New Mexico Annual Expense Report is a comprehensive financial document that provides detailed insights into the expenditures incurred by the state of New Mexico over a specific fiscal year. This report serves as a vital tool for overviewing and assessing the financial health of the state government. The New Mexico Annual Expense Report offers a comprehensive breakdown of various categories of expenses, including operating costs, public services, infrastructure development, education, healthcare, public safety, welfare programs, and more. It allows policymakers, auditors, and citizens to gain a thorough understanding of how funds are allocated and utilized to support various government functions and programs. Different types of New Mexico Annual Expense Reports might include: 1. State Government Annual Expense Report: This report focuses on the expenses incurred by the state government and its agencies, providing an overview of spending on administrative tasks, salaries, maintenance, and other operational costs. It helps in assessing the efficiency and effectiveness of government operations. 2. Education Expense Report: This variant concentrates on the expenses related to education in New Mexico, ranging from K-12 public education to higher education institutions. It provides a detailed breakdown of spending on school infrastructure, teacher salaries, student resources, and other educational programs. 3. Infrastructure Expense Report: This type of expense report emphasizes the funds invested in New Mexico's infrastructure, such as roadways, bridges, public transportation, and utilities. It outlines the costs of construction, maintenance, and repairs required to ensure the state's infrastructure remains functional and robust. 4. Healthcare Expense Report: This report focuses on the healthcare-related expenditures in New Mexico, including funding for hospitals, clinics, healthcare providers, public health campaigns, and Medicaid. It offers insights into the allocation of funds to meet the increasing healthcare needs of the population. 5. Public Safety Expense Report: This variant provides information on the expenses associated with law enforcement agencies, fire departments, and emergency services. It highlights the costs of personnel, equipment, training, and the maintenance of public safety infrastructure. The New Mexico Annual Expense Report is crucial to promoting transparency, accountability, and fiscal responsibility within the state government. It enables stakeholders to identify areas where budgetary adjustments may be necessary and supports informed decision-making for future financial planning.

New Mexico Annual Expense Report

Description

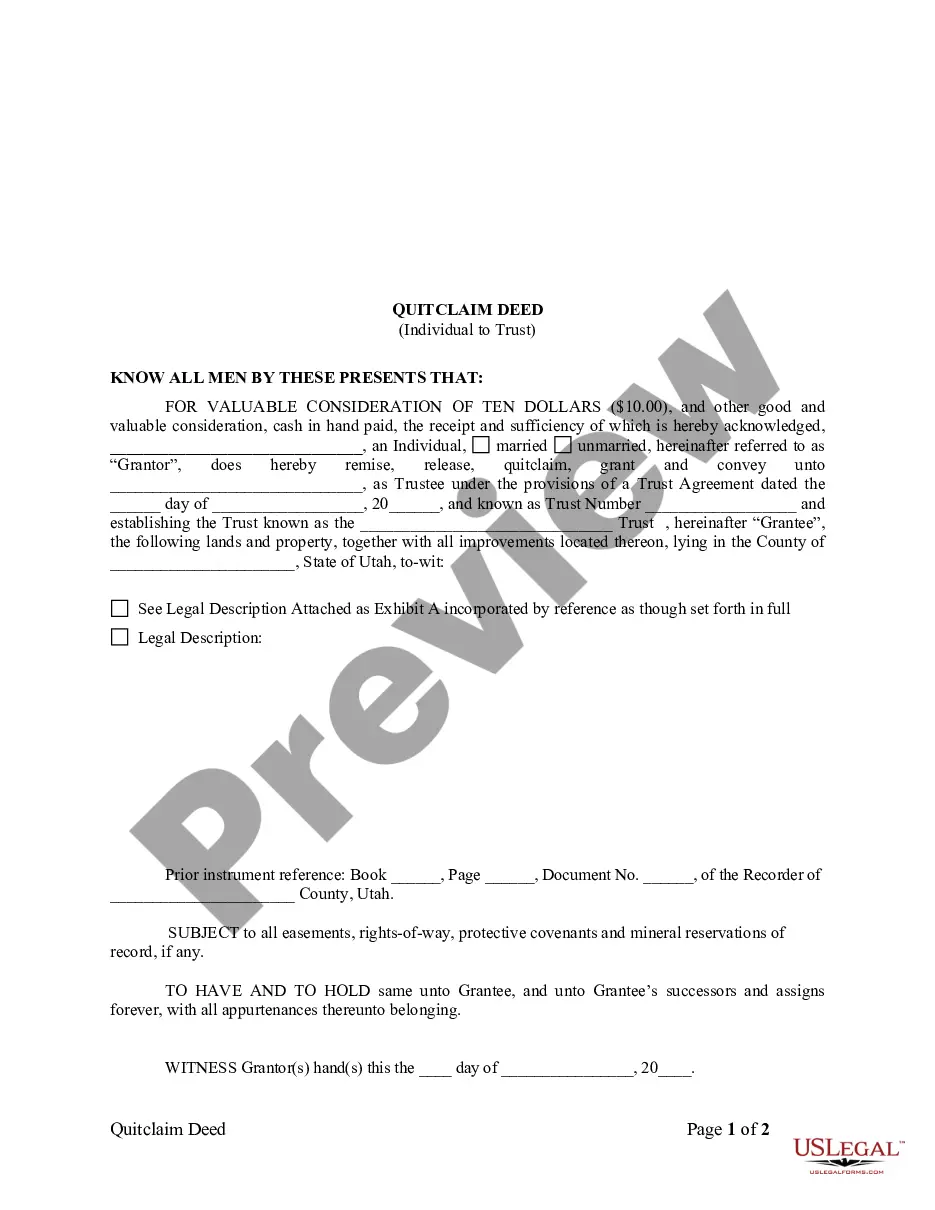

How to fill out New Mexico Annual Expense Report?

Finding the right lawful papers format might be a have difficulties. Obviously, there are a variety of web templates available on the net, but how can you discover the lawful develop you need? Use the US Legal Forms site. The service provides a huge number of web templates, such as the New Mexico Annual Expense Report, that you can use for company and private demands. Every one of the forms are checked out by professionals and meet up with state and federal demands.

If you are previously registered, log in to the profile and then click the Down load switch to get the New Mexico Annual Expense Report. Make use of your profile to check with the lawful forms you may have bought earlier. Check out the My Forms tab of your profile and acquire another duplicate of the papers you need.

If you are a fresh customer of US Legal Forms, listed here are straightforward guidelines so that you can comply with:

- First, make certain you have chosen the correct develop for your city/region. You are able to look over the form making use of the Review switch and browse the form information to guarantee it is the right one for you.

- If the develop does not meet up with your requirements, use the Seach area to get the proper develop.

- When you are positive that the form is proper, go through the Acquire now switch to get the develop.

- Select the rates plan you want and enter in the necessary information and facts. Design your profile and pay for your order with your PayPal profile or Visa or Mastercard.

- Choose the data file structure and down load the lawful papers format to the product.

- Complete, revise and produce and indication the acquired New Mexico Annual Expense Report.

US Legal Forms is definitely the biggest local library of lawful forms where you will find various papers web templates. Use the service to down load skillfully-produced files that comply with express demands.

Form popularity

FAQ

Yes, New Mexico requires LLCs to file an Annual Expense Report. This report is a key part of maintaining your LLC’s compliance within the state. Filing on time ensures that your LLC remains in good standing, which is essential for business operations. Platforms like US Legal Forms can aid you in navigating the filing process efficiently and effectively.

New Mexico's fiscal budget plays a significant role in how state funds are allocated each year. The budget reflects revenue projections, spending priorities, and economic forecasts. It's essential to understand how the budget impacts businesses and the community. Regularly reviewing fiscal reports can give you insight into local economic health, which can ultimately influence your business decisions.

Many states, including New Mexico, require businesses to file annual reports, but rules vary widely. Typically, states mandate these reports for corporations and LLCs to maintain good standing. You might want to consult local regulations to determine specific requirements in other states. Being aware of these obligations helps you manage your business better and avoid unnecessary complications.

The filing of the New Mexico Annual Expense Report is required for corporations and limited liability companies (LLCs) registered in New Mexico. Any business entity that operates in the state must stay compliant with this requirement. This ensures that your business maintains good standing with state authorities. It is vital to check specific guidelines based on your business type to confirm your filing obligations.

Yes, preparing the New Mexico Annual Expense Report is mandatory for certain businesses. This report helps the state maintain financial transparency and accountability. If your business falls under the requirements specified by the state, you must file this report each year. Ensuring compliance with this obligation is crucial for avoiding penalties.

You can obtain New Mexico State tax forms from the New Mexico Taxation and Revenue Department's official website. All necessary forms, including those for your New Mexico Annual Expense Report, are available for download. Additionally, you can reach out to uslegalforms for assistance in obtaining and completing tax forms, ensuring your submissions are accurate and timely.

The state comptroller is responsible for managing the state's finances, which includes overseeing budgets and audits. This position plays a key role in maintaining financial integrity for state departments, and their work directly affects your New Mexico Annual Expense Report. Understanding the functions of the state comptroller can help you ensure compliance with state financial regulations.

The state controller of New Mexico is an important figure in financial oversight, ensuring accountability and transparency in state spending. Knowing who currently holds this position can provide clarity on who to contact for queries regarding fiscal policies, including matters related to your New Mexico Annual Expense Report. It is beneficial to stay updated on any changes in this office.

In New Mexico, the state controller is an elected official. This position is critical in overseeing the state's financial management, including the preparation of the New Mexico Annual Expense Report. Understanding the role of the state controller can help you navigate financial reporting and compliance in your business.

The head of the New Mexico state government is the Governor. The Governor plays a crucial role in overseeing state operations and implementing laws, including those that pertain to fiscal responsibility, such as the New Mexico Annual Expense Report. Keeping informed about the Governor's policies can help your business remain compliant with state regulations.