Title: Understanding the New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption Description: The New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an essential document used by homeowners in New Mexico to claim an exemption from tax reporting requirements when selling or exchanging their primary residence. In this detailed description, we will delve into the various aspects and types of this certification, along with relevant keywords to aid comprehension. 1. New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence: This specific type of certification is designed for New Mexico residents who have recently sold or exchanged their principal residence (primary home) and are seeking an exemption from tax reporting requirements. The certification relieves taxpayers from providing information about the transaction to the New Mexico Taxation and Revenue Department. Keywords: New Mexico Certification, No Information Reporting, Sale or Exchange, Principal Residence, Tax Exemption, Tax Reporting Requirements. 2. Types of New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence: a) Standard Certification: This is the most common type of certification used by homeowners when they sell or exchange their principal residence in New Mexico. It affirms that the transaction meets the criteria for exemption from tax information reporting. Keywords: Standard Certification, Homeowners, Sell, Exchange, Principal Residence, Criteria, Exemption. b) Certification for Specific Circumstances: In certain situations, homeowners may need to provide additional information or documentation to support their certification request. These specific circumstances may include recent divorce, death of a spouse, or financial hardship, among others. Keywords: Specific Circumstances, Additional Information, Documentation, Recent Divorce, Death of Spouse, Financial Hardship. c) Certification for Military Members: Military service members may be granted a separate certification that considers their unique circumstances such as frequent relocation or deployment. Keywords: Military Members, Separate Certification, Unique Circumstances, Relocation, Deployment. d) Certification for Seniors or Persons with Disabilities: This certification may provide additional exemptions or considerations for senior citizens or individuals with disabilities, acknowledging their distinct needs and situation. Keywords: Seniors, Persons with Disabilities, Additional Exemptions, Distinct Needs, Situation. Using the New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption ensures homeowners comply with tax regulations while also minimizing the paperwork burden associated with selling or exchanging their principal residence in New Mexico. Note: It is important to consult the New Mexico Taxation and Revenue Department or a qualified tax professional for accurate and up-to-date information regarding the certification process and eligibility criteria.

New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out New Mexico Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Are you inside a place in which you will need papers for sometimes company or personal functions just about every working day? There are tons of lawful document themes available online, but discovering ones you can rely is not straightforward. US Legal Forms provides a huge number of develop themes, like the New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, that happen to be created to meet federal and state requirements.

If you are currently informed about US Legal Forms internet site and also have a merchant account, simply log in. Following that, you are able to down load the New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption design.

If you do not offer an account and wish to begin to use US Legal Forms, abide by these steps:

- Find the develop you require and make sure it is for your right area/county.

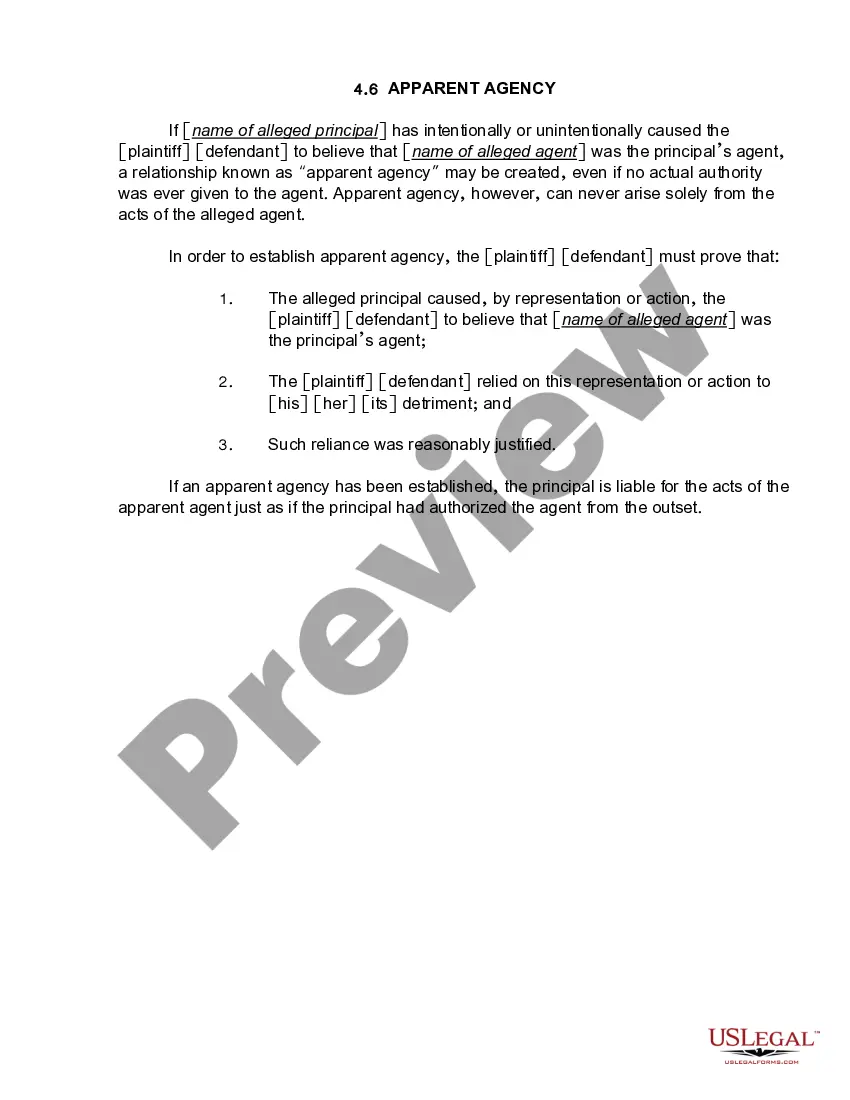

- Utilize the Preview button to review the shape.

- Browse the information to ensure that you have selected the appropriate develop.

- If the develop is not what you are searching for, use the Look for discipline to find the develop that fits your needs and requirements.

- Whenever you discover the right develop, just click Get now.

- Select the costs plan you desire, submit the necessary details to create your bank account, and pay for the transaction with your PayPal or bank card.

- Pick a handy paper format and down load your version.

Get all of the document themes you might have purchased in the My Forms menus. You may get a extra version of New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption any time, if possible. Just click the essential develop to down load or print out the document design.

Use US Legal Forms, probably the most considerable variety of lawful forms, to conserve efforts and avoid blunders. The support provides appropriately manufactured lawful document themes which you can use for an array of functions. Produce a merchant account on US Legal Forms and commence making your way of life easier.