New Mexico Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock When starting a business in New Mexico, entrepreneurs have the option to incorporate their company as an S Corporation (S Corp) or as a Small Business Corporation with Qualification for Section 1244 Stock. These two forms of incorporation offer unique advantages and cater to the specific needs and goals of small businesses. In this article, we will delve into the details of each type and shed light on their features. 1. Incorporating as an S Corporation: Incorporating as an S Corp in New Mexico offers several benefits to small business owners. One notable advantage is taxation. S Corporations are pass-through entities, meaning that income, deductions, and tax credits are passed through to shareholders, who report them on their individual tax returns, avoiding the double taxation prevalent in C Corporations. This can result in significant tax savings. Additionally, S Corporations may be eligible for self-employment tax savings, reducing the burden for business owners. 2. Incorporating as a Small Business Corporation with Qualification for Section 1244 Stock: Establishing a Small Business Corporation with Qualification for Section 1244 Stock provides another avenue for entrepreneurs in New Mexico. This form of incorporation grants certain tax advantages to shareholders. Section 1244 of the Internal Revenue Code allows individuals to claim ordinary loss deductions for stock investments in small businesses, up to $50,000 per year for single taxpayers and $100,000 for joint taxpayers. This provision can be immensely beneficial if the business faces financial challenges or fails, as the shareholders can recoup some of their investments through tax deductions. It's important to note that both forms of incorporation require filing the appropriate documents with the New Mexico Secretary of State's office. These documents typically include the Articles of Incorporation and may also include additional paperwork depending on the specific requirements of each form. When incorporating as an S Corp or a Small Business Corporation with Qualification for Section 1244 Stock in New Mexico, consulting with a legal professional or a business advisor is highly recommended. They can provide personalized guidance, ensure compliance with the state's regulations, and help entrepreneurs make informed decisions based on their unique circumstances. In conclusion, entrepreneurs in New Mexico have the option to incorporate their businesses as an S Corp or a Small Business Corporation with Qualification for Section 1244 Stock. Each form offers distinct advantages, such as tax savings and deductions. Careful consideration and consulting with professionals are crucial in determining the most suitable form of incorporation based on the business's objectives and tax strategies.

New Mexico Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

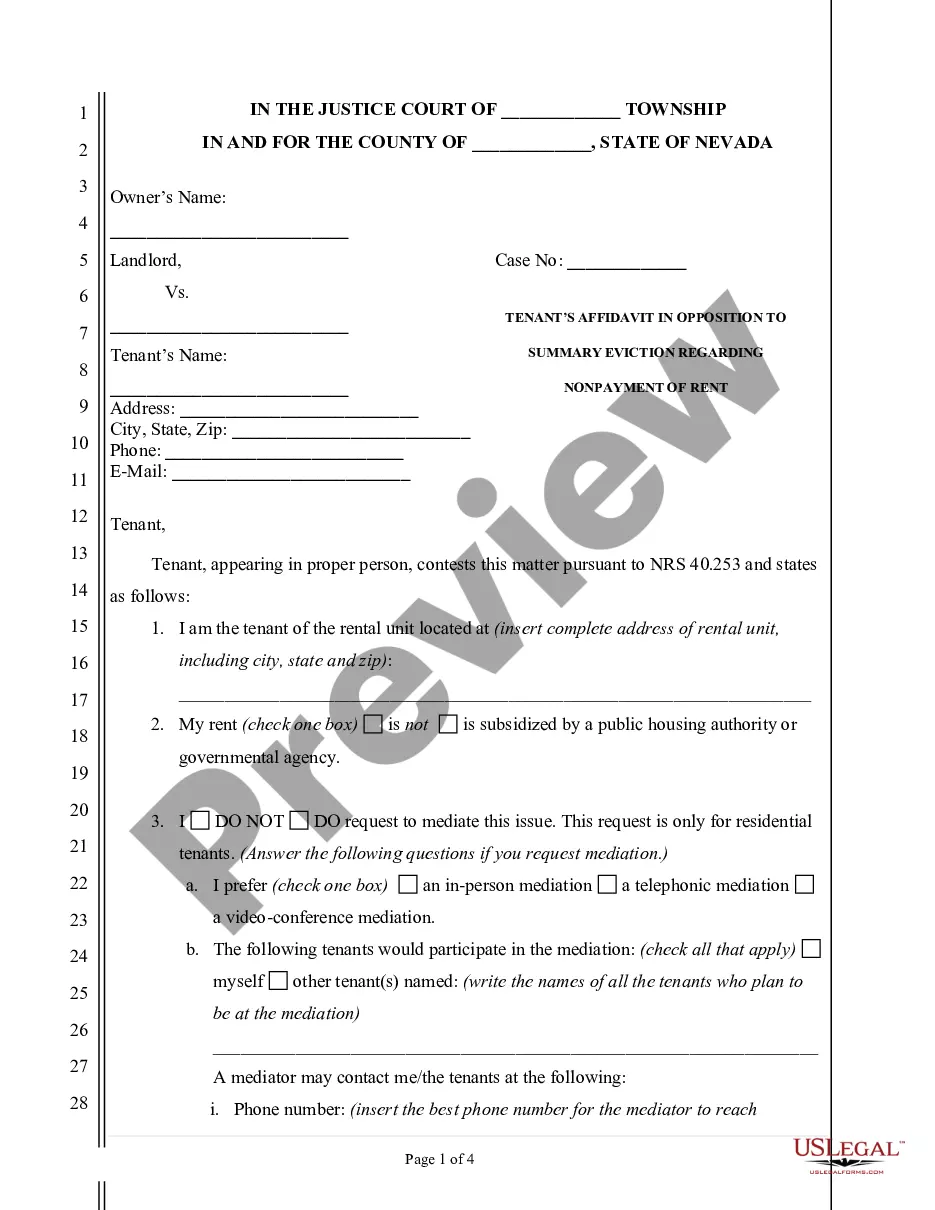

How to fill out New Mexico Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Choosing the best authorized papers format might be a have a problem. Naturally, there are tons of templates available on the Internet, but how can you get the authorized type you require? Utilize the US Legal Forms internet site. The assistance gives a large number of templates, including the New Mexico Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, which can be used for business and personal requires. All the forms are checked out by experts and meet up with federal and state specifications.

In case you are previously authorized, log in for your accounts and then click the Acquire option to find the New Mexico Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock. Make use of accounts to look throughout the authorized forms you might have acquired previously. Proceed to the My Forms tab of your respective accounts and have an additional copy of your papers you require.

In case you are a brand new end user of US Legal Forms, listed below are straightforward instructions for you to stick to:

- Initially, ensure you have selected the appropriate type for the town/county. You may examine the form using the Preview option and browse the form description to make certain it will be the right one for you.

- In the event the type will not meet up with your requirements, use the Seach discipline to find the proper type.

- Once you are certain the form is suitable, click the Buy now option to find the type.

- Select the prices strategy you desire and type in the required info. Build your accounts and purchase an order making use of your PayPal accounts or charge card.

- Opt for the submit structure and acquire the authorized papers format for your device.

- Full, modify and print out and sign the obtained New Mexico Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock.

US Legal Forms is the biggest library of authorized forms where you can discover numerous papers templates. Utilize the company to acquire appropriately-created paperwork that stick to state specifications.

Form popularity

FAQ

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

The maximum aggregate loss that may be treated by a taxpayer as ordinary loss for a taxable year with respect to an issuing corporation's Section 1244 stock is $50,000, or $100,000 for a husband and wife filing a joint return. Any loss in excess of the maximum allowable loss must be treated as a capital loss.

1244 loss is the property's adjusted basis reduced by liabilities to which the property is subject or that the corporation assumed. However, if the property's fair market value (FMV) is less than its adjusted basis when it is transferred to the corporation, any Sec.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec. 1363, which provides that the taxable income of an S corporation must be computed in the same manner as that of an individual.

In order to qualify as §1244 stock, the stock must be issued, and the consideration paid by the shareholder must consist of money or other property, not services. Stock and other securities are not "other property" for this purpose.