The New Mexico Angel Investor Agreement is a legally binding contract between entrepreneurs seeking funding for their startup business and angel investors located in the state of New Mexico. This agreement defines the terms and conditions under which the angel investor provides financial support to the entrepreneur, in exchange for an equity stake or other agreed-upon forms of return. The main purpose of a New Mexico Angel Investor Agreement is to protect the rights and interests of both parties involved in the investment deal. It outlines the obligations, responsibilities, and expectations of the entrepreneur and the angel investor, ensuring a fair and transparent investment process. The agreement also provides a framework for addressing potential disputes or unforeseen circumstances that may arise during the investment period. Key elements typically included in a New Mexico Angel Investor Agreement are: 1. Investment Terms: This section describes the amount of investment, the equity stake or return on investment the angel investor expects, and any conditions or milestones that need to be met for the investment to be disbursed. 2. Voting Rights: The agreement may outline the angel investor's rights to vote on critical business decisions, such as major strategic changes or fundraising rounds, based on their equity ownership. 3. Information Rights: The investor agreement may detail the entrepreneur's obligation to provide regular updates, financial statements, and reports to the angel investor, ensuring transparency and accountability. 4. Exit Strategy: This section outlines the various exit options available to the angel investor, such as selling their equity stake, and how the valuation or buyout process will be conducted. 5. Intellectual Property Protection: If the startup has intellectual property assets, the agreement may address the protection, licensing, or transfer of these assets. Furthermore, there are different types of New Mexico Angel Investor Agreements that cater to specific investment scenarios and preferences. These may include: 1. Convertible Note Agreement: This type of agreement allows the angel investor to provide debt financing, which can later convert into equity ownership at a predetermined valuation or triggering event. 2. Preferred Stock Agreement: In this agreement, the angel investor receives preferred shares, which grant them certain additional rights and privileges compared to common shareholders, such as priority in liquidation payouts. 3. Revenue Sharing Agreement: This type of agreement involves the angel investor receiving a percentage of the startup's revenue for a specific period, rather than equity ownership, providing an alternative return on investment structure. In summary, a New Mexico Angel Investor Agreement is a comprehensive legal document that governs the relationship between entrepreneurs and angel investors in New Mexico. It ensures clarity, protection, and accountability for both parties involved in funding a startup venture.

New Mexico Angel Investor Agreement

Description

How to fill out New Mexico Angel Investor Agreement?

If you wish to total, acquire, or print out legal file templates, use US Legal Forms, the most important assortment of legal types, which can be found on the Internet. Use the site`s simple and convenient search to obtain the documents you will need. Various templates for company and individual reasons are sorted by groups and claims, or key phrases. Use US Legal Forms to obtain the New Mexico Angel Investor Agreement with a handful of mouse clicks.

When you are currently a US Legal Forms customer, log in to the profile and click the Down load option to find the New Mexico Angel Investor Agreement. You may also access types you formerly downloaded in the My Forms tab of your respective profile.

If you work with US Legal Forms the first time, follow the instructions listed below:

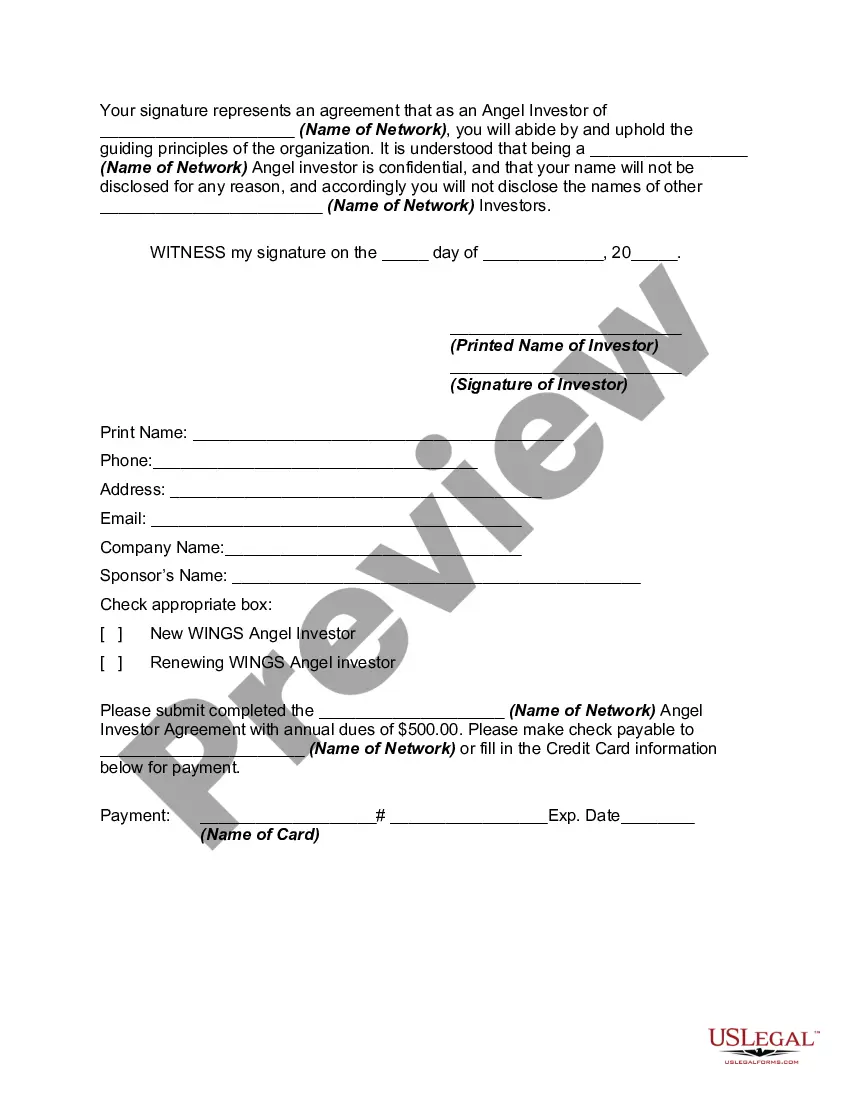

- Step 1. Be sure you have selected the shape for that appropriate area/country.

- Step 2. Make use of the Preview solution to check out the form`s articles. Do not forget to see the description.

- Step 3. When you are unhappy using the develop, make use of the Research industry near the top of the display to get other types of your legal develop web template.

- Step 4. When you have identified the shape you will need, go through the Buy now option. Choose the pricing plan you prefer and include your credentials to register to have an profile.

- Step 5. Procedure the purchase. You can use your credit card or PayPal profile to accomplish the purchase.

- Step 6. Choose the structure of your legal develop and acquire it on your system.

- Step 7. Comprehensive, change and print out or indication the New Mexico Angel Investor Agreement.

Each legal file web template you get is your own forever. You have acces to every develop you downloaded inside your acccount. Click on the My Forms section and decide on a develop to print out or acquire again.

Be competitive and acquire, and print out the New Mexico Angel Investor Agreement with US Legal Forms. There are thousands of specialist and condition-particular types you may use for the company or individual requirements.