New Mexico Notice of Private Sale of Collateral (Non-consumer Goods) on Default is a legal document used to inform interested parties about the private sale of collateral after a default occurs. This notice is specific to non-consumer goods, meaning it applies to transactions involving commercial or business-related assets rather than personal or household items. A detailed description of this notice and its types is as follows: 1. Purpose: The New Mexico Notice of Private Sale of Collateral (Non-consumer Goods) on Default serves as a legally required notification for secured creditors who wish to sell the collateral (assets pledged as security) of a debtor to recover the outstanding debt owed to them. It provides information regarding the sale and invites interested parties to participate. 2. Contents of the Notice: a. Title: The notice typically bears the title "Notice of Private Sale of Collateral (Non-consumer Goods) on Default" to clearly identify its purpose and scope. b. Parties Involved: The notice includes the names and contact details of the secured creditor (the party owed the debt) and the debtor (the party who pledged the collateral). c. Description of Collateral: It provides a detailed description of the collateral being sold, including its location, condition, quantity, any unique identifiers, and other relevant information that helps identify the assets. d. Default Information: The notice mentions the reason for default and provides a timeline of events leading up to the sale, such as missed payments, breaches of contract, or failure to meet obligations under the loan agreement. e. Sale Details: The notice outlines the date, time, and location of the private sale. Additionally, it may state any terms and conditions for participation, such as pre-qualification requirements or bidding procedures. f. Secured Party's Rights: It includes a statement detailing the rights of the secured party, including their ability to resell the collateral through a private sale and the proceeds being applied towards the outstanding debt. g. Redemption Period: In some cases, the notice may mention a redemption period, allowing the debtor to reclaim the collateral by paying the outstanding debt plus any associated expenses before the sale. h. Information for Interested Parties: The notice provides instructions for interested parties to request additional information regarding the collateral, sale, or any other relevant details. This usually includes contact information for the secured creditor or their representative. 3. Types of New Mexico Notice of Private Sale of Collateral (Non-consumer Goods) on Default: a. General Notice: This is the standard notice used when a secured creditor is planning to sell non-consumer goods collateral after a default, according to New Mexico state laws. b. Notice with Redemption Period: In certain cases, if permitted by the loan agreement or applicable laws, a notice including a redemption period may be used, allowing the debtor an opportunity to reclaim the collateral before the sale. c. Notice for Specific Types of Collateral: Depending on the nature of the collateral, specific notices may be required to comply with state regulations. For example, the notice may need to include additional information or comply with specific requirements when dealing with motor vehicles, real estate, or intellectual property. It is important to consult with legal professionals or refer to the relevant New Mexico statutes to ensure compliance with state laws when drafting or using a New Mexico Notice of Private Sale of Collateral (Non-consumer Goods) on Default.

New Mexico Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

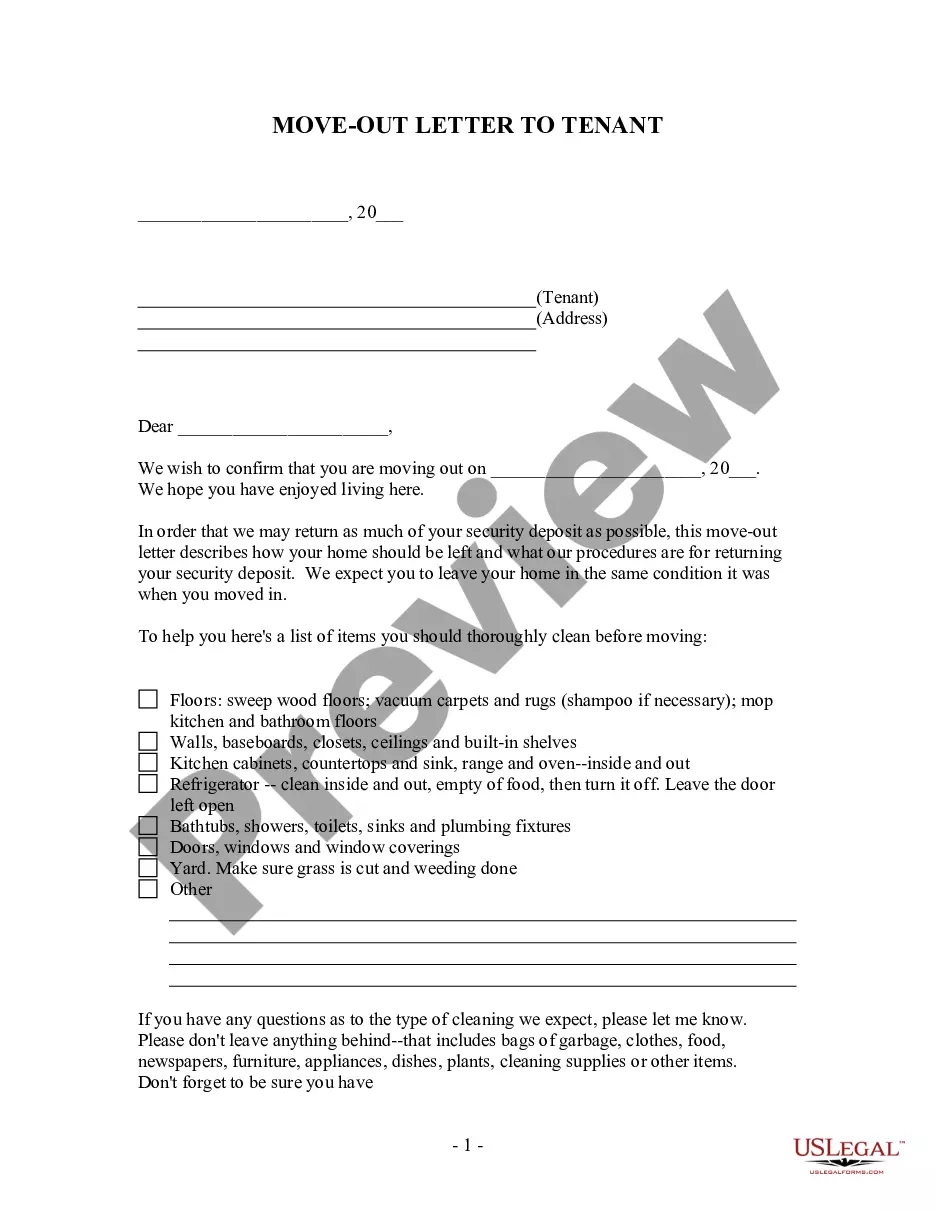

How to fill out Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

Are you within a placement that you need documents for either company or specific reasons just about every day time? There are plenty of legal papers layouts available on the net, but getting versions you can trust isn`t easy. US Legal Forms provides thousands of form layouts, much like the New Mexico Notice of Private Sale of Collateral (Non-consumer Goods) on Default, that are written to satisfy federal and state requirements.

If you are previously familiar with US Legal Forms site and get a merchant account, just log in. After that, you can download the New Mexico Notice of Private Sale of Collateral (Non-consumer Goods) on Default web template.

If you do not offer an account and need to begin to use US Legal Forms, follow these steps:

- Find the form you will need and make sure it is to the correct metropolis/area.

- Use the Preview button to review the form.

- Look at the information to ensure that you have chosen the appropriate form.

- If the form isn`t what you`re seeking, make use of the Search industry to discover the form that suits you and requirements.

- If you get the correct form, click Get now.

- Opt for the costs program you want, fill out the desired information and facts to make your bank account, and pay money for an order utilizing your PayPal or bank card.

- Select a hassle-free document formatting and download your duplicate.

Discover each of the papers layouts you possess purchased in the My Forms food selection. You can get a more duplicate of New Mexico Notice of Private Sale of Collateral (Non-consumer Goods) on Default whenever, if needed. Just select the required form to download or print out the papers web template.

Use US Legal Forms, by far the most extensive collection of legal forms, to save lots of efforts and avoid mistakes. The service provides professionally made legal papers layouts that you can use for a range of reasons. Generate a merchant account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

Through Pledge: Transfer of collateral to the secured party for the purpose of perfection. Some types of collateral can only be perfected through possession eg; CDs, stocks and bonds.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

(12) "Collateral" means the property subject to a security interest or agricultural lien. The term includes: (A) proceeds to which a security interest attaches; (B) accounts, chattel paper, payment intangibles, and promissory notes that have been sold; and. (C) goods that are the subject of a consignment.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

Through Pledge: Transfer of collateral to the secured party for the purpose of perfection. Some types of collateral can only be perfected through possession eg; CDs, stocks and bonds.

Under §9-622, a proposal to accept collateral in full satisfaction of the debt that is consented to by the debtor discharges the obligation not just the consenting debtor's liability for that obligation.

A secured transaction is any deal in which a creditor receives a security interest in the debtor's property. The creditor is known as the secured party and holds a security interest in the debtor's property. The property is known as the collateral for the loan. The security interest helps ensure the debtor's payment.

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase