The New Mexico Partnership Agreement for Restaurant Business is a legally binding document that outlines the terms and conditions of collaboration between two or more individuals or entities in the restaurant industry. This partnership agreement serves as a roadmap for the successful operation of a restaurant business in the state of New Mexico. Key terms and keywords associated with a New Mexico Partnership Agreement for Restaurant Business include: 1. Agreement: The partnership agreement is a formal written contract that clearly defines the rights, responsibilities, and obligations of all partners involved. 2. Partners: This refers to the individuals or entities who are entering into the partnership agreement to jointly own and operate a restaurant business. Partners can be individuals, corporations, or limited liability companies. 3. Profit and Loss Sharing: This clause entails the agreed-upon division of profits, losses, and expenses among the partners. It specifies the percentage or ratio of distribution, ensuring a fair sharing of financial burdens and benefits. 4. Capital Contributions: This outlines the capital investments made by each partner into the restaurant business, including cash, equipment, inventory, or property. It specifies the value of each contribution and the ownership interest that each partner holds. 5. Management and Decision-Making: This section defines the decision-making process and the roles and responsibilities of each partner in managing the restaurant business. It may include voting rights, decision-making procedures, and the appointment of a managing partner or management committee. 6. Duration and Termination: This clause specifies the duration of the partnership and the conditions under which it may be terminated. It may include provisions for withdrawal, dissolution, or buyout options, ensuring a clear exit strategy for partners. Different types of New Mexico Partnership Agreements for Restaurant Businesses may include: 1. General Partnership Agreement: This is the most common type of partnership agreement where all partners possess equal rights and responsibilities and share profits and losses equally. 2. Limited Partnership Agreement: In this arrangement, there are two types of partners: general partners and limited partners. General partners have management control and take on personal liability, while limited partners contribute capital but have limited involvement and liability. 3. Limited Liability Partnership (LLP) Agreement: Laps offer partners limited liability protection while allowing them to actively participate in managing the restaurant business. This agreement combines aspects of general partnerships and corporations. 4. Joint Venture Agreement: A joint venture agreement is similar to a partnership agreement, but it is aimed at achieving a particular business objective or project instead of a long-term partnership. It allows multiple parties to collaborate and share resources for a specific venture. In conclusion, the New Mexico Partnership Agreement for Restaurant Business is an essential legal document that formalizes the relationship and responsibilities of partners in a restaurant business. By clearly outlining the terms and conditions, this agreement ensures a harmonious and efficient operation of the restaurant venture in New Mexico.

New Mexico Partnership Agreement for Restaurant Business

Description

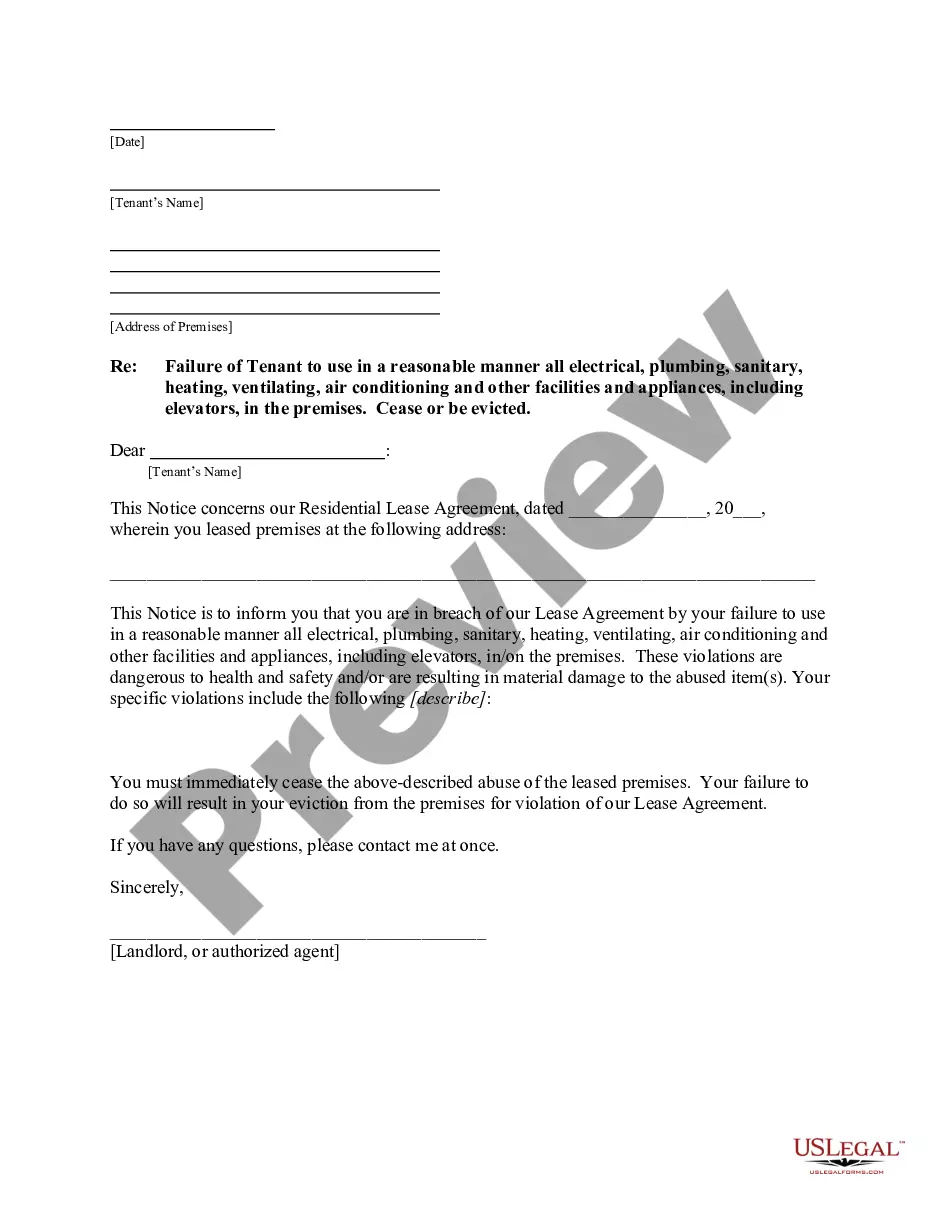

How to fill out New Mexico Partnership Agreement For Restaurant Business?

US Legal Forms - among the most significant libraries of legal types in the United States - gives a wide range of legal record web templates it is possible to obtain or print out. While using website, you will get thousands of types for business and personal functions, categorized by groups, says, or key phrases.You will find the newest models of types like the New Mexico Partnership Agreement for Restaurant Business in seconds.

If you already possess a membership, log in and obtain New Mexico Partnership Agreement for Restaurant Business in the US Legal Forms collection. The Down load option can look on each and every develop you view. You get access to all earlier delivered electronically types inside the My Forms tab of your own profile.

If you wish to use US Legal Forms for the first time, allow me to share straightforward instructions to help you started off:

- Make sure you have chosen the right develop for your personal area/county. Go through the Review option to examine the form`s content. Look at the develop description to actually have selected the right develop.

- In case the develop does not fit your specifications, take advantage of the Search field on top of the monitor to discover the the one that does.

- Should you be content with the shape, verify your selection by visiting the Buy now option. Then, pick the prices program you favor and supply your references to register for an profile.

- Procedure the transaction. Use your credit card or PayPal profile to finish the transaction.

- Choose the formatting and obtain the shape on your product.

- Make alterations. Fill up, modify and print out and signal the delivered electronically New Mexico Partnership Agreement for Restaurant Business.

Each and every format you added to your bank account lacks an expiration day which is yours eternally. So, in order to obtain or print out yet another duplicate, just visit the My Forms section and then click around the develop you need.

Get access to the New Mexico Partnership Agreement for Restaurant Business with US Legal Forms, by far the most extensive collection of legal record web templates. Use thousands of expert and express-specific web templates that meet up with your small business or personal requirements and specifications.

Form popularity

FAQ

Create Your Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...

Current Bank AccountAddress Proof of the partnership firm. Identity proofs of all the partners. Partnership registration certificate (if partnership has been registered) Any registration document issued by central or state government (normally GST certificate is submitted)

8 things your small business partnership agreement should includeWhat each business partner will contribute.How finances will be managed.Distribution of profits and losses.A process for dispute resolution.A non-compete clause.A non-disclosure confidentiality clause.A non-solicitation clause.More items...?

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

Features of partnership form of organisation are discussed as below:Two or More Persons:Contract or Agreement:Lawful Business:Sharing of Profits and Losses:Liability:Ownership and Control:Mutual Trust and Confidence:Restriction on Transfer of Interest:More items...

It's ultimately up to you and the partners to decide how to create the partnership agreement. It's a legal contract, so it should be worded as such, and signed by all parties. You can choose an online template, create one yourself or speak to an attorney to draw up the contract.

PARTNERSHIP BUSINESS LAW two or more partners who shall all shoulder unlimited liabilities according to the law; a partnership agreement in written form; capital fund contributed by all partners; a name of the business concerned; operating sites and conditions of the business.

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

How to Write a Business Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...