New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits

Description

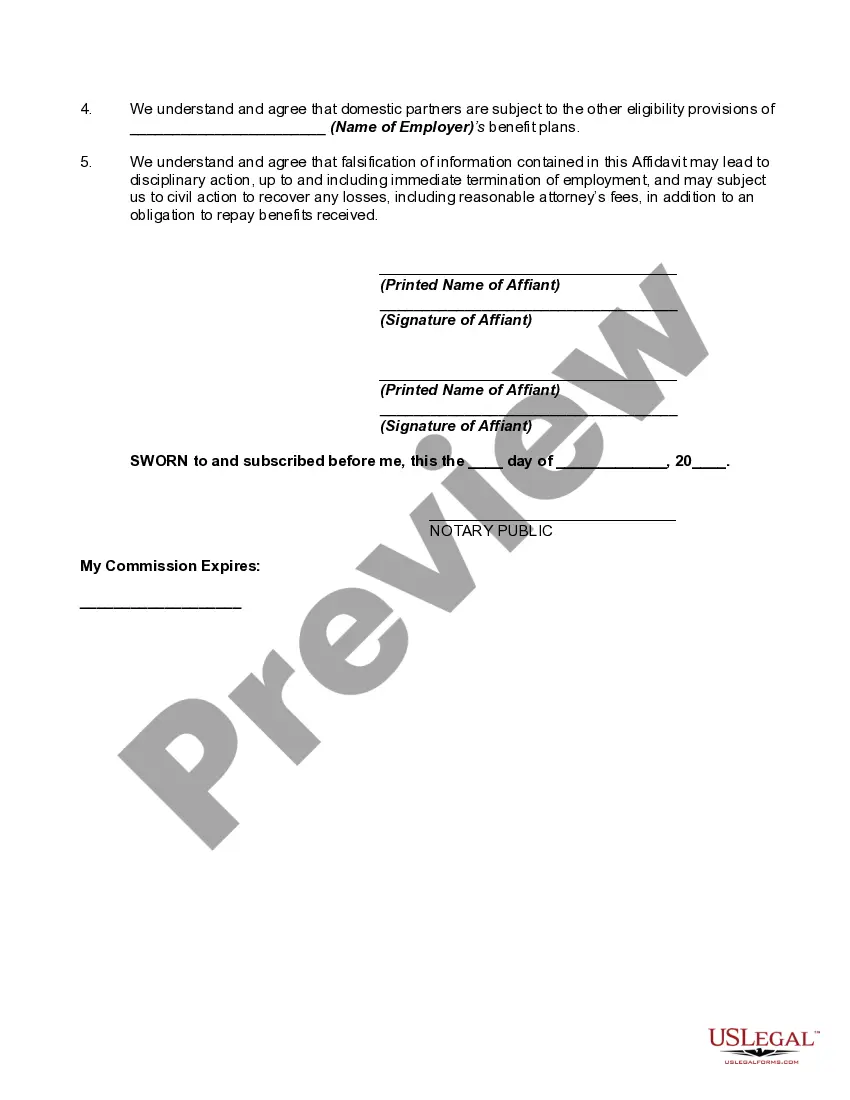

How to fill out Affidavit Of Both Domestic Partners To Employer In Order To Receive Benefits?

If you want to finalize, acquire, or print authentic documentation templates, utilize US Legal Forms, the foremost collection of lawful forms available online.

Leverage the site's straightforward and user-friendly search feature to find the documents you require.

A variety of templates for business and personal uses are organized by categories and regions, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

Step 6. Select the format of the legal document and download it to your device.

- Utilize US Legal Forms to locate the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits.

- You can also access forms you previously saved under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review method to examine the form's details. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form design.

- Step 4. Once you have located the form you need, click the Purchase now option. Choose your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

If you and your partner live together but are not married, you each file your own taxes as single individuals. You must report your income separately and cannot claim joint benefits. Nevertheless, by completing the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, you can enhance your access to certain benefits and protections offered to domestic partners.

To claim your domestic partner on your taxes, you cannot include them on your return as a dependent, since federal law does not recognize domestic partnerships. However, you may need to inform your employer of your domestic partnership through the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. This helps secure benefits for your partner but does not affect your tax filing directly.

Domestic partners usually file as single people or may file as head of household if they have dependents. Unfortunately, domestic partnerships are not recognized for joint filing at the federal level. By using the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, you can clarify your status with your employer and gain access to partner benefits.

Domestic partner relationship status signifies a committed partnership between two individuals who live together and share a domestic life but are not legally married. A domestic partnership may involve different rights and benefits, which can vary by state. In New Mexico, for example, you can use the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits to establish your partnership officially.

Yes, domestic partners typically file taxes as single individuals unless they meet the requirements for another filing status. It's important to understand that each partner must submit their taxes independently. However, if you use the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, you may need to check how this affects your tax situation.

To prove your domestic partnership for health insurance, you will typically need to provide documentation, such as the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. This affidavit outlines your relationship and demonstrates your eligibility for benefits. Additionally, your employer may require other documents, such as joint financial obligations or shared living arrangements, to confirm your domestic partnership.

Yes, New Mexico legally recognizes domestic partnerships. This recognition allows domestic partners to access certain rights and benefits, including health insurance through employers. To ensure you can receive these benefits, it's important to submit the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. This affidavit serves as a formal declaration of your relationship and may be necessary for your employer's benefits administrator.

To add your domestic partner to your health insurance, you generally need to fill out an affidavit, specifically the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. After completing this form, submit it to your employer's HR department along with any required documentation. Be sure to check the enrollment period, as adding a domestic partner may need to occur during open enrollment or a qualifying life event.

Proving domestic partnership for health insurance typically involves submitting the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. Along with this affidavit, some employers might request additional documentation, such as shared financial records or joint leases. It's crucial to review your employer's guidelines to gather complete evidence. This step ensures you both can access the necessary health benefits.

To prove domestic partnership insurance, you may need to complete the New Mexico Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. This legal statement demonstrates your commitment to each other and can often fulfill the requirements set by your employer. Remember to consult your employer's policies for any additional documents that may be needed to validate your partnership.