New Mexico Raffle Contract and Agreement

Description

How to fill out Raffle Contract And Agreement?

Are you in the location where you will require paperwork for potentially business or specific purposes nearly every working day.

There are numerous legitimate form templates accessible online, but finding ones you can trust isn’t simple.

US Legal Forms offers a vast array of document templates, including the New Mexico Raffle Contract and Agreement, designed to comply with state and federal regulations.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Select a convenient document format and download your version.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the New Mexico Raffle Contract and Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you require and ensure it is tailored to the correct city/region.

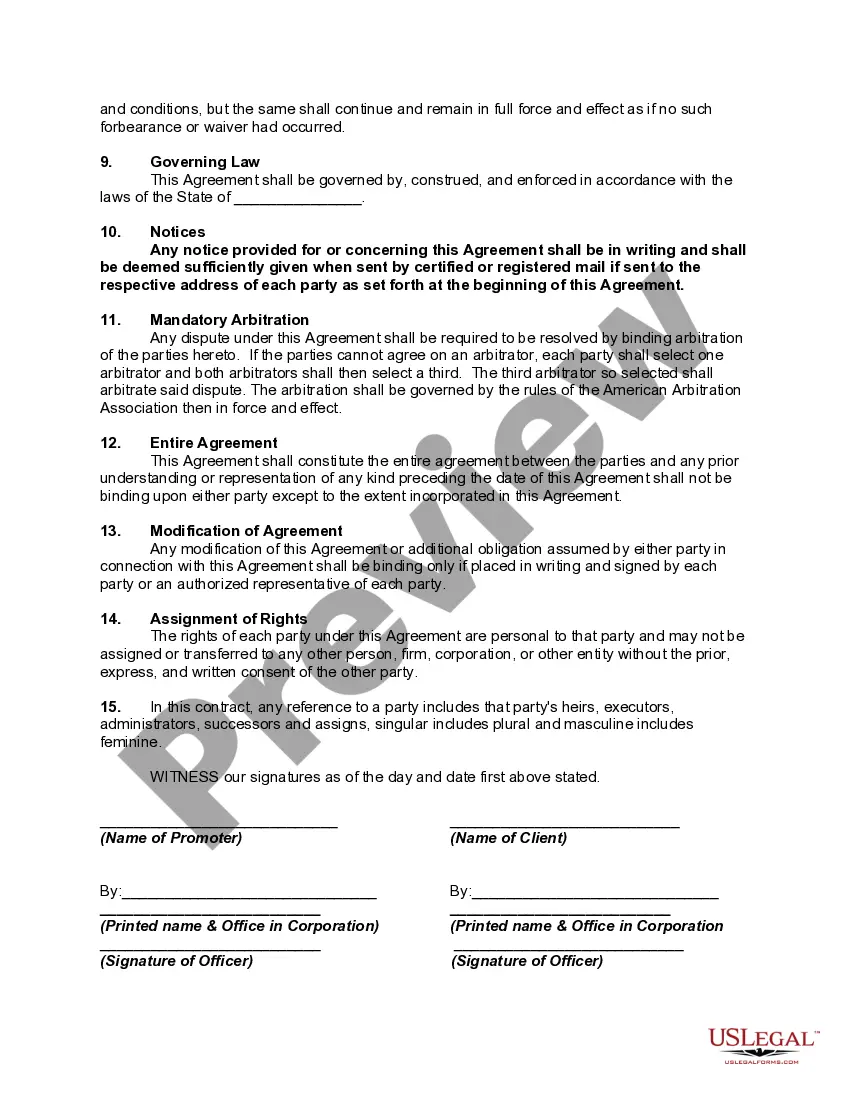

- Utilize the Preview feature to review the form.

- Verify the details to confirm you have selected the correct document.

- If the document isn’t what you need, use the Lookup field to find the template that fulfills your requirements.

- Once you locate the right document, click Buy now.

Form popularity

FAQ

Bingo is not legal in all states across the United States. Each state has its own rules regarding gaming activities, including bingo. If you plan to organize or participate in bingo games, it is essential to understand the legal framework and have a New Mexico Raffle Contract and Agreement, especially if you are in New Mexico, where specific guidelines exist.

In New Mexico, you must be at least 18 years old to play bingo. This age requirement ensures that participants can engage in gaming activities responsibly. When planning to organize bingo events, ensure you have a clear New Mexico Raffle Contract and Agreement to comply with all local regulations.

Yes, there are specific rules and regulations for conducting raffles in New Mexico. Organizers must adhere to guidelines such as licensing, transparent record-keeping, and appropriate distribution of proceeds. To facilitate compliance and ensure a successful event, you can create a comprehensive New Mexico Raffle Contract and Agreement using our expert platform.

Yes, bingo is legal in New Mexico, but it is also regulated under state law. Just like raffles, organizations must comply with specific guidelines to conduct bingo games. For a seamless experience, consider drafting a New Mexico Raffle Contract and Agreement that addresses all your gaming event needs, including bingo.

A raffle involves selling tickets for a chance to win a prize, where the ticket holders are competing against one another. In contrast, an opportunity drawing usually allows participants to enter without purchasing tickets, often involving a random selection process. It is essential to have a clear New Mexico Raffle Contract and Agreement to outline these distinctions and ensure your event adheres to legal requirements.

In New Mexico, raffle laws require that organizations must be non-profit and registered to conduct raffles. Additionally, there are regulations about prize limits and the allocation of proceeds. To navigate these laws effectively, utilizing a well-drafted New Mexico Raffle Contract and Agreement from our services can help you stay compliant.

Yes, you can conduct raffles in New Mexico. However, you must follow the state's specific laws regarding the organization and management of these events. To ensure compliance while creating a New Mexico Raffle Contract and Agreement, consider using our platform, where you can find templates and guidance tailored to your needs.

You can file your New Mexico state taxes online through the New Mexico Taxation and Revenue Department's website. They provide user-friendly forms and instructions to simplify the filing process. If you're at the helm of organizing a raffle, our platform can assist you in creating a solid New Mexico Raffle Contract and Agreement, making tax filing easier and more manageable.

Filing federal taxes exclusively is not advisable if you reside in New Mexico and earn income there. State tax regulations require you to file a state return, particularly if you engage in fundraising activities like raffles. A solid New Mexico Raffle Contract and Agreement can help elucidate your taxes, ensuring you comply with both state and federal requirements.

To obtain a CRS number in New Mexico, register online through the New Mexico Taxation and Revenue Department's portal. The CRS number is essential for businesses, including those conducting raffles, as it identifies you for tax purposes. Utilizing a New Mexico Raffle Contract and Agreement can streamline this process by clarifying your business structure and tax obligations.