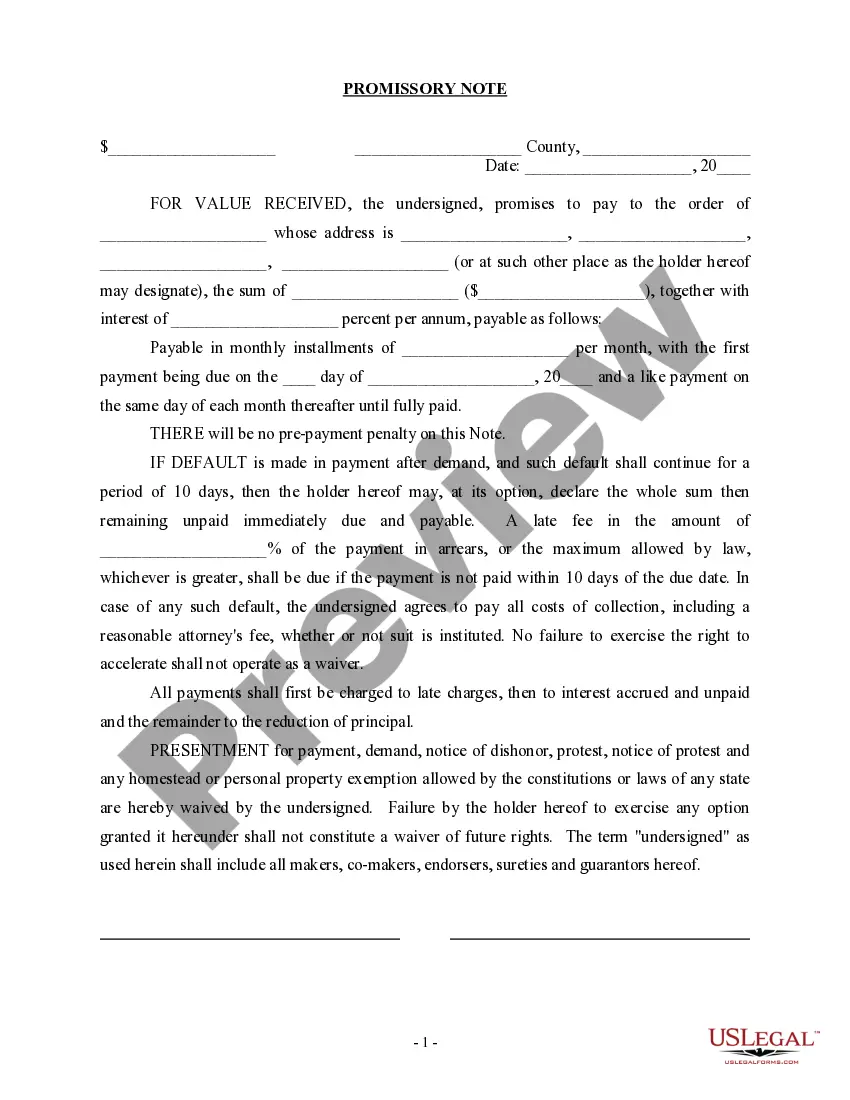

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

New Mexico Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

You can spend a number of hours online searching for the legal document format that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that have been reviewed by experts.

You can obtain or print the New Mexico Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase from the service.

To find another copy of your document, use the Search field to locate the format that suits your needs and requirements.

- If you have a US Legal Forms account, you may sign in and click the Download button.

- Then, you may complete, modify, print, or sign the New Mexico Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase.

- Every legal document format you obtain is yours permanently.

- To obtain an additional copy of any acquired form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the county/city that you choose.

- Review the form details to confirm you have picked the appropriate type.

Form popularity

FAQ

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A secured promissory note may include a security agreement as part of its terms. If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

A. As used in this section, "loan secured by real estate" means an obligation executed or assumed by the borrower that is secured by mortgage, deed of trust, or similar instrument, encumbering real estate that is owned by the borrower and upon which the bank relies as the principal security for the loan.