New Mexico Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

How to fill out Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

It is possible to spend time online attempting to find the authorized record web template that suits the state and federal demands you want. US Legal Forms supplies thousands of authorized varieties that happen to be analyzed by specialists. You can actually down load or print the New Mexico Sample Letter for Request of State Attorney's opinion concerning Taxes from our services.

If you currently have a US Legal Forms profile, it is possible to log in and click on the Acquire switch. After that, it is possible to total, modify, print, or indication the New Mexico Sample Letter for Request of State Attorney's opinion concerning Taxes. Every single authorized record web template you get is the one you have forever. To obtain another duplicate associated with a obtained kind, check out the My Forms tab and click on the related switch.

If you work with the US Legal Forms site for the first time, adhere to the easy recommendations listed below:

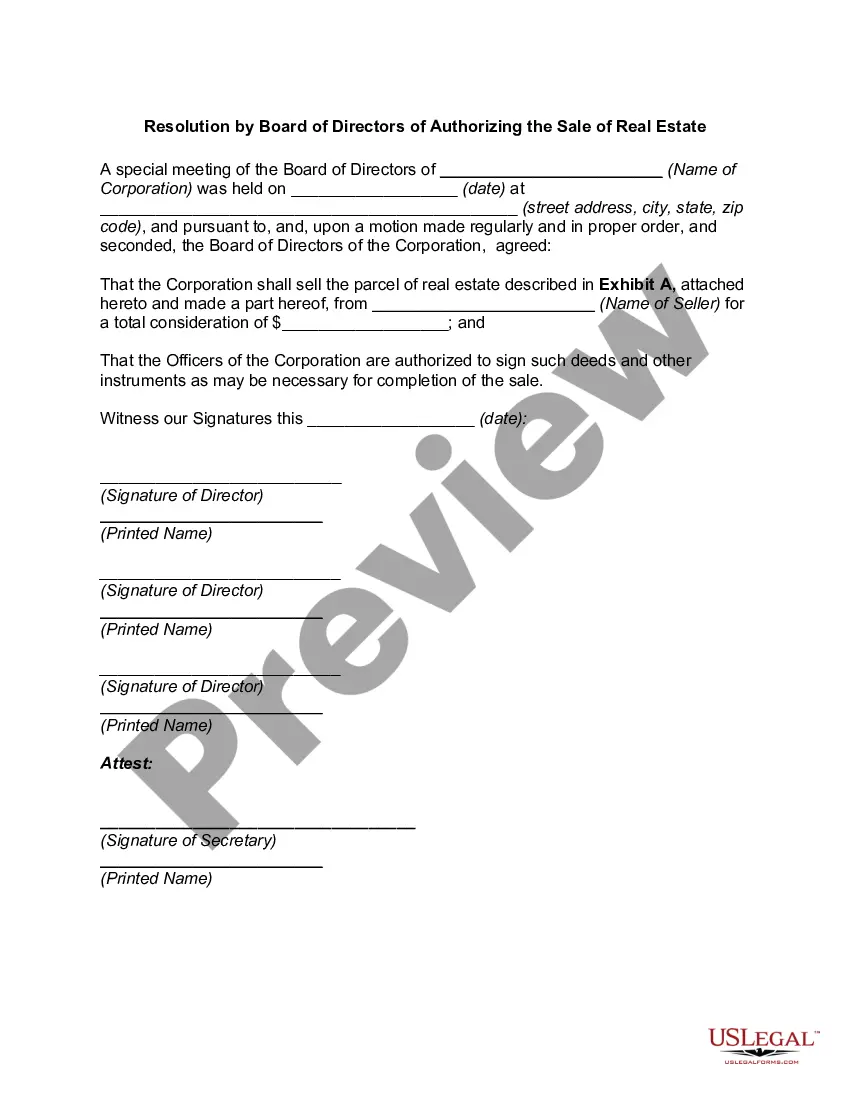

- Very first, make certain you have selected the correct record web template for the county/metropolis of your choice. Look at the kind information to ensure you have selected the right kind. If accessible, take advantage of the Review switch to check throughout the record web template too.

- If you would like discover another edition of your kind, take advantage of the Look for discipline to obtain the web template that suits you and demands.

- When you have identified the web template you would like, click on Get now to carry on.

- Select the rates plan you would like, enter your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal profile to fund the authorized kind.

- Select the format of your record and down load it in your device.

- Make modifications in your record if possible. It is possible to total, modify and indication and print New Mexico Sample Letter for Request of State Attorney's opinion concerning Taxes.

Acquire and print thousands of record layouts making use of the US Legal Forms site, which provides the greatest collection of authorized varieties. Use professional and condition-particular layouts to take on your organization or person requires.

Form popularity

FAQ

A marketed opinion is written advice that is intended to be used or referred to by a person other than the practitioner (or a person who is a member of, associated with, or employed by the practitioner's firm) to promote, market, or recommend the arrangement opined upon, to one or more taxpayers.

Under Circular 230[3], a tax opinion is subject to the following requirements: (i) the opinion must be based on reasonable[4] factual and legal assumptions (including assumptions as to future events); (ii) the opinion must reasonably consider all relevant facts and circumstances that the practitioner knows or ...

A property has two options for protesting, either by: 1. Filing a Petition of Protest with County Assessor as provided in the Property Tax Code (7-35-1 NMSA 1978) or 2. Filing a Claim for Refund after paying his/her taxes as provided in the Property Tax Code.

An effective tax opinion letter will discuss factual details as well as technical concerns. It should include a thoughtful tax analysis. Citing examples to uphold the position from authorities and Tax Court can strengthen the letter as well.

Tax Opinions Are About More Than Penalty Protection. Most tax advisers say this, but a tax opinion should not only be about penalty protection. No client wants or expects the claimed tax position to fail. If all the opinion accomplishes is saving penalties, the client won't be happy.

Generally, no assessment of tax (or start of court proceedings without a prior assessment) may be made after three years from the end of the calendar year in which the tax payment was due.

New Mexico Tax Power of Attorney (Form ACD-31102), otherwise known as the ?Taxation and Revenue Department Tax Information Authorization,? is a form used to appoint someone, usually a tax attorney or accountant, to represent your tax-related affairs.

A tax opinion can be about almost any tax issue. A good tax opinion discusses the facts, legal arguments, and pertinent authorities. One portion of the opinion says, "it is our opinion that?." But the vast majority of the opinion should analyze the facts and the law, presenting an even-handed assessment.