The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

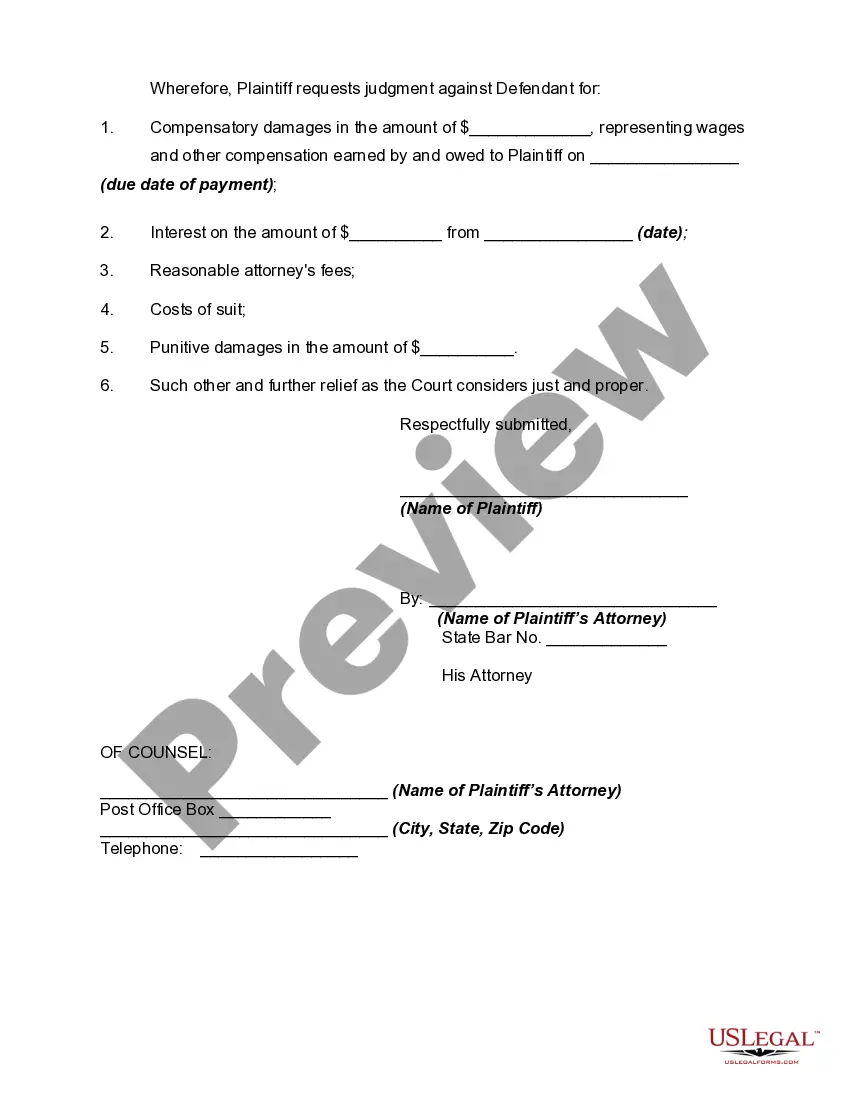

New Mexico Complaint for Recovery of Unpaid Wages is a legal document used by employees who have not received the full compensation they are entitled to from their employer. This complaint is filed with the New Mexico Department of Workforce Solutions and serves as a formal request for the recovery of unpaid wages. Keywords: New Mexico, Complaint, Recovery of Unpaid Wages, employee, employer, compensation, Department of Workforce Solutions. There are different types of New Mexico Complaints for Recovery of Unpaid Wages, categorized based on specific circumstances: 1. Regular Wages: This type of complaint is applicable when an employee has not been paid their regular wages as per their employment agreement or statutory law. It covers situations such as non-payment of hourly wages, salaries, commissions, or other forms of remuneration. 2. Overtime Wages: Employees who have worked more than the legally mandated number of hours per week and have not received the appropriate overtime pay can file a complaint specifically focused on recovering unpaid overtime wages. 3. Minimum Wage Violation: In cases where an employer has failed to pay the minimum wage that is set by federal or state law, employees can file a complaint specifically targeting the recovery of unpaid minimum wages. 4. Unpaid Benefits: Employees who have not received certain benefits they are entitled to, such as health insurance, vacation pay, sick leave, or retirement contributions, can file a complaint to recover these unpaid benefits. 5. Unlawful Wage Deductions: When an employer makes unauthorized deductions from an employee's wages, such as for expenses that are the employer's responsibility or for losses caused by the employee's mistakes, employees can file a complaint to recover the wrongfully deducted wages. 6. Wage Theft: Wage theft refers to a range of illegal practices used by employers to withhold wages from employees. This type of complaint is filed when an employee has experienced multiple violations related to unpaid wages, such as non-payment, underpayment, or improper deductions from their earnings. It is important for employees to gather evidence such as pay stubs, employment agreements, time records, and any communication related to wages to support their claims when filing a New Mexico Complaint for Recovery of Unpaid Wages. By submitting a thorough and well-documented complaint, employees increase their chances of successfully recovering their unpaid wages through the legal process.