New Mexico Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners

Description

How to fill out Assignment Of Partnership Interest To A Corporation With Consent Of Remaining Partners?

You may commit hours on the Internet searching for the legal file template that fits the state and federal requirements you need. US Legal Forms gives thousands of legal forms that are evaluated by professionals. It is simple to acquire or produce the New Mexico Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners from your service.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Download key. After that, you are able to full, revise, produce, or signal the New Mexico Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners. Each legal file template you get is the one you have forever. To have one more copy for any acquired type, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms site the very first time, stick to the easy instructions below:

- First, ensure that you have chosen the right file template to the area/city of your liking. See the type outline to ensure you have selected the proper type. If offered, take advantage of the Review key to search through the file template too.

- If you wish to find one more variation in the type, take advantage of the Lookup field to get the template that meets your requirements and requirements.

- After you have located the template you desire, just click Buy now to proceed.

- Select the pricing plan you desire, key in your references, and register for your account on US Legal Forms.

- Full the purchase. You can use your credit card or PayPal bank account to purchase the legal type.

- Select the format in the file and acquire it in your product.

- Make modifications in your file if required. You may full, revise and signal and produce New Mexico Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners.

Download and produce thousands of file templates using the US Legal Forms web site, which offers the biggest assortment of legal forms. Use specialist and express-certain templates to take on your company or individual requirements.

Form popularity

FAQ

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

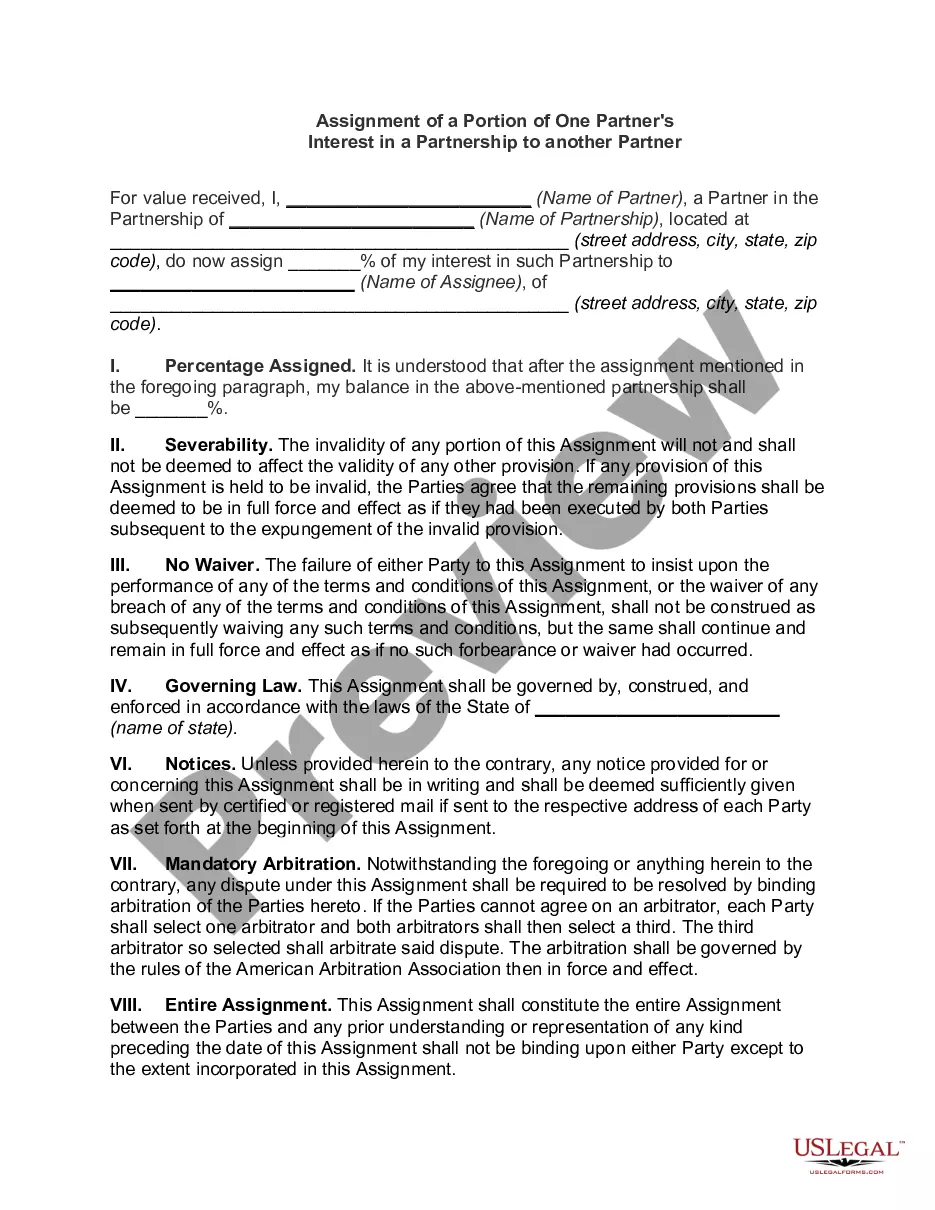

An Assignment of Partnership Interest occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner.

What is Partner's Interest in the Partnership? This refers to the partner's share of the profits and losses, based on the terms of the partnership agreement.

A transfer of partnership interest is exactly what it sounds like: the transfer of ownership and future obligations ? including capital calls ? from one limited partner in exchange for liquidity. In some cases, the transfer can be agreed upon via a pledge, with the actual logistics taking place at a later date.

The partnership's operating agreement and overall operations also affect the gift of partnership interests and more importantly, the availability of the annual gift tax exclusions. In order to qualify for the annual gift tax exclusion, the gift must be of a present interest in property.

? The Uniform Partnership Act has adopted the theory that a partnership is not a legal entity separate and distinct from its membership except for such purposes as keeping partnership accounts, marshalling assets and conveyancing.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

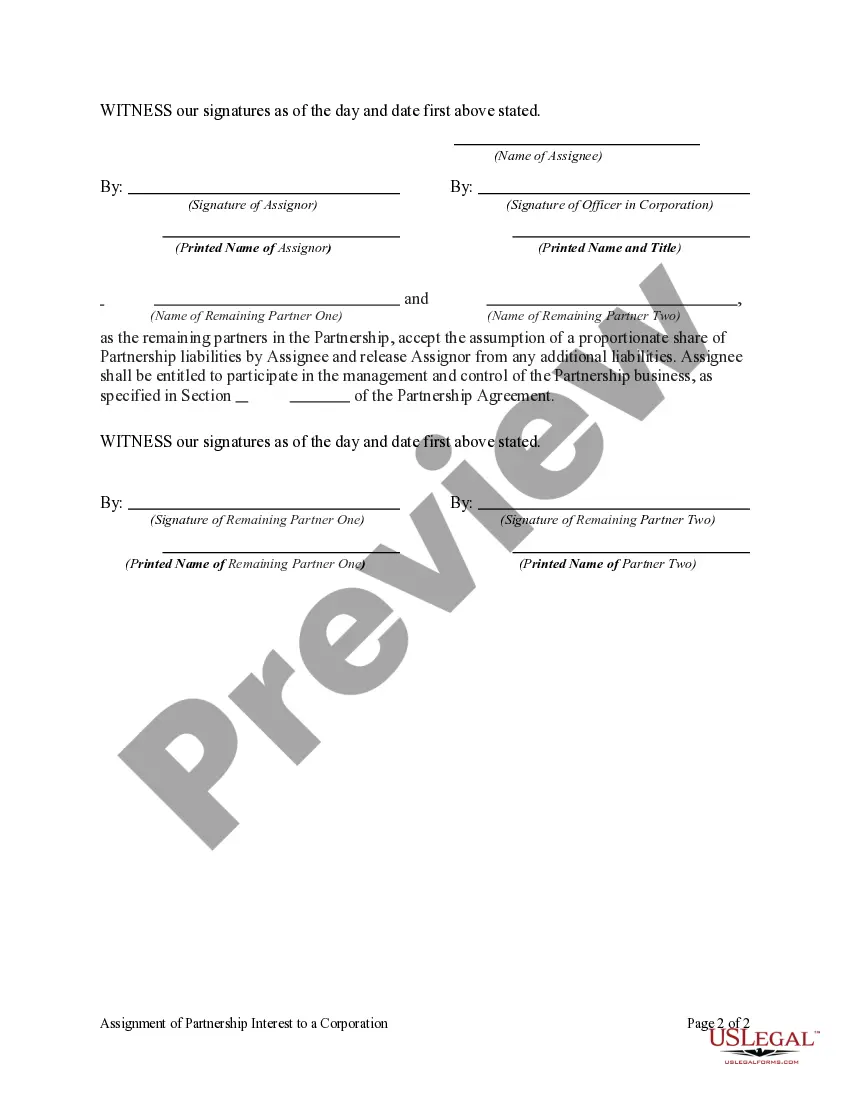

Assignment of Partnership Interest: A partner may assign his or her interest in the partnership to another party, who will then be entitled to receive the partner's share of profits and, upon termination, the partner's capital contribution.