New Mexico Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

Are you presently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, including the New Mexico Notice of Default under Security Agreement in Purchase of Mobile Home, designed to comply with federal and state regulations.

Select the pricing plan you wish, fill in the necessary details to create your account, and purchase the order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the New Mexico Notice of Default under Security Agreement in Purchase of Mobile Home at any time, if needed. Click on the appropriate form to download or print the document template. Use US Legal Forms, the largest collection of legal templates, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms to start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New Mexico Notice of Default under Security Agreement in Purchase of Mobile Home template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct locality/state.

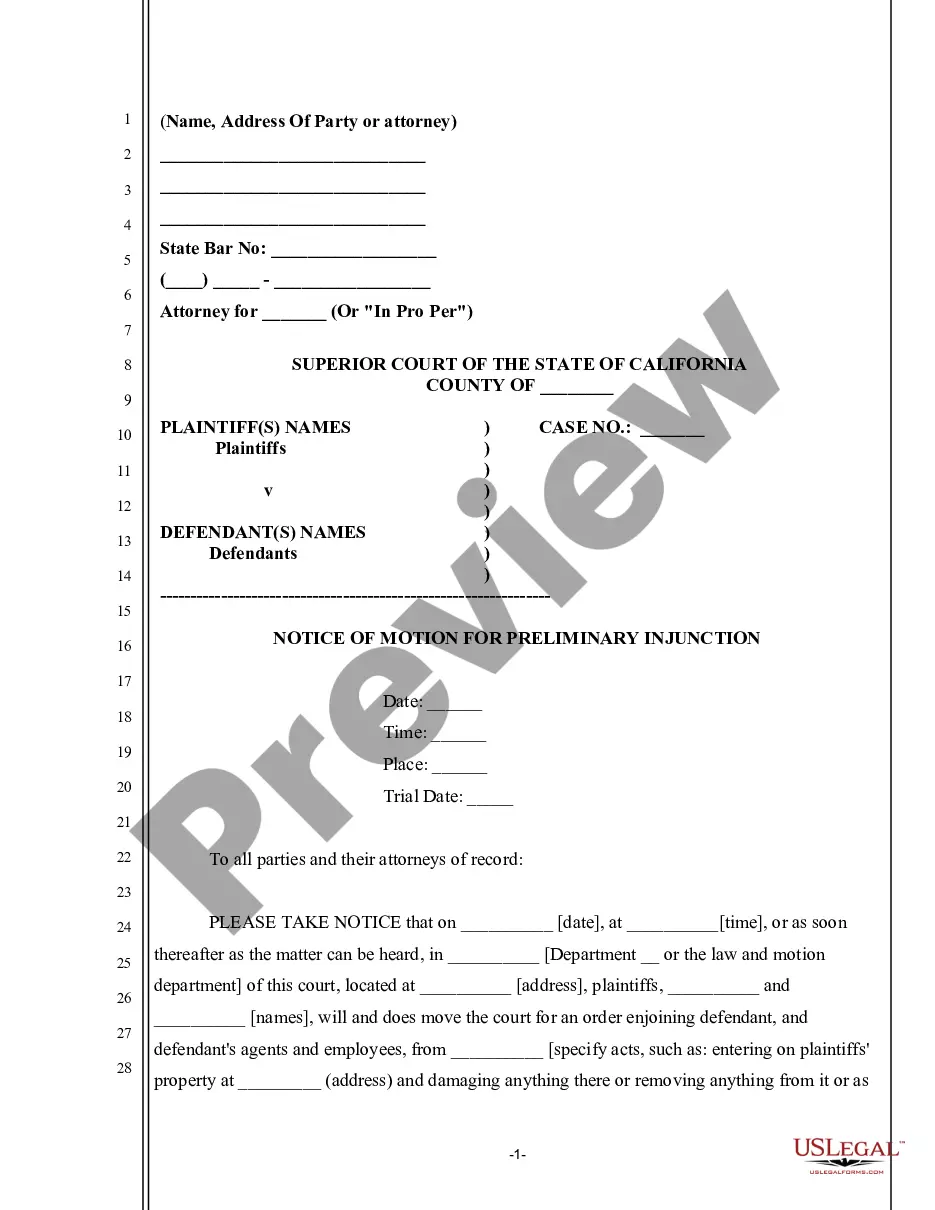

- Utilize the Preview feature to review the document.

- Check the description to confirm you have selected the correct form.

- If the form isn’t exactly what you’re looking for, use the Search field to find the form that meets your requirements.

- Once you obtain the right form, click Acquire now.

Form popularity

FAQ

An agreement becomes invalid primarily when it lacks mutual consent, includes illegal terms, or does not meet the formal requirements set forth by the law. For instance, if your security agreement regarding a mobile home does not encompass the necessary descriptions or signatures, it may face invalidation. Understanding these pitfalls can help you draft better agreements. That’s why it's critical to review your documents carefully.

A security agreement is valid when it is clear, written, and signed by the involved parties, outlining all necessary details about the collateral. Specifically, in New Mexico, this means clearly defining the mobile home as collateral. Clarity ensures that all parties understand their obligations and rights. By adhering to these principles, both creditors and debtors can enjoy a secure and enforceable agreement.

For a valid security agreement, conditions such as a written document, proper signatures, and explicit collateral description are essential. In New Mexico, this is particularly relevant when dealing with mobile homes as the collateral. Other factors, like legal capacity of the parties involved, also contribute to the agreement's validity. Ensuring all these conditions are met can help prevent future issues.

A security agreement becomes invalid if it fails to meet certain legal requirements, such as being written, properly executed, or descriptive enough to identify the collateral. If you do not accurately define the mobile home involved, for example, you risk the agreement falling apart. In some cases, an invalid agreement may leave creditors without recourse in a default situation. Therefore, being meticulous when drafting the agreement is vital.

A valid security agreement must include an adequate description of the collateral, be signed by the parties involved, and clearly outline the rights and obligations of the debtor and creditor. Specifically for mobile homes in New Mexico, the proper identification of the property is imperative. Additionally, the agreement should be in writing to meet legal standards. Taking these steps can safeguard the interests of all parties involved.

For a creditor to have an enforceable security interest, they must have a security agreement that describes the collateral. In New Mexico, this is particularly important when dealing with mobile homes. A properly executed agreement ensures that the creditor's interests are protected in case of default. Thus, it is crucial to follow the right steps in creating and documenting this agreement.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

Terms Contained in a Security Agreement A basic security agreement should have the description of the parties involved, the collateral and the statement of intention of providing security interest along with signatures from all parties.

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.