New Mexico Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Are you presently in the position that you need to have paperwork for either enterprise or personal uses nearly every time? There are plenty of legitimate document themes available on the Internet, but finding versions you can trust is not straightforward. US Legal Forms provides 1000s of type themes, like the New Mexico Articles of Incorporation, Not for Profit Organization, with Tax Provisions, which are written in order to meet state and federal demands.

In case you are previously informed about US Legal Forms internet site and possess a free account, just log in. Following that, it is possible to download the New Mexico Articles of Incorporation, Not for Profit Organization, with Tax Provisions web template.

If you do not provide an accounts and need to start using US Legal Forms, adopt these measures:

- Find the type you will need and ensure it is for the proper area/area.

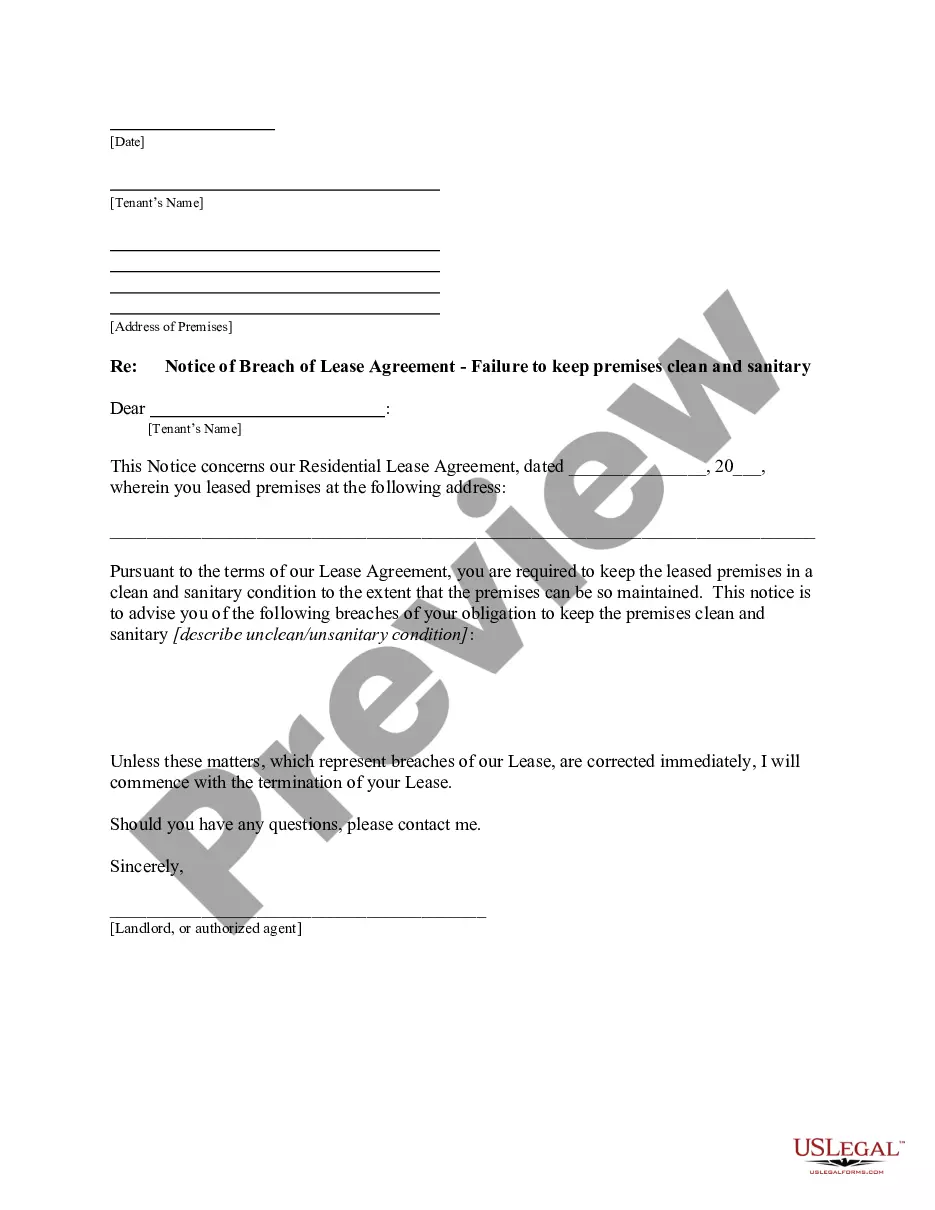

- Take advantage of the Preview option to check the form.

- Look at the outline to actually have selected the appropriate type.

- In the event the type is not what you are looking for, make use of the Look for discipline to find the type that meets your requirements and demands.

- When you discover the proper type, just click Purchase now.

- Pick the costs strategy you need, fill in the required info to produce your money, and pay money for the order utilizing your PayPal or bank card.

- Decide on a hassle-free file file format and download your copy.

Get all the document themes you possess purchased in the My Forms menus. You can obtain a additional copy of New Mexico Articles of Incorporation, Not for Profit Organization, with Tax Provisions any time, if possible. Just click on the essential type to download or print out the document web template.

Use US Legal Forms, probably the most substantial selection of legitimate kinds, to conserve time and prevent errors. The service provides expertly manufactured legitimate document themes which can be used for a variety of uses. Make a free account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

Register for Required State Licenses Yes. Your nonprofit can register for a state tax ID by submitting an Application for Business Tax Identification Number (Form ACD-31015) to the New Mexico Taxation and Revenue Department. You can submit online, and there is no filing fee.

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

New Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501(c) of the Internal Revenue Code with a classification as an educational or social entity. Your gross receipts may be exempt from gross receipts tax under Section 7-9-29 NMSA 1978.

Governmental Entity Exemptions For example: New Mexico cities, counties and public schools. Receipts of any foreign nation are exempt when exemption is required by a treaty to which the United States is a party (7-9-13).

Nonprofit organizations recognized by the federal government under Section 501(c) of the Internal Revenue Code enjoy tax-exempt status in New Mexico to varying degrees for income (not pur- chases) covered by their IRS letters of authoriza- tion. Federal law distinguishes among many types of nonprofit organizations.

The state does not have a sales tax; instead it assesses a gross receipts tax on merchants. Individually billed accounts (IBA) are not exempt from the gross receipts tax. Centrally billed accounts (CBA) may be exempt from the gross receipts tax.

Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to receive tax-deductible contributions in ance with Code section 170.