Title: New Mexico Sale of Deceased Partner's Interest: Understanding the Process and Types Meta Description: Learn about the intricacies of the New Mexico Sale of Deceased Partner's Interest, including its legal procedures, rights of surviving partners, and different types, such as probate sales and private negotiations. Introduction: The Sale of Deceased Partner's Interest in New Mexico refers to the legal process through which a deceased partner's ownership or financial stake in a partnership is transferred to the surviving partner(s) or other beneficiaries. This comprehensive guide will provide an in-depth understanding of the New Mexico laws, procedures, and various types of sales associated with the Sale of Deceased Partner's Interest. 1. Legal Procedures for Sale of Deceased Partner's Interest in New Mexico: — Probate Process: When a partner passes away, their interest in a partnership is considered a part of their estate. The probate court oversees the distribution or sale of this interest according to the deceased partner's will or the state's intestacy laws. — Partnership Agreement: In the absence of a specific provision in the partnership agreement regarding the sale of a deceased partner's interest, New Mexico law governs the division and sale. 2. Rights of Surviving Partners in the Sale of Deceased Partner's Interest: — Right of First Refusal: Under New Mexico law, surviving partners usually have the right of first refusal to purchase the deceased partner's interest. They must be given the opportunity to buy the interest before it's offered to outside buyers. — Buyout Agreements: Sometimes, partners may have a buyout agreement in place, specifying how a deceased partner's interest will be valued and sold. These agreements may supersede the default rules set by law. 3. Types of New Mexico Sale of Deceased Partner's Interest: — Probate Sales: In cases where the deceased partner's estate goes through the probate process, the sale of their interest often occurs under the supervision of the probate court. This ensures a fair distribution of assets and protects the rights of all involved parties. — Private Negotiations: In situations where the deceased partner's interest does not pass through probate, surviving partners or beneficiaries can engage in private negotiations to sell the interest. These negotiations may involve consultations with attorneys or mediators to ensure a smooth and fair transaction. 4. Key Considerations in the Sale of Deceased Partner's Interest: — Valuation of the Deceased Partner's Interest: Determining the fair market value of the deceased partner's interest is crucial for an equitable sale. Different methods, such as appraisals or the use of pre-established formulae, can be employed. — Legal Compliance: Complying with New Mexico's partnership laws, including legal documentation, tax obligations, and any specific requirements set forth in the partnership agreement, is essential throughout the sale process. — Professional Assistance: Given the complexity of the Sale of Deceased Partner's Interest, seeking guidance from experienced attorneys specializing in partnership law can ensure all legal obligations are met and protect the interests of surviving partners or beneficiaries. Conclusion: The New Mexico Sale of Deceased Partner's Interest involves legal processes, considerations, and rights that vary depending on the circumstances. Understanding the procedures and types of sales associated with this transaction is vital for surviving partners and beneficiaries to ensure a smooth transition and protect their interests. Seeking professional advice is strongly recommended navigating the complexities of the sale process successfully.

New Mexico Sale of Deceased Partner's Interest

Description

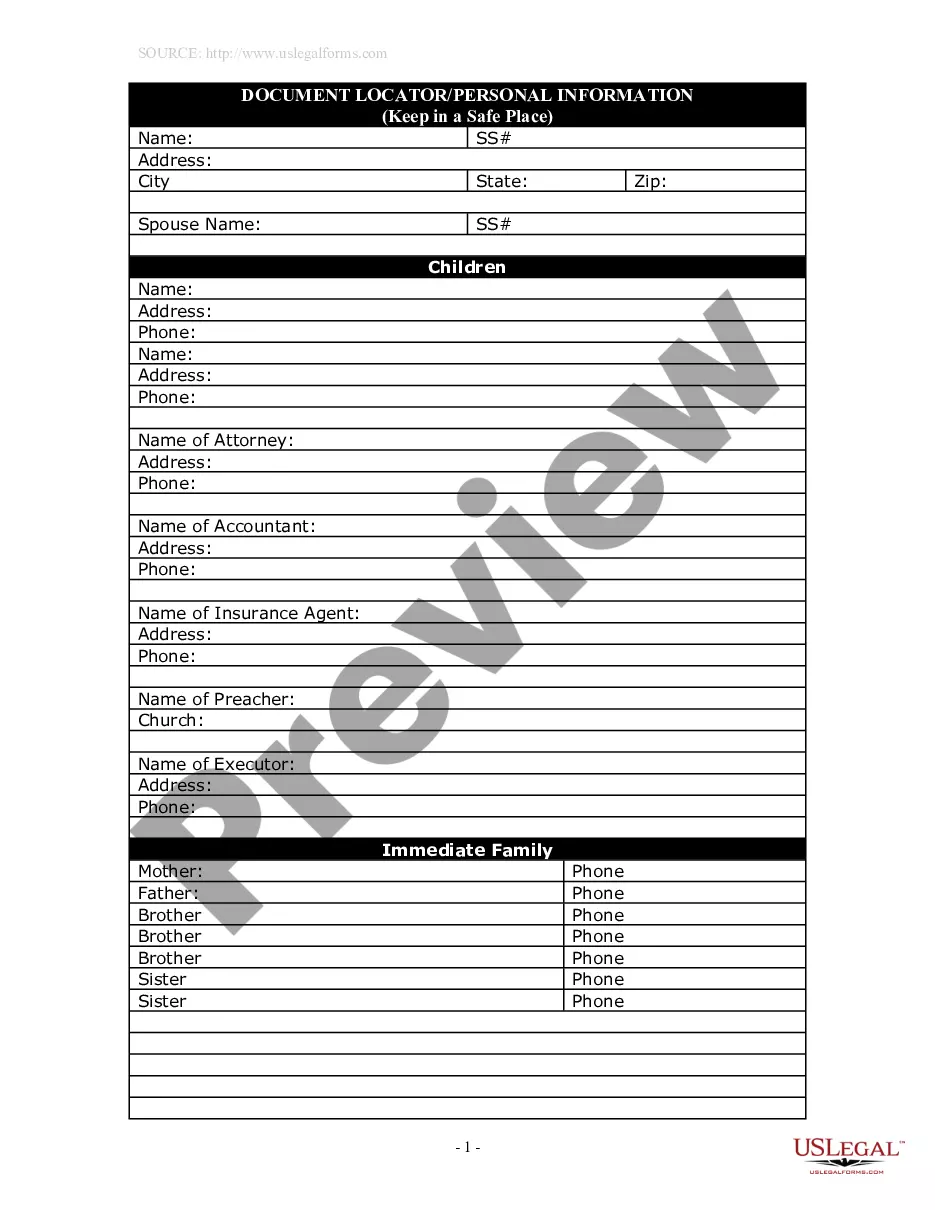

How to fill out New Mexico Sale Of Deceased Partner's Interest?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a selection of legal document templates that you can obtain or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest forms such as the New Mexico Sale of Deceased Partner's Interest in just a few moments.

Click the Review button to check the content of the form.

Review the form information to make sure you have chosen the right form.

- If you have a monthly subscription, Log In to get the New Mexico Sale of Deceased Partner's Interest from the US Legal Forms collection.

- The Acquire option appears on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- To start using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your area/county.

Form popularity

FAQ

Transferable interest means the right, as initially owned by a person in the person's capacity as a partner, to receive distributions from a partnership, whether or not the person remains a partner or continues to own any part of the right. The term applies to any fraction of the interest, by whomever owned.

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

Most legislation states that the partnership will end upon the death or bankruptcy of any partner. If your partner dies, you will then owe your partner's estate their share of the partnership that accrues at the date of their death.

A transfer of partnership interest takes place when a partner in a business relinquishes their ownership rights and responsibilities to another individual or company.

After the Death of a Business PartnerThe deceased's estate takes over their share of the partnership. A transfer happens of the other partner's share to you on a payment to the estate. You buy the share of the partnership using a financial formula.

If it was death that had caused the end of the partnership, then the monies are paid out in equal shares to the surviving ex-partners and the deceased's estate. When all the partners are living there may be room to negotiate, but when one of them dies, the options disappear, especially if the beneficiaries are minors.

In the same way, the death of a partner immediately dissolves the partnership; Expelling a partner for fraud would have the same effect; Taking on a new partner would also dissolve the partnership.

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

Interesting Questions

More info

Interconnect Wolters Kluwer Interconnect History Help Login Interconnect Wolters Kluwer Interconnect History Help Login Interconnect Wolters Kluwer Interconnect History Help Login Interconnect Wolters Kluwer Interconnect History Help Login Interconnect Wolters Kluwer Interconnect History Help Login.