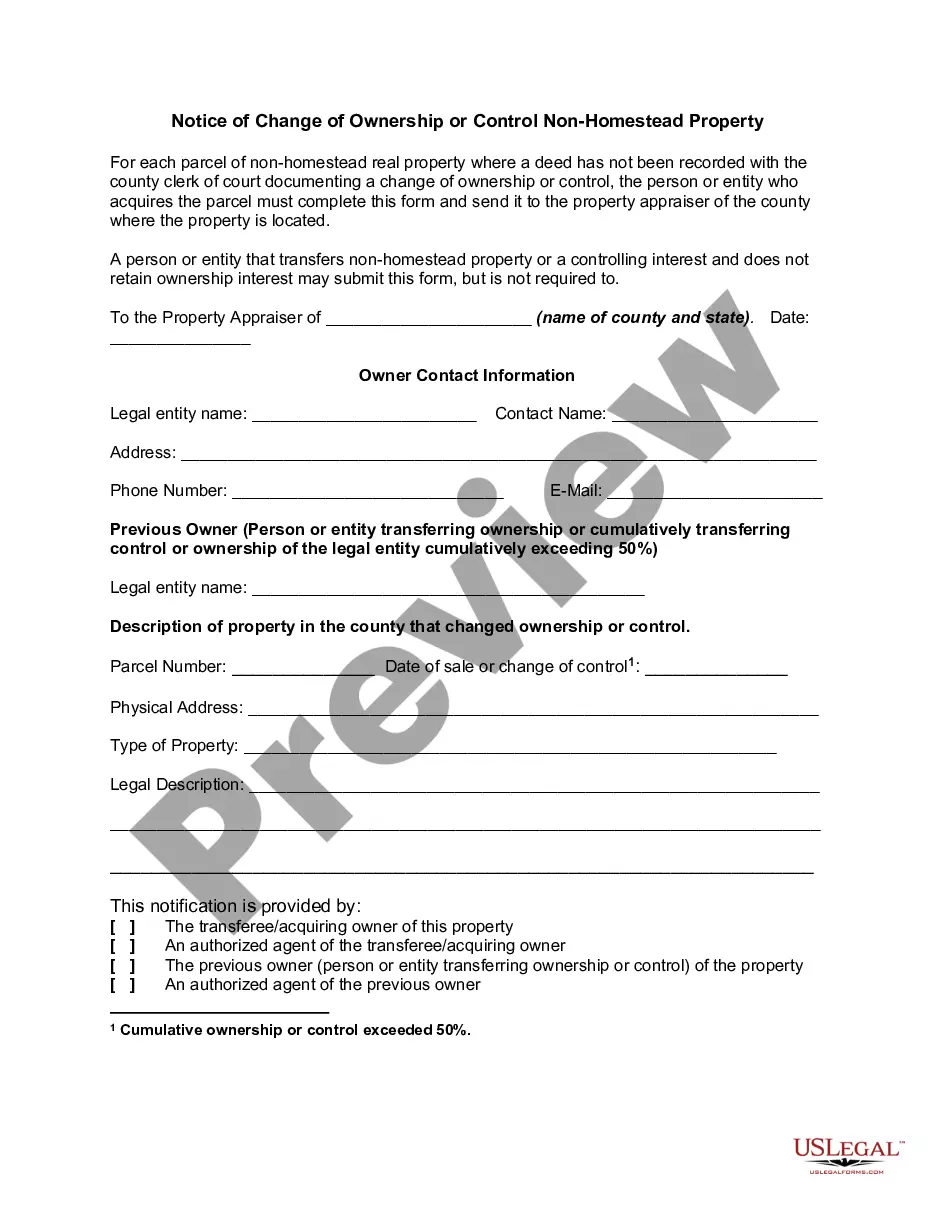

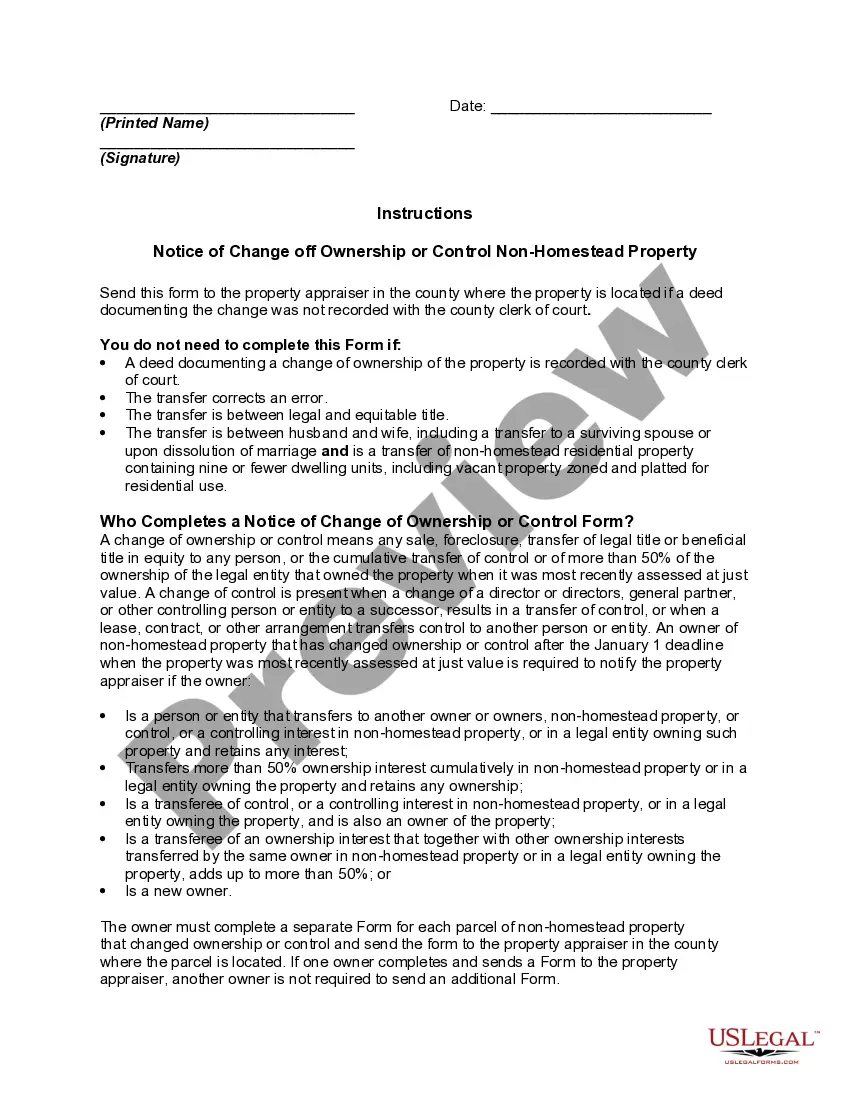

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A New Mexico Notice of Change of Ownership or Control Non-Homestead Property is a legal document that must be filed when there is a change in ownership or control of a non-homestead property in the state of New Mexico. It is used to notify the relevant authorities, such as the county assessor's office and the New Mexico Taxation and Revenue Department, about the change in ownership. This notice is required by law to ensure accurate property assessments and to maintain transparency in property ownership records. It helps the authorities keep track of who owns a particular non-homestead property and enables them to update property tax information accordingly. The New Mexico Notice of Change of Ownership or Control Non-Homestead Property includes important details about the property, the previous owner, and the new owner or controlling entity. Some relevant keywords associated with this document are: 1. Non-Homestead Property: Refers to any property that is not the primary residence of the owner. This could include commercial buildings, vacant land, or investment properties. 2. Change of Ownership: Indicates the transfer of ownership rights from one party to another. It could be a sale, gift, inheritance, or any other legal transfer. 3. Change of Control: Refers to a change in the controlling entity of the property, such as when a corporation or LLC takes over ownership. 4. County Assessor's Office: The local government office responsible for assessing the value of properties in a specific county and determining property taxes. 5. New Mexico Taxation and Revenue Department: The state agency responsible for collecting taxes, including property taxes, and enforcing tax laws. 6. Legal Requirement: Highlights the mandatory nature of the notice, emphasizing that failure to file the document can result in penalties or legal consequences. Different types or situations warranting the filing of a New Mexico Notice of Change of Ownership or Control Non-Homestead Property include: 1. Change of Ownership due to Sale: When a non-homestead property is sold to a new owner, this notice must be filed to update ownership records and ensure accurate property tax assessments. 2. Change of Ownership due to Inheritance: In the event of a property being inherited by a new owner, this notice is required to record the change and update the ownership details. 3. Change of Ownership due to Gift: If a non-homestead property is gifted to a new owner, the notice must be filed to formalize the change in ownership and maintain accurate property records. 4. Change of Control due to Business Transfer: When a non-homestead property is transferred under the control of a new entity, such as through a merger or acquisition, this notice is necessary to update ownership and control information. In conclusion, the New Mexico Notice of Change of Ownership or Control Non-Homestead Property is a critical document that ensures proper recording and tracking of ownership changes for non-homestead properties in the state. It helps maintain property tax accuracy and transparency in property ownership records. Compliance with this legal requirement is vital to avoid penalties and potential legal consequences.