This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Agreement between Mortgage Brokers to Find Acceptable Lender for Client

Description

How to fill out Agreement Between Mortgage Brokers To Find Acceptable Lender For Client?

US Legal Forms - one of several most significant libraries of lawful forms in the United States - delivers an array of lawful file templates you may obtain or print out. Making use of the web site, you may get 1000s of forms for company and individual uses, sorted by groups, claims, or search phrases.You can get the most recent variations of forms much like the New Mexico Agreement between Mortgage Brokers to Find Acceptable Lender for Client in seconds.

If you already have a registration, log in and obtain New Mexico Agreement between Mortgage Brokers to Find Acceptable Lender for Client through the US Legal Forms local library. The Down load option will show up on every form you see. You get access to all in the past downloaded forms within the My Forms tab of the bank account.

In order to use US Legal Forms the very first time, listed below are straightforward guidelines to help you get began:

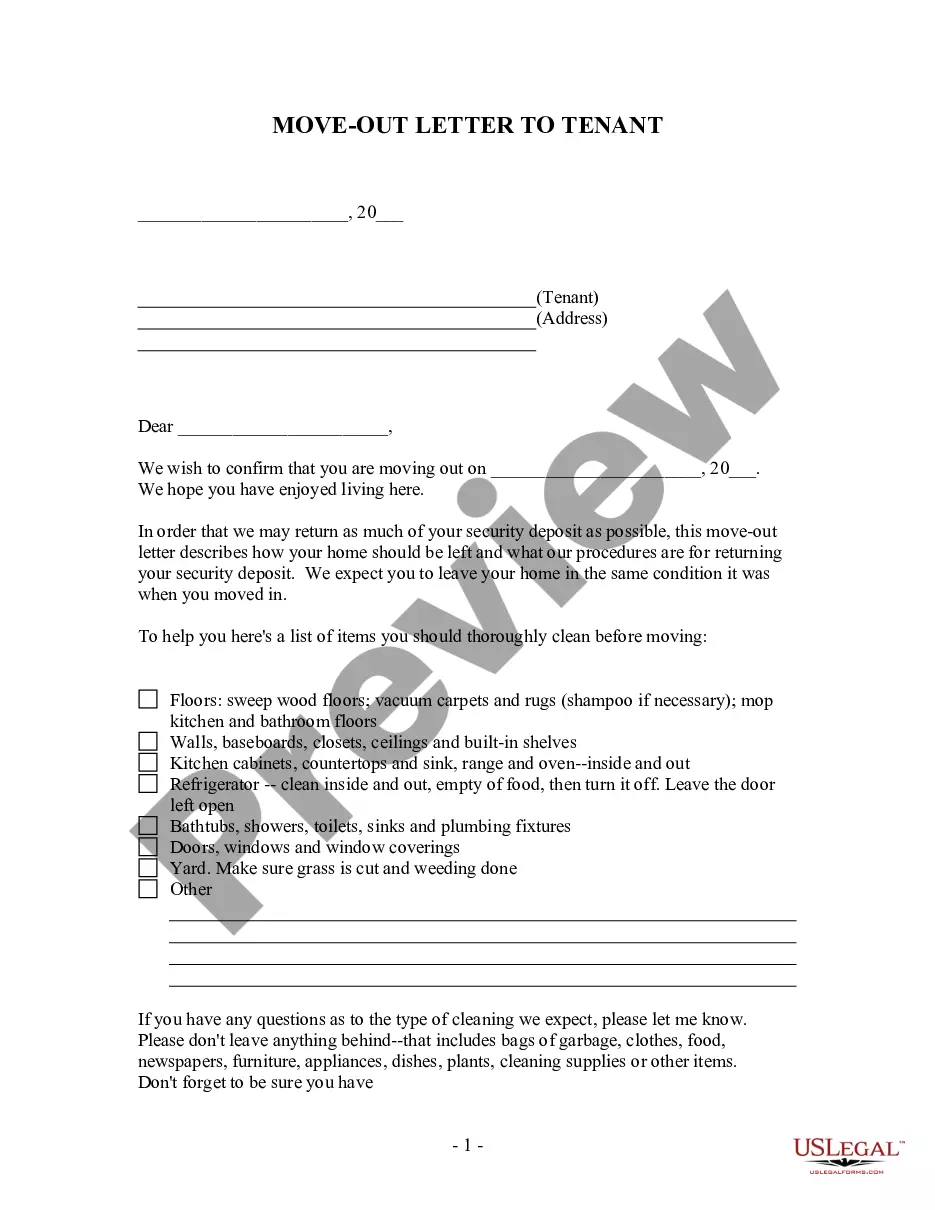

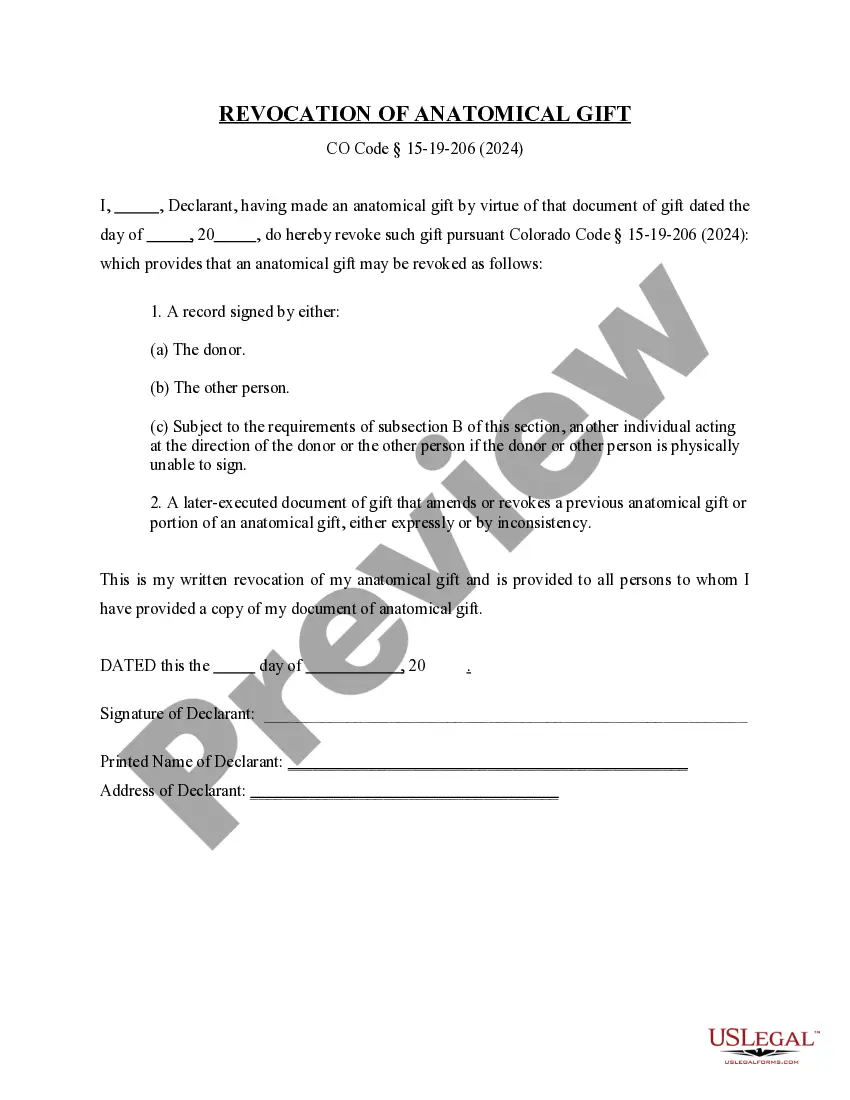

- Be sure to have picked the right form to your town/region. Select the Review option to examine the form`s content material. Browse the form description to actually have selected the right form.

- In the event the form doesn`t satisfy your specifications, make use of the Lookup field at the top of the display screen to obtain the one which does.

- Should you be content with the form, validate your choice by clicking the Purchase now option. Then, opt for the rates prepare you favor and provide your accreditations to sign up to have an bank account.

- Method the financial transaction. Use your Visa or Mastercard or PayPal bank account to finish the financial transaction.

- Choose the file format and obtain the form on your own gadget.

- Make alterations. Fill out, revise and print out and signal the downloaded New Mexico Agreement between Mortgage Brokers to Find Acceptable Lender for Client.

Each and every design you added to your bank account lacks an expiration date and it is your own property for a long time. So, if you want to obtain or print out an additional backup, just visit the My Forms section and click in the form you require.

Get access to the New Mexico Agreement between Mortgage Brokers to Find Acceptable Lender for Client with US Legal Forms, the most considerable local library of lawful file templates. Use 1000s of expert and state-distinct templates that meet up with your business or individual needs and specifications.

Form popularity

FAQ

A mortgage broker is a third party who will act on your behalf to arrange your home loan application. Instead of working directly with a bank or financial institution, a mortgage broker can work with various lenders to find the right home loan for you.

A mortgage broker acts as an intermediary by helping consumers identify the best lender for their situation, while a direct lender is a bank or other financial institution that decides whether you qualify for the loan and, if you do, hands over the check.

The main difference between a mortgage broker and lender is a broker doesn't lend you money. Instead, a mortgage broker helps you find the most suitable lender for your home purchase. A mortgage lender then provides the loan to you to buy the property.

If the brokerage is unable to verify the identity of a party to the transaction, the brokerage must advise the borrower, lender or investor (as appropriate): Before submitting the borrower's mortgage application to the lender or arranging a mortgage renewal agreement with the lender.

"A mortgage broker, essentially, is a conduit between the buyer and the bank. Instead of someone going straight to the bank to get a loan, they can go to a mortgage broker who will have access to a whole lot of different lenders - quite often a panel of up to 30 different lenders.

Finance Brokers are the Agent of the Borrower Not the Lender - Elliott May.

Lack of familiarity: You'll need to deal with a new person during your application. Free: Brokers are paid by lenders, not by you. No access to some lenders: Not all lenders work with brokers.

Using a mortgage broker to take out a mortgage can be quicker and easier than comparing deals and applying for a mortgage directly with a mortgage lender. This is particularly true if your financial situation means you risk being turned down for a mortgage by certain lenders.

When borrowers work with a loan officer, they deal directly with the institution that will lend them money. When borrowers work with a mortgage broker, they work with a third party. The broker merely facilitates the process between the borrower and the lender.

Using multiple brokers can be advantageous especially if you have already used a broker that isn't whole of market and they're struggling to provide you with a mortgage. But, in most cases it is best to vet your broker upfront and use a whole of market broker with an exemplary reputation.