The New Mexico Estoppel Affidavit of Mortgagor is a legal document that is commonly used in real estate transactions. It is an important document that helps establish the rights and obligations of the mortgagor (the borrower) and the mortgagee (the lender) in relation to a property located in New Mexico. This affidavit serves as a declaration by the mortgagor regarding the accuracy and completeness of certain information related to the property and the mortgage. In essence, the New Mexico Estoppel Affidavit of Mortgagor confirms that the mortgagor acknowledges the terms and conditions of the mortgage agreement and states that all information provided is true and accurate to the best of their knowledge. This affidavit is crucial when there is a change in the ownership or transfer of the property. Key elements mentioned in the New Mexico Estoppel Affidavit of Mortgagor include the property's legal description, current balance, interest rate, maturity date, the existence of any liens or judgments against the property, and any known issues or disputes related to the mortgage. This document is usually required by lenders or potential buyers as a means of obtaining assurance that the mortgagor has provided accurate and complete information about the property and their financial obligations. While there are no specific types of Estoppel Affidavit of Mortgagor under New Mexico law, variations can occur depending on specific requirements set by individual lenders or title companies. Some variations may pertain to different formats, additional clauses, or additional information required. In summary, the New Mexico Estoppel Affidavit of Mortgagor plays a crucial role in real estate transactions within the state. It helps ensure transparency, minimizes potential disputes, and provides documentation necessary for lenders, buyers, and other interested parties to understand the current status of the mortgage and the property.

New Mexico Estoppel Affidavit of Mortgagor

Description

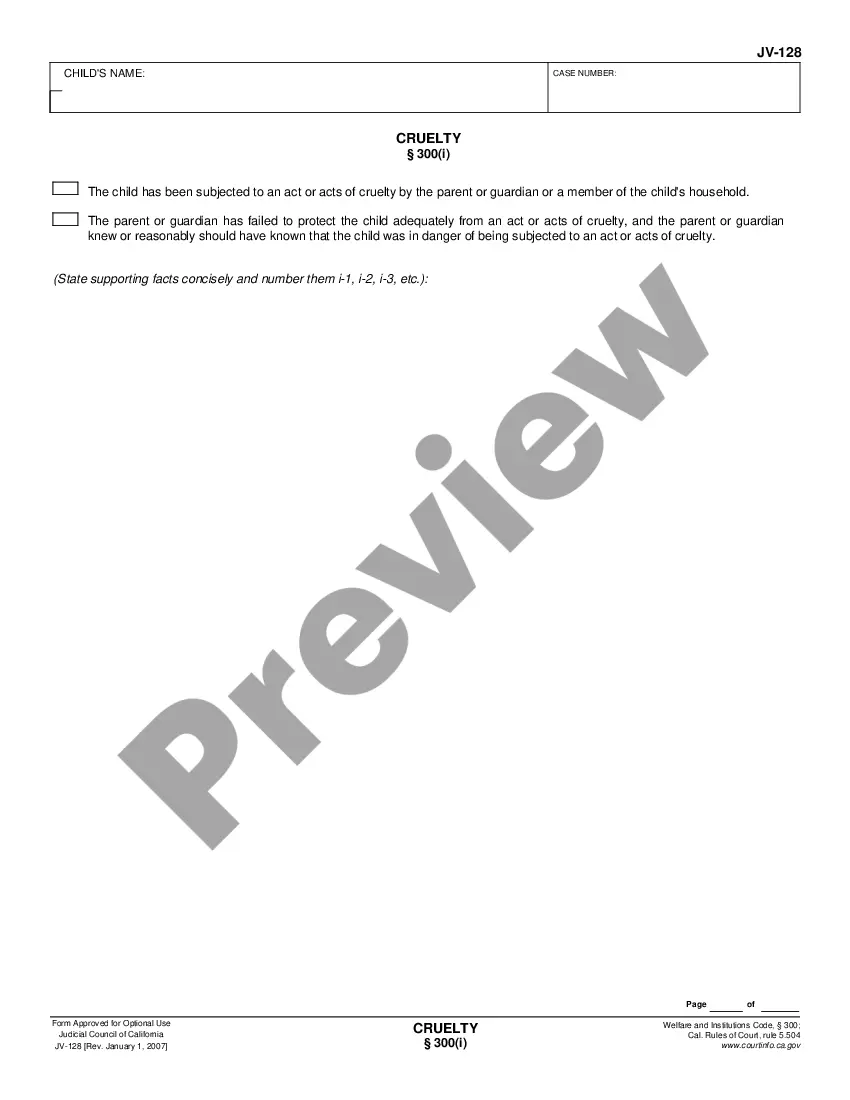

How to fill out New Mexico Estoppel Affidavit Of Mortgagor?

US Legal Forms - among the greatest libraries of legitimate kinds in America - delivers a wide range of legitimate document templates you may obtain or print out. Utilizing the website, you may get a large number of kinds for enterprise and person functions, sorted by groups, claims, or key phrases.You will discover the most recent variations of kinds such as the New Mexico Estoppel Affidavit of Mortgagor within minutes.

If you already have a monthly subscription, log in and obtain New Mexico Estoppel Affidavit of Mortgagor from your US Legal Forms collection. The Acquire switch will show up on each type you view. You have accessibility to all in the past delivered electronically kinds from the My Forms tab of your profile.

In order to use US Legal Forms the first time, allow me to share simple guidelines to get you began:

- Be sure to have picked out the correct type for your area/region. Click the Review switch to analyze the form`s articles. Read the type information to ensure that you have chosen the proper type.

- In the event the type doesn`t suit your requirements, take advantage of the Search discipline on top of the monitor to get the one who does.

- If you are happy with the shape, verify your option by clicking the Buy now switch. Then, pick the rates strategy you want and give your references to sign up on an profile.

- Method the financial transaction. Make use of credit card or PayPal profile to finish the financial transaction.

- Choose the format and obtain the shape on the system.

- Make adjustments. Load, edit and print out and signal the delivered electronically New Mexico Estoppel Affidavit of Mortgagor.

Each design you added to your account lacks an expiration time and it is yours eternally. So, if you want to obtain or print out one more duplicate, just check out the My Forms portion and click on around the type you want.

Gain access to the New Mexico Estoppel Affidavit of Mortgagor with US Legal Forms, probably the most comprehensive collection of legitimate document templates. Use a large number of skilled and status-certain templates that meet your company or person demands and requirements.