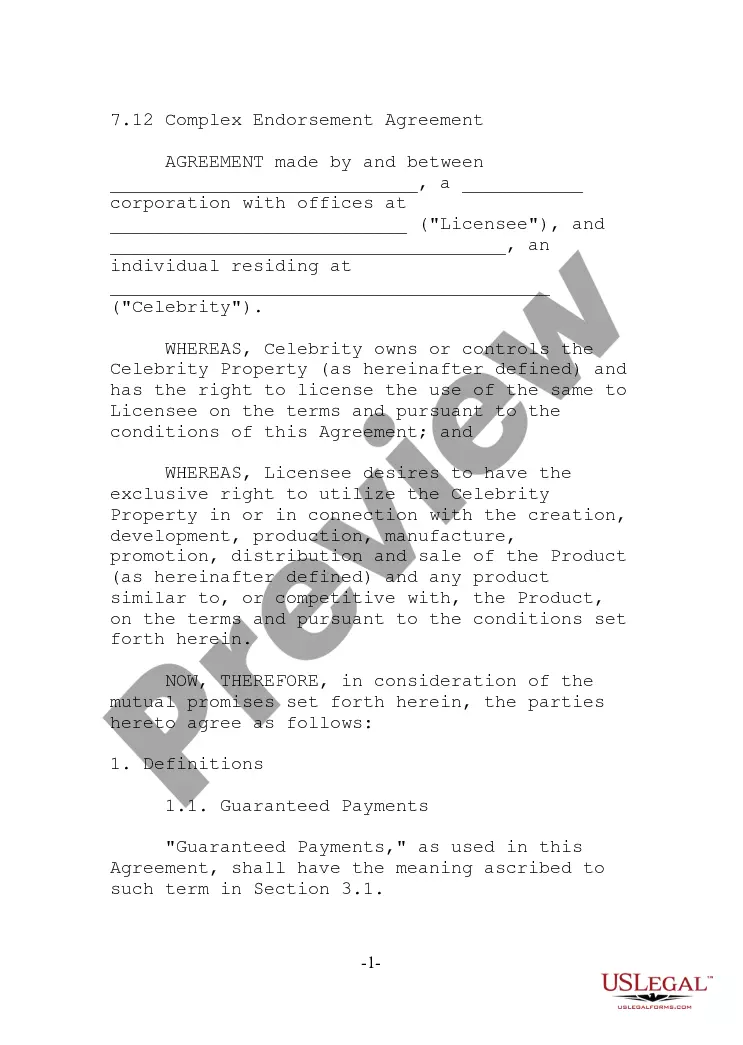

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

A New Mexico Buy-Sell Agreement is a legally binding contract between two shareholders of a closely held corporation in the state of New Mexico. This agreement outlines the terms and conditions under which the shareholders may buy, sell, or transfer their shares to each other or to a third party. It is an essential document that helps protect the interests of the shareholders and the corporation. Keywords: New Mexico, Buy-Sell Agreement, two shareholders, closely held corporation There are typically two main types of New Mexico Buy-Sell Agreements between two shareholders of closely held corporations: 1. Cross-Purchase Agreement: In this type of agreement, each shareholder has the right or obligation to purchase the shares of the other shareholder upon certain triggering events such as death, disability, retirement, or voluntary sale. The agreement sets forth the price, payment terms, and other relevant details for the transaction. The remaining shareholder(s) will usually buy the departing shareholder's shares. 2. Stock Redemption Agreement: In this type of agreement, the corporation itself has the right or obligation to repurchase a shareholder's shares upon triggering events. The agreement outlines the terms and conditions for the corporation to buy back the shares, including the price, payment terms, and the source of funds. Both types of agreements serve to ensure a smooth transition of ownership and maintain the stability of the closely held corporation in the event of unforeseen circumstances. They can help prevent disputes, provide a fair valuation mechanism, and ensure that shares are distributed according to the shareholders' wishes. When drafting a New Mexico Buy-Sell Agreement between two shareholders of a closely held corporation, it is crucial to consider various factors such as the shareholders' goals, the corporation's financial situation, and potential triggering events. Additionally, it is essential to consult with legal professionals experienced in New Mexico corporate law to ensure compliance with state-specific requirements. In summary, a New Mexico Buy-Sell Agreement between two shareholders of a closely held corporation is a valuable tool that establishes the rules and procedures for the buying and selling of shares. It can help protect the interests of shareholders and the ongoing operations of the corporation.