New Mexico Simple Promissory Note for Tutition Fee

Description

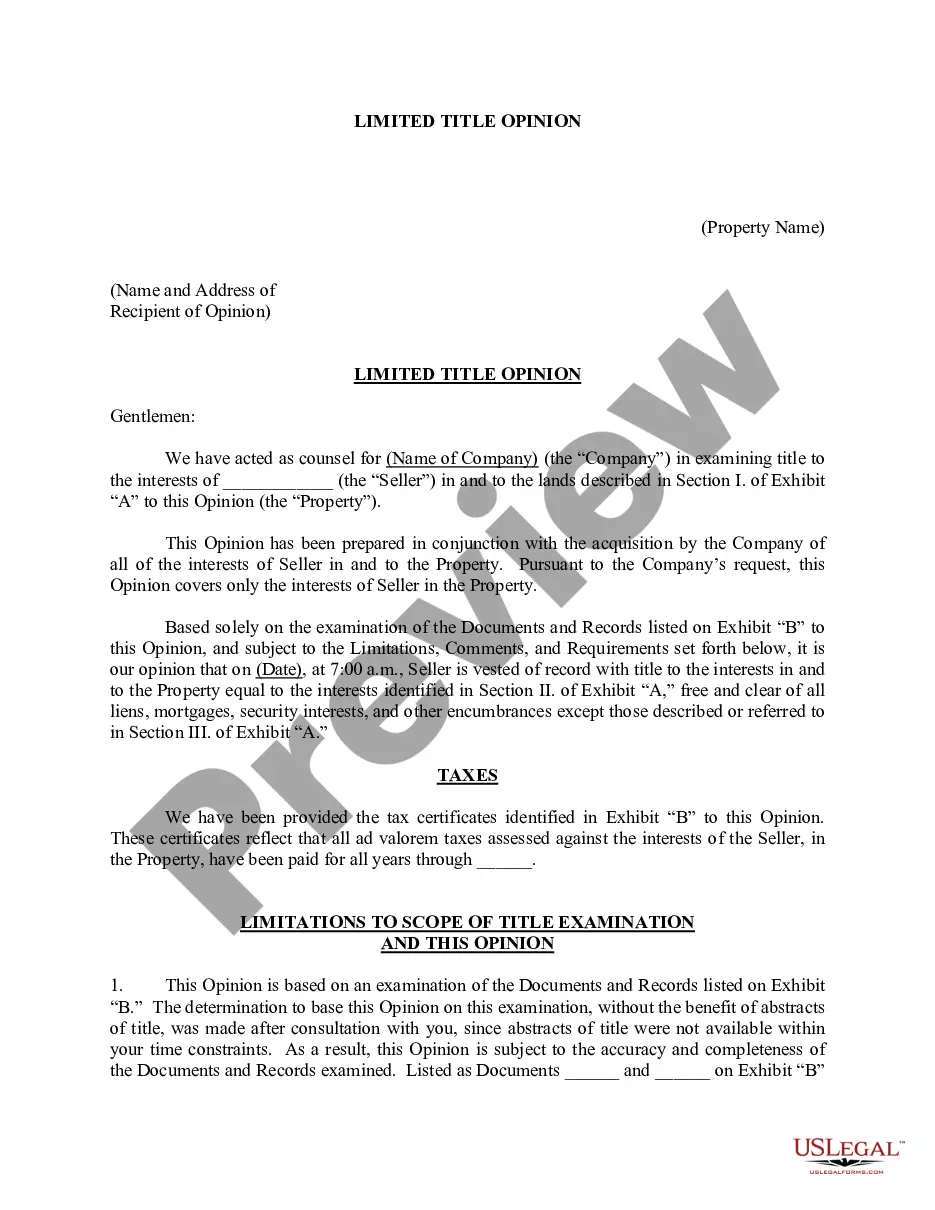

How to fill out Simple Promissory Note For Tutition Fee?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you can access numerous forms for business and personal reasons, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the New Mexico Simple Promissory Note for Tuition Fee in seconds.

Review the form summary to ensure you have selected the proper form.

If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- If you already have a monthly subscription, Log In to access the New Mexico Simple Promissory Note for Tuition Fee in the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview option to review the content of the form.

Form popularity

FAQ

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P. I promise to pay said amount on or before . Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

Only legal tender money is acceptable as promissory note. Rare currencies or coins wouldn't be taken as valid promissory notes. The amount to be paid should also be certain. It is not payable to bearer It is illegal to make promissory note payable to bearer under the provisions of the RBI Act.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P. I promise to pay said amount on or before . Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.