Introduction: A New Mexico Crummy Trust Agreement for Benefit of Child with Parents as Trustees is a legal arrangement established in New Mexico, where parents act as trustees to create a trust for the benefit of their child. The purpose of this trust is to provide financial security and support for the child's future needs. Below we will explore the details of this trust agreement, its benefits, and possible variations. Key Elements of the New Mexico Crummy Trust Agreement: 1. Trustees: The parents act as trustees, meaning they create and fund the trust for their child's benefit. They have the authority to determine the terms, conditions, and beneficiaries of the trust. 2. Beneficiaries: The primary beneficiary of this trust is the child. The trust assets are managed for the child's benefit, ensuring their financial wellbeing. Other beneficiaries, such as siblings, can be included if specified in the trust agreement. 3. Crummy Powers: One crucial aspect of this trust is the inclusion of Crummy powers. These powers allow annual gift exclusions, enabling the trustees to contribute funds to the trust while minimizing gift tax implications. 4. Trustee: A trustee is appointed to manage the trust assets and ensure they are used for the child's benefit. The trustee can be an individual, a professional trustee, or a trust company, depending on the preferences and circumstances of the trustees. 5. Distributions: The trust agreement outlines the rules and guidelines for distributing the trust assets to the child. This may include annual distributions, specific events such as education expenses, healthcare needs, or reaching a certain age, as determined by the trustees. Types of New Mexico Crummy Trust Agreements for Benefit of Child with Parents as Trustees: While the basic structure remains the same, there can be variations in the specific terms and conditions of this trust agreement. Some common types include: 1. Crummy Life Insurance Trust: This trust agreement includes annual gifts used to pay life insurance premiums, ensuring that the child will eventually receive the insurance proceeds. 2. Crummy Charitable Trust: In this variation, a portion of the trust assets is designated for charitable causes while still benefiting the child. It allows the trustees to combine charitable giving with providing for their child's future. 3. Crummy Special Needs Trust: This trust is tailored for children with special needs who may require government assistance while still benefiting from the trust. It ensures that the child's eligibility for government programs is not jeopardized. Conclusion: A New Mexico Crummy Trust Agreement for Benefit of Child with Parents as Trustees is a versatile tool for parents to provide financial security for their child's future while minimizing gift tax implications. By including Crummy powers and customization options, the trustees can adapt the trust agreement to their specific needs, whether it involves life insurance, charitable giving, or special needs considerations. Seek legal advice to create a New Mexico Crummy Trust Agreement that aligns with your unique circumstances and provides lasting benefits for your child.

New Mexico Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

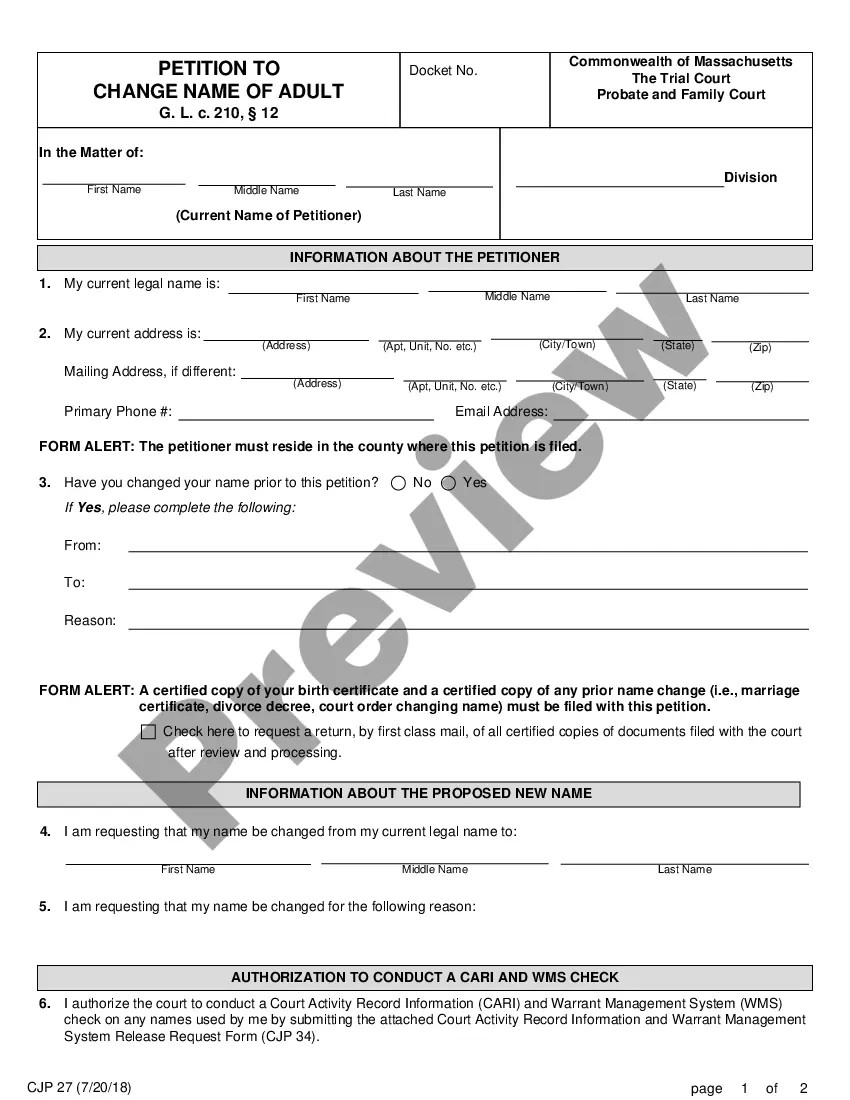

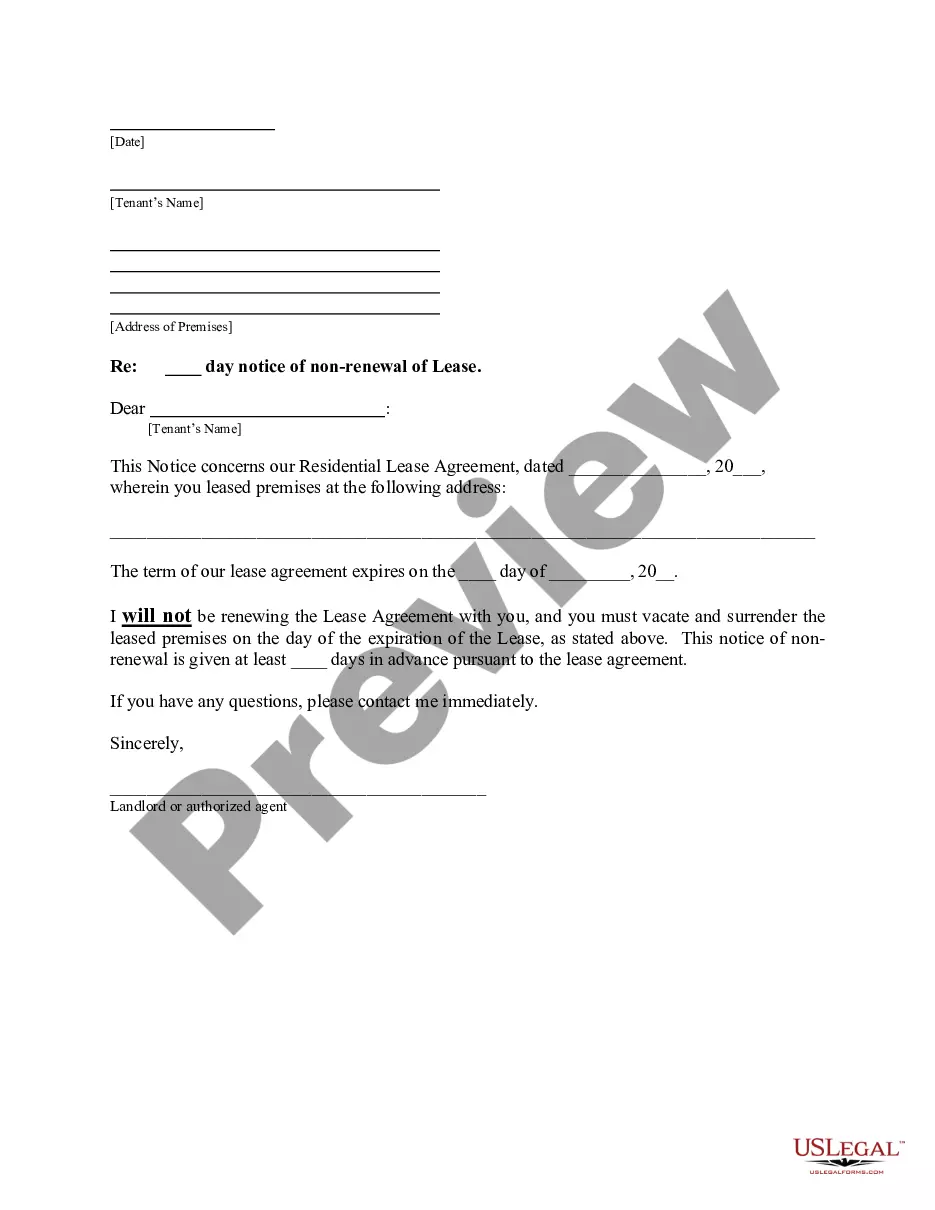

How to fill out New Mexico Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

Discovering the right legal papers design can be quite a have a problem. Naturally, there are a variety of templates accessible on the Internet, but how will you get the legal develop you require? Take advantage of the US Legal Forms internet site. The services delivers thousands of templates, such as the New Mexico Crummey Trust Agreement for Benefit of Child with Parents as Trustors, that can be used for company and private requirements. All of the kinds are checked out by professionals and meet up with federal and state needs.

In case you are presently signed up, log in for your account and click the Download button to have the New Mexico Crummey Trust Agreement for Benefit of Child with Parents as Trustors. Utilize your account to appear with the legal kinds you possess ordered earlier. Visit the My Forms tab of the account and acquire an additional version of your papers you require.

In case you are a new end user of US Legal Forms, here are easy directions that you should comply with:

- First, be sure you have chosen the right develop for your personal town/county. It is possible to look over the shape utilizing the Preview button and look at the shape explanation to make sure it is the right one for you.

- In the event the develop fails to meet up with your preferences, utilize the Seach area to get the appropriate develop.

- When you are certain the shape is acceptable, select the Purchase now button to have the develop.

- Pick the prices plan you want and enter in the needed info. Design your account and purchase the order making use of your PayPal account or Visa or Mastercard.

- Opt for the file format and download the legal papers design for your device.

- Complete, edit and print and sign the received New Mexico Crummey Trust Agreement for Benefit of Child with Parents as Trustors.

US Legal Forms is definitely the greatest collection of legal kinds in which you can see a variety of papers templates. Take advantage of the service to download professionally-produced papers that comply with condition needs.

Form popularity

FAQ

Crummey Trust, Definition This type of trust is typically used by parents who want to make financial gifts to minor or adult children, though anyone can establish one on behalf of a beneficiary.

A Hanging Crummey power allows the withdrawal right to lapse only for the amount that IRC § 2514(e) protects from treatment of release, which is the gift amount less the greater of $5,000 or 5% of the value of the property out of which the withdrawal right could have been satisfied.

A Crummey Trust allows you to take advantage of the gift tax exclusions and simultaneously minimize your estate taxes. You do not have to provide an opportunity for the beneficiary to withdraw the entire balance of the trust until a certain age. A Crummey trust can have multiple beneficiaries.

The beneficiaries of the trust will not have to pay income taxes on the life insurance proceeds that they ultimately receive.

Crummey powers give the beneficiary a limited time (often 30, 45 or 60 days) to withdraw contributions to a trust at will, converting the future interest gift to a present interest gift. This withdrawal right is generally limited to an amount equal to the current annual gift tax exclusion.

If the proper criteria are met during your lifetime, upon your death, the trust assets will not be included in your estate for estate tax purposes. The beneficiaries of the trust will not have to pay income taxes on the life insurance proceeds that they ultimately receive.

Key Takeaways. Crummey power allows a person to receive a gift that is not eligible for a gift-tax exclusion and then effectively transform the status of that gift into one that is eligible for a gift-tax exclusion.

Crummey trusts are typically used by parents to provide their children with lifetime gifts while sheltering their money from gift taxes as long as the gift's value is equal to or less than the permitted annual exclusion amount.

Crummey power is a technique that enables a person to receive a gift that is not eligible for a gift-tax exclusion and change it into a gift that is, in fact, eligible. Individuals often apply Crummey power to contributions in an irrevocable trust.

A Section 2503c trust is a type of minor's trust established for a beneficiary under the age of 21 which allows parents, grandparents, and other donors to make tax-free gifts to the trust up to the annual gift tax exclusion amount and the generation skipping transfer tax exclusion amount.