New Mexico Mortgage Note

Description

How to fill out Mortgage Note?

If you have to complete, down load, or printing legitimate document layouts, use US Legal Forms, the biggest assortment of legitimate forms, which can be found on the Internet. Use the site`s easy and practical search to discover the papers you want. Various layouts for enterprise and specific functions are categorized by types and states, or search phrases. Use US Legal Forms to discover the New Mexico Mortgage Note with a number of clicks.

In case you are presently a US Legal Forms consumer, log in for your account and click the Obtain switch to find the New Mexico Mortgage Note. You may also access forms you previously downloaded from the My Forms tab of the account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for your right area/region.

- Step 2. Utilize the Review solution to look through the form`s content. Never forget about to read the description.

- Step 3. In case you are not satisfied with all the develop, use the Look for discipline on top of the screen to get other types of the legitimate develop web template.

- Step 4. Once you have located the form you want, click on the Purchase now switch. Select the prices plan you prefer and add your credentials to sign up for an account.

- Step 5. Method the purchase. You can use your bank card or PayPal account to accomplish the purchase.

- Step 6. Select the structure of the legitimate develop and down load it in your product.

- Step 7. Complete, modify and printing or signal the New Mexico Mortgage Note.

Every legitimate document web template you get is your own property for a long time. You might have acces to each and every develop you downloaded inside your acccount. Select the My Forms segment and pick a develop to printing or down load again.

Contend and down load, and printing the New Mexico Mortgage Note with US Legal Forms. There are millions of specialist and express-particular forms you may use for the enterprise or specific requirements.

Form popularity

FAQ

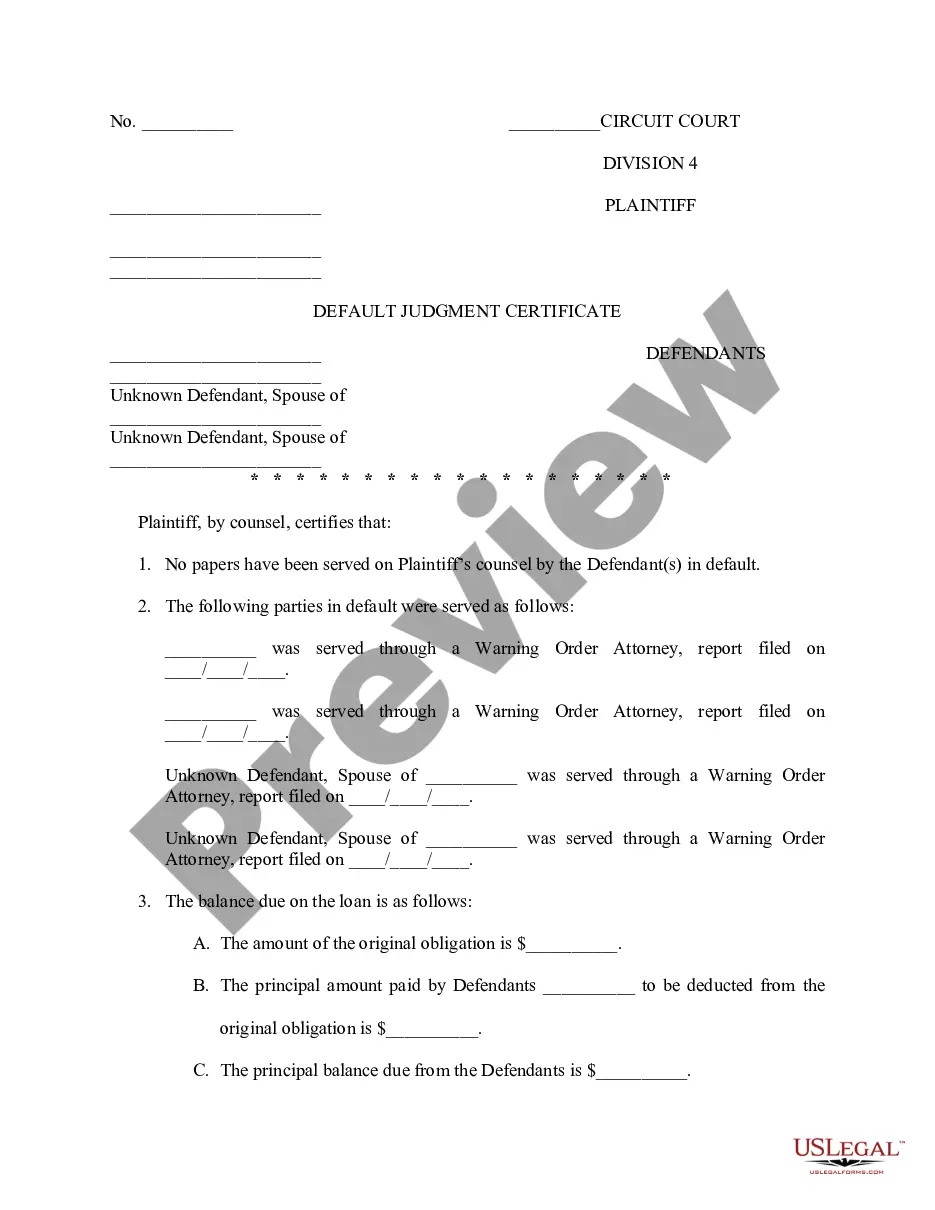

A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesn't.

A borrower usually must sign a promissory note along with the mortgage. The promissory note gives legal protections to the lender if the borrower defaults on the debt and provides clarification to the borrower so that they understand their repayment obligations.

Promissory Note Vs. Mortgage. A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

A promissory note is a written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property. A promissory note is often referred to as a mortgage, but they are separate contracts.

So, as a rule of thumb, if someone is on the Deed, they must be on the Mortgage. But just because they are on the Mortgage, doesn't mean they are on the Note.