New Mexico Complex Deed of Trust and Security Agreement

Description

How to fill out Complex Deed Of Trust And Security Agreement?

Choosing the right legitimate record design can be quite a have a problem. Obviously, there are tons of templates available online, but how will you get the legitimate kind you want? Make use of the US Legal Forms website. The services provides a huge number of templates, such as the New Mexico Complex Deed of Trust and Security Agreement, that you can use for company and personal requires. Each of the types are inspected by pros and meet state and federal requirements.

When you are already signed up, log in to the accounts and click the Acquire switch to find the New Mexico Complex Deed of Trust and Security Agreement. Make use of your accounts to search throughout the legitimate types you may have acquired previously. Go to the My Forms tab of your accounts and obtain another copy of the record you want.

When you are a brand new customer of US Legal Forms, listed below are simple recommendations for you to follow:

- Very first, ensure you have selected the appropriate kind to your town/region. It is possible to examine the form while using Review switch and look at the form information to make certain it is the right one for you.

- If the kind does not meet your requirements, take advantage of the Seach industry to find the proper kind.

- When you are certain the form is suitable, go through the Acquire now switch to find the kind.

- Select the costs prepare you need and enter in the necessary information. Create your accounts and purchase an order with your PayPal accounts or credit card.

- Opt for the submit file format and acquire the legitimate record design to the system.

- Total, revise and printing and sign the received New Mexico Complex Deed of Trust and Security Agreement.

US Legal Forms will be the biggest local library of legitimate types in which you can find various record templates. Make use of the service to acquire appropriately-created paperwork that follow state requirements.

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

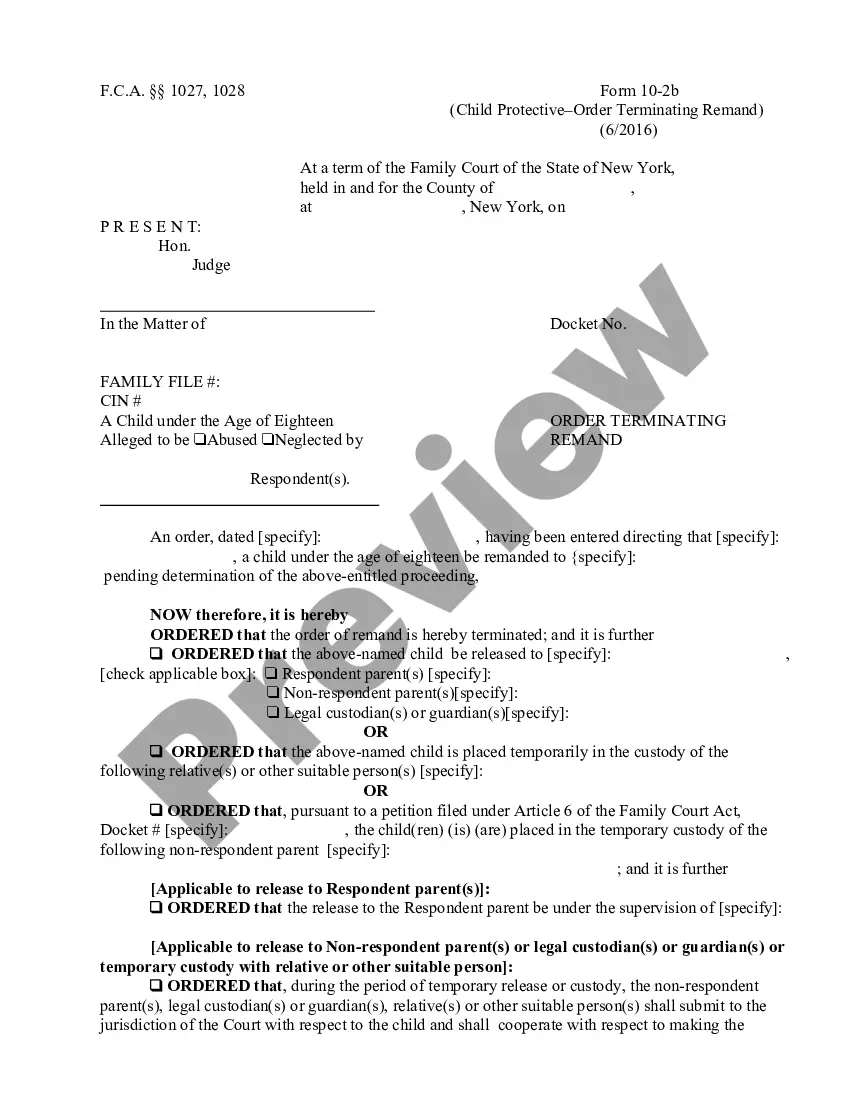

A New Mexico deed of trust assigns a real estate title to a trustee to keep until a loan has been repaid from the owner of the property (the ?borrower?) to the provider of the loan (the ?lender?).

Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan.

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateNevadaYNew HampshireYNew JerseyYNew MexicoY47 more rows

Signing Requirements for New Mexico Deeds The current owner who is transferring real estate must sign and acknowledge a deed before a notary or other officer. Notary certificates must include the date of acknowledgment; the notary's signature, stamp or seal; and the commission expiration date.