New Mexico Startup Costs Worksheet

Description

How to fill out Startup Costs Worksheet?

You might spend multiple hours online trying to locate the legal document template that meets the state and federal criteria you require.

US Legal Forms offers thousands of legal documents that can be reviewed by experts.

You can easily download or print the New Mexico Startup Costs Worksheet from my service.

If available, use the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the New Mexico Startup Costs Worksheet.

- Each legal document template you acquire is yours forever.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for your region/area of preference.

- Check the form description to make sure you have chosen the correct form.

Form popularity

FAQ

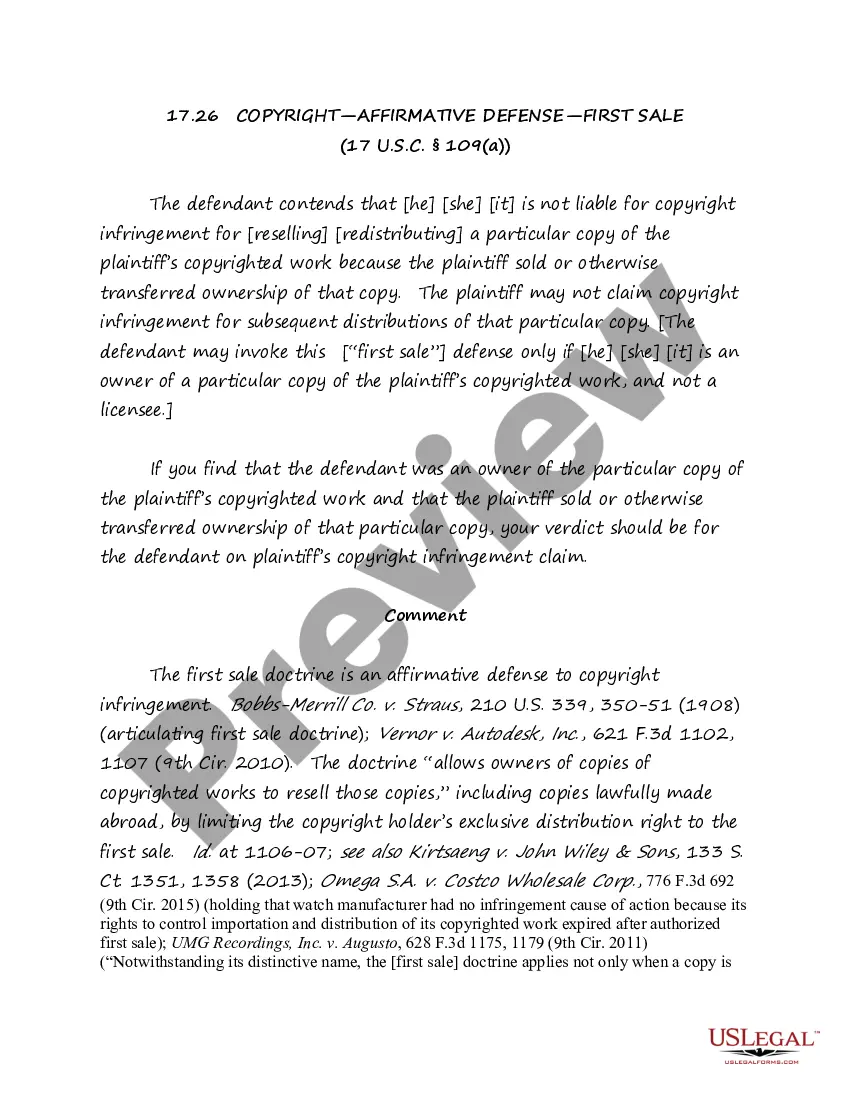

Startup costs are primarily mentioned in Section 195 of the IRS Code. This section outlines the rules regarding the deduction and amortization of these costs. Familiarizing yourself with this regulation and using the New Mexico Startup Costs Worksheet can ease your compliance with tax laws.

Start-up costs can be treated as capital expenses or current expenses, depending on how you choose to deduct them. Generally, you can deduct a portion in the first year and amortize the remainder over 15 years. The New Mexico Startup Costs Worksheet is a valuable tool to understand which expenses qualify and how they impact your taxes.

How to calculate total expenses?Net income = End equity - Beginning equity (from the balance sheet)Total Expenses = Net Revenue - Net Income.

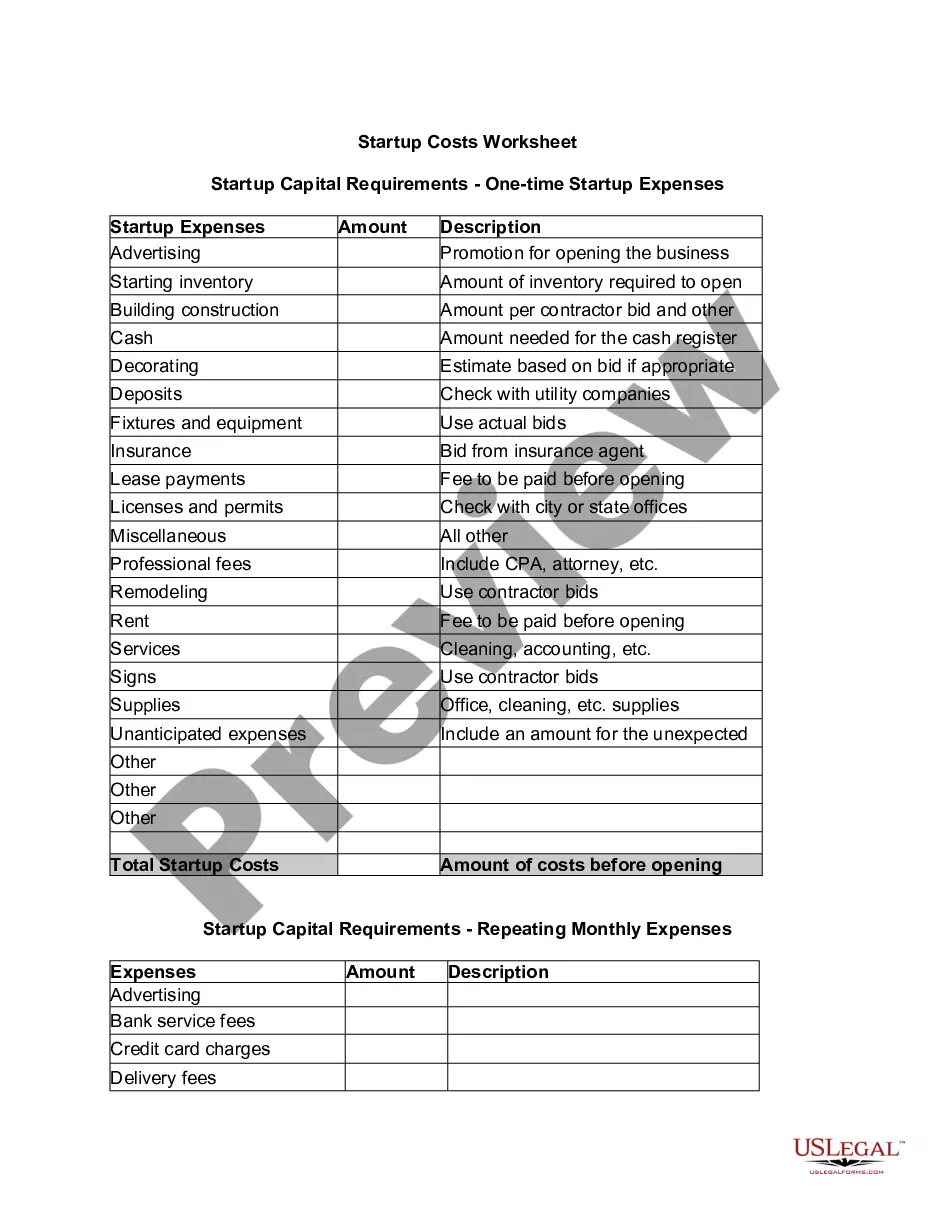

How to calculate startup costsIdentify your expenses. Start by writing down the startup costs you've already incurred but don't stop there.Estimate your costs. Once you've developed a list of your business needs, note the average cost for each category.Do the math.Add a cushion.Put the numbers to work.

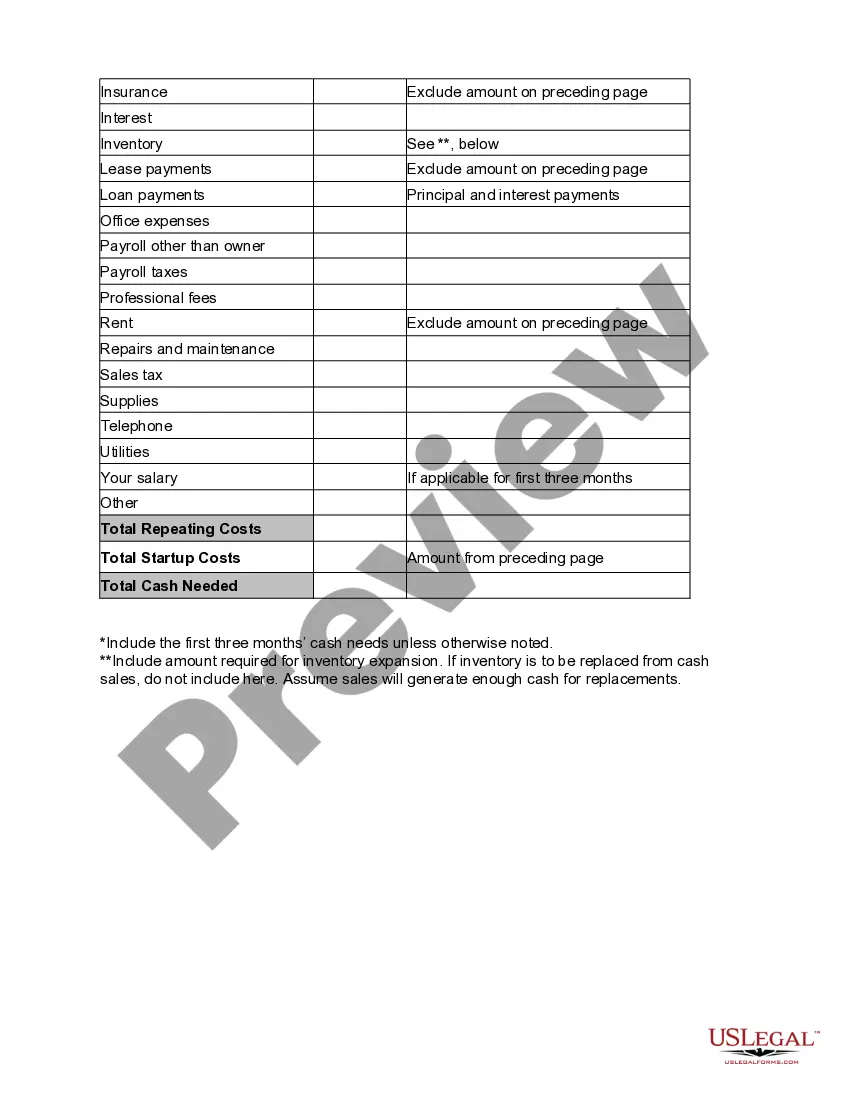

Startup costs will include equipment, incorporation fees, insurance, taxes, and payroll. Although startup costs will vary by your business type and industry an expense for one company may not apply to another.

Start-up costs can be capitalized and amortized if they meet both of the following tests: You could deduct the costs if you paid or incurred them to operate an existing active trade or business (in the same field), and; You pay or incur the costs before the day your active trade or business begins.

How to calculate startup costsIdentify your expenses. Start by writing down the startup costs you've already incurred but don't stop there.Estimate your costs. Once you've developed a list of your business needs, note the average cost for each category.Do the math.Add a cushion.Put the numbers to work.

Startup capital is what entrepreneurs use to pay for any or all of the required expenses involved in creating a new business. This includes paying for the initial hires, obtaining office space, permits, licenses, inventory, research and market testing, product manufacturing, marketing, or any other operational expense.

Compute your total startup capital. Add up capital needed prior to launch and the capital required to fund the cash deficit. This is your total startup capital.

You can calculate the capital requirements by adding founding expenses, investments and start-up costs together. By subtracting your equity capital from the capital requirements, you calculate how much external capital you are going to need.