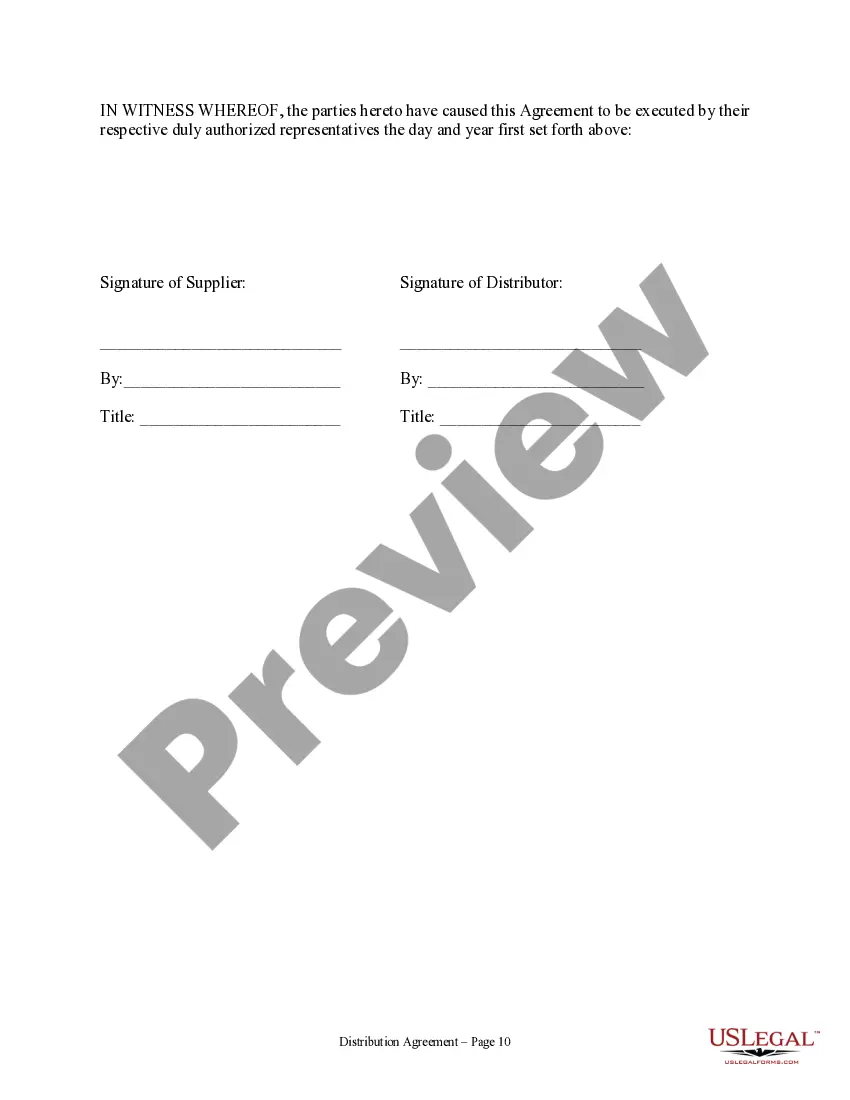

A New Mexico Distribution Agreement is a legally binding contract that establishes the terms and conditions for the distribution of goods or services between parties operating in the state of New Mexico. This agreement outlines the rights, responsibilities, and obligations of both the distributor and the supplier. The New Mexico Distribution Agreement governs the relationship between the supplier, who manufactures or supplies the product, and the distributor, who is responsible for promoting, selling, and distributing the product within the designated territory of New Mexico. This agreement sets forth the terms related to product pricing, marketing efforts, payment terms, territory restrictions, exclusivity, and termination clauses. There are different types of New Mexico Distribution Agreements that can be used depending on the specific requirements of the parties involved: 1. Exclusive Distribution Agreement: This type of agreement grants the distributor exclusive rights to distribute the supplier's products in a specific geographical area within New Mexico. The supplier will refrain from appointing any other distributors or selling directly to customers within the agreed territory. 2. Non-Exclusive Distribution Agreement: Unlike the exclusive distribution agreement, this type allows the supplier to appoint multiple distributors within New Mexico. The distributor's role is to sell and promote the products alongside other distributors, without any exclusive territorial rights. 3. Selective Distribution Agreement: This agreement allows the supplier to select a limited number of distributors based on specific criteria to ensure that the products are sold in a controlled and quality-focused manner. The supplier retains the right to approve or deny any additional distributors within New Mexico. 4. Franchise Distribution Agreement: In certain cases, the New Mexico Distribution Agreement may be combined with a franchise agreement. This agreement grants the distributor the right to operate a business using the supplier's trade name, brand, or trademark, typically in exchange for royalty fees or a percentage of sales. Regardless of the type, a typical New Mexico Distribution Agreement will include provisions related to product quality control, intellectual property rights, confidentiality, dispute resolution, and duration of the agreement. In conclusion, a New Mexico Distribution Agreement is a crucial legal instrument that outlines the terms and conditions governing the distribution of products within the state. By clearly defining the roles, responsibilities, and expectations of both the supplier and distributor, this agreement ensures a smooth and mutually beneficial business relationship.

New Mexico Distribution Agreement

Description

How to fill out New Mexico Distribution Agreement?

US Legal Forms - one of the greatest libraries of authorized kinds in the USA - provides a wide array of authorized papers themes you may down load or print out. Making use of the site, you can find 1000s of kinds for organization and person uses, categorized by classes, states, or key phrases.You will discover the most recent variations of kinds such as the New Mexico Distribution Agreement in seconds.

If you have a registration, log in and down load New Mexico Distribution Agreement from the US Legal Forms library. The Down load switch can look on every develop you perspective. You gain access to all earlier acquired kinds inside the My Forms tab of your own bank account.

If you want to use US Legal Forms for the first time, listed below are easy recommendations to get you started out:

- Ensure you have picked the proper develop for your personal metropolis/region. Go through the Review switch to check the form`s content. Browse the develop information to ensure that you have chosen the correct develop.

- In case the develop does not match your demands, utilize the Lookup discipline on top of the display to obtain the one that does.

- In case you are happy with the shape, validate your decision by simply clicking the Get now switch. Then, opt for the prices strategy you favor and provide your accreditations to register to have an bank account.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal bank account to finish the financial transaction.

- Select the formatting and down load the shape on your gadget.

- Make adjustments. Load, revise and print out and sign the acquired New Mexico Distribution Agreement.

Every template you put into your money lacks an expiry time and is also the one you have permanently. So, if you wish to down load or print out another copy, just check out the My Forms segment and click in the develop you want.

Gain access to the New Mexico Distribution Agreement with US Legal Forms, the most substantial library of authorized papers themes. Use 1000s of professional and status-particular themes that meet up with your small business or person requires and demands.

Form popularity

FAQ

Yes, in New Mexico, property taxes may decrease for residents aged 65 and older due to available exemptions. These exemptions can offer significant financial relief, making it easier for seniors to manage their property costs. If you are considering a New Mexico Distribution Agreement, be sure to factor in how these tax considerations influence your overall financial strategy.

To apply for a New Mexico CRS number, visit the New Mexico Taxation and Revenue Department's website. Fill out the application form, providing necessary information about your business operations. Having a solid New Mexico Distribution Agreement in place can streamline your business processes and help you maintain compliance with state regulations.

Several groups can be exempt from paying property taxes in New Mexico, including seniors, veterans, and individuals with disabilities. These exemptions allow eligible individuals to better manage their financial responsibilities. As you navigate these benefits, the New Mexico Distribution Agreement can help outline any specific terms related to property ownership and obligations.

In New Mexico, seniors aged 65 years or older can qualify for property tax exemptions. This exemption can significantly reduce their property tax burden. To ensure you maximize your benefits, review the provisions in the New Mexico Distribution Agreement regarding property tax exemptions. Consulting with local authorities can also provide clarification.

In New Mexico, seniors may not stop paying income taxes entirely. However, they might qualify for certain exemptions or credits. The New Mexico Distribution Agreement can be a helpful tool in planning your finances and understanding applicable tax obligations. Always check with a tax professional for specific advice.

To execute a New Mexico Distribution Agreement, start by gathering all necessary information regarding the parties involved. Next, draft the agreement outlining the terms, including distribution rights and obligations. After completing the document, each party should sign it, ensuring mutual consent. Lastly, consider keeping a copy for your records.

To get a CRS number in New Mexico, you must register your business with the New Mexico Taxation and Revenue Department. This can be done online using their website, where you will need to provide necessary business details and any identification numbers. Having a CRS number is vital for businesses entering a New Mexico Distribution Agreement, as it facilitates tax collection and compliance with state laws.

The CRS-1 form in New Mexico is used to report gross receipts taxes and withholdings for your business. If you are entering into a New Mexico Distribution Agreement, understanding how to complete this form is crucial for maintaining compliance. This form allows you to accurately report your sales and ensure that you fulfill your tax obligations, fostering a good business reputation.

To obtain a certificate of good standing in New Mexico, you need to request it through the New Mexico Secretary of State’s office. You can apply online or by mail, and you will typically need to provide your business name and other identifying information. A certificate of good standing can enhance your New Mexico Distribution Agreement by demonstrating that your business complies with state regulations.

The fastest way to obtain a tax ID number in New Mexico is by applying online through the New Mexico Taxation and Revenue Department's website. Completing the application digitally provides immediate processing, which is ideal for businesses looking to enter a New Mexico Distribution Agreement quickly. This approach ensures that you receive your tax ID promptly, allowing you to focus on your business operations.