New Mexico Investment Letter: Exploring Intrastate Offering Opportunities The New Mexico Investment Letter is a comprehensive publication that provides in-depth information and analysis on various investment opportunities available within the state of New Mexico. One crucial aspect highlighted in this letter is the Intrastate Offering, a unique investment avenue targeted towards local investors. Intrastate Offering, also known as intrastate crowdfunding or intrastate equity crowdfunding, refers to a specific type of securities offering where businesses can raise capital from residents of the same state. This investment method gained popularity after the passage of the JOBS Act in 2012, which eased certain regulations and allowed for the democratization of investment opportunities. New Mexico offers several types of Investment Letters regarding Intrastate Offering, each focusing on distinct investment sectors. Here are a few notable ones: 1. New Mexico Investment Letter — Technology Sector: This letter provides comprehensive insights into technology-focused companies within New Mexico seeking intrastate investments. It covers promising startups, innovative ventures, and emerging tech entities that are harnessing the state's technological potential. Investors interested in technology-driven enterprises can find detailed analysis, market trends, and investment recommendations. 2. New Mexico Investment Letter — Renewable Energy Sector: Renewable energy projects are rapidly gaining momentum in New Mexico, and this investment letter focuses on those opportunities. It features a wide array of intrastate offerings related to solar, wind, hydroelectric, and geothermal energy projects. Readers can learn about the potential returns, environmental impact, and regulatory aspects related to these sustainable investments. 3. New Mexico Investment Letter — Real Estate Sector: This letter specializes in highlighting Intrastate Offering opportunities within the New Mexico real estate market. It covers residential, commercial, and industrial projects, analyzing market conditions, development plans, and potential returns. Investors seeking to diversify their portfolio by investing in the local real estate sector will find this letter highly valuable. 4. New Mexico Investment Letter — Small Business Development: This investment letter focuses on intrastate offerings meant to support the development of small businesses in New Mexico. It sheds light on local entrepreneurs' innovations, expansion plans, and growth potential. This letter aims to encourage investment in local small businesses, fostering economic growth and creating job opportunities. The New Mexico Investment Letter serves as a comprehensive guide, equipping investors with the knowledge and insights they need to make informed decisions regarding intrastate offerings. By covering various sectors and investment types, it enables readers to explore options aligned with their investment goals and interests, subsequently contributing to the growth and development of New Mexico's economy.

New Mexico Investment Letter regarding Intrastate Offering

Description

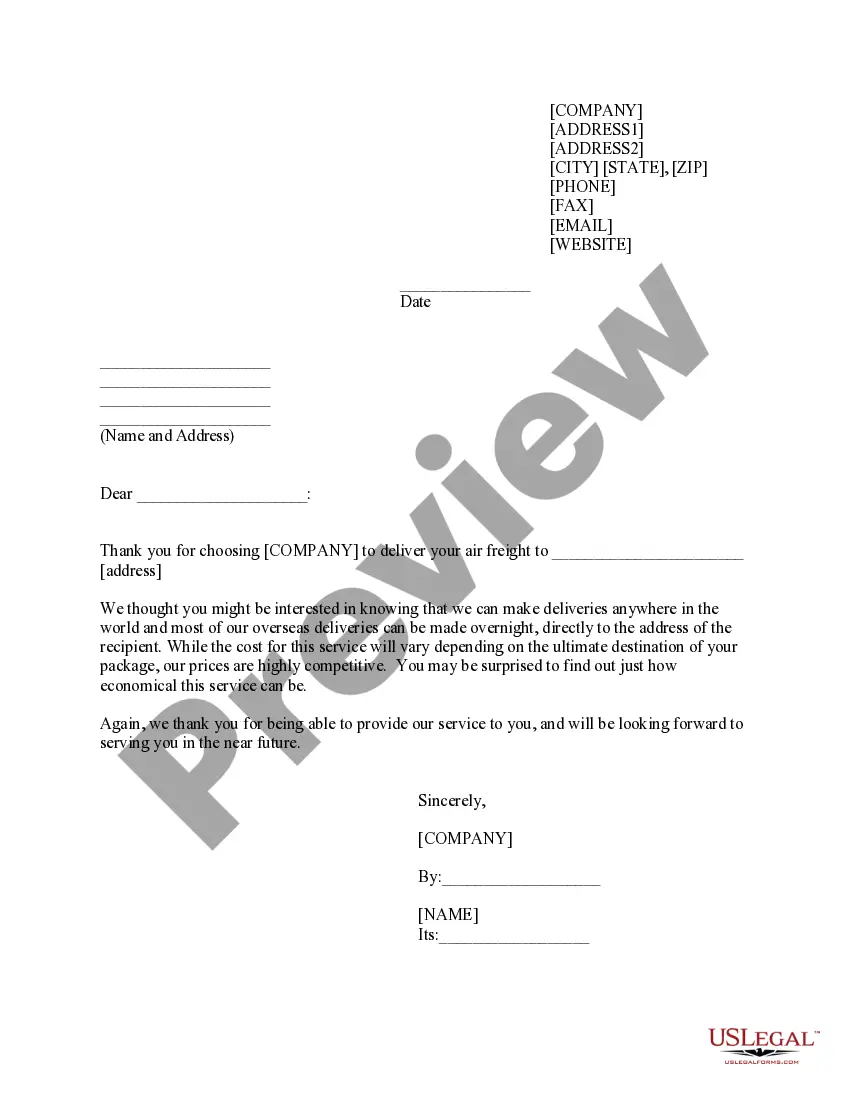

How to fill out New Mexico Investment Letter Regarding Intrastate Offering?

If you want to total, obtain, or print authorized file themes, use US Legal Forms, the biggest assortment of authorized varieties, that can be found on-line. Utilize the site`s simple and easy convenient look for to discover the paperwork you will need. Different themes for organization and specific reasons are categorized by categories and claims, or search phrases. Use US Legal Forms to discover the New Mexico Investment Letter regarding Intrastate Offering in just a few clicks.

Should you be presently a US Legal Forms buyer, log in for your profile and click on the Down load option to have the New Mexico Investment Letter regarding Intrastate Offering. You can also accessibility varieties you in the past delivered electronically within the My Forms tab of your profile.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape for that correct city/country.

- Step 2. Use the Preview solution to examine the form`s content. Do not forget to read the information.

- Step 3. Should you be not satisfied together with the develop, take advantage of the Look for industry at the top of the display screen to locate other variations of your authorized develop web template.

- Step 4. When you have located the shape you will need, click on the Buy now option. Opt for the costs program you favor and put your qualifications to register for an profile.

- Step 5. Approach the transaction. You can use your charge card or PayPal profile to complete the transaction.

- Step 6. Pick the file format of your authorized develop and obtain it on your system.

- Step 7. Full, edit and print or indicator the New Mexico Investment Letter regarding Intrastate Offering.

Each authorized file web template you purchase is your own property for a long time. You might have acces to each and every develop you delivered electronically in your acccount. Click on the My Forms section and decide on a develop to print or obtain once again.

Be competitive and obtain, and print the New Mexico Investment Letter regarding Intrastate Offering with US Legal Forms. There are millions of expert and condition-particular varieties you may use for your organization or specific needs.

Form popularity

FAQ

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

In the United States, an intrastate offering is a securities offering that can only be purchased in the state in which it is being issued. Because the offering only includes one state, it does not fall under the jurisdiction of the Securities and Exchange Commission (SEC).

Section 3(a)(11) of the Securities Act is generally known as the intrastate offering exemption. This exemption seeks to facilitate the financing of local business operations. To qualify for the intrastate offering exemption, a company must: be organized in the state where it is offering the securities.

Rule 147 is a rule that can be used by a company to raise funds without actually registering with the Securities and Exchange Commission (SEC).

Section 4(a)(2) is also known as the private placement exemption and is the most widely used exemption for securities offerings in the U.S. The exemption allows an issuer to raise an unlimited amount of capital in private transactions from sophisticated investors who are able to fend for themselves.

In 2016, the SEC amended Rule 147 to modernize it and establish an intrastate offering exemption known as Rule 147A. The amended rule allows for offers of securities to be made available to out-of-state residents, as well as for the exemptions to apply to issuers of securities that incorporated out-of-state.

2 Section 3(a)(11) of the Securities Act is generally known as the intrastate offering exemption. To qualify for the exemption, an issuer must be organized in the state where it is offering the securities; carry out a significant amount of its business in that state; and make offers and sales only to residents of

A Limited Offering includes any offer to you to purchase any Securities, whether stock, debt securities, or partnership interests, from any entity, unless those Securities are registered under the Securities Act of 1933 (that is, are publicly offered/publicly traded Securities).

Definition of Interstate Offering Interstate Offering is a multi-state offering of securities, which requires that the issuer register with the SEC as well as with the states in which the securities will be sold.