under Section 7-1-38 NMSA 1978 and a period of ten years has passed from the date the lien was filed, as shown on the notice of lien, the taxes, penalties and interest for which the lien is claimed shall be conclusively presumed to have ...