A New Mexico Partnership Agreement for Corporation is a legally binding document that outlines the guidelines, rights, and responsibilities of the partners involved in a corporation formed in the state of New Mexico. This agreement establishes the relationship between the partners and governs their interactions, decision-making processes, profit and loss distribution, as well as the overall management of the corporation. Some relevant keywords associated with a New Mexico Partnership Agreement for Corporation include: 1. Partnership Agreement: This refers to a formal contract that sets forth the terms and conditions under which a partnership operates. It outlines the rights and obligations of each partner and serves as the foundation for the partnership's operations. 2. Corporation: In the context of a New Mexico Partnership Agreement, it refers to a type of business entity that is formed and governed under state law. Unlike other types of partnerships, a partnership corporation is a separate legal entity from its partners, providing liability protection and various tax advantages. 3. New Mexico: This keyword signifies that the partnership agreement is specific to the laws and regulations of the state of New Mexico. Each state may have different requirements and provisions for partnership agreements, making it crucial to align the agreement with the local jurisdiction. Different types of New Mexico Partnership Agreements for Corporations may include: 1. General Partnership (GP): This is the simplest form of partnership where two or more partners jointly own and manage the business. In a general partnership, all partners are equally liable for the partnership's debts and obligations. 2. Limited Partnership (LP): A limited partnership consists of at least one general partner and one or more limited partners. The general partner(s) holds unlimited liability for the partnership's actions, while limited partners' liability is limited to their investment in the partnership. Limited partners typically have no involvement in the management of the corporation. 3. Limited Liability Partnership (LLP): An LLP provides protection against personal liabilities for all partners involved. It combines the features of a corporation and a partnership, allowing partners to participate in the management of the business while enjoying limited personal liability. 4. Limited Liability Company (LLC): Although not strictly a partnership, an LLC allows multiple owners, known as members, to operate a business while enjoying limited liability. This entity offers flexibility in management and taxation, making it an attractive option for many businesses. It's important to note that the choice of partnership type depends on various factors, including the partners' goals, risk tolerance, and desired level of control. Seeking legal advice is advisable when drafting a New Mexico Partnership Agreement for a Corporation to ensure compliance with state laws and to address specific needs.

New Mexico Partnership Agreement for Corporation

Description

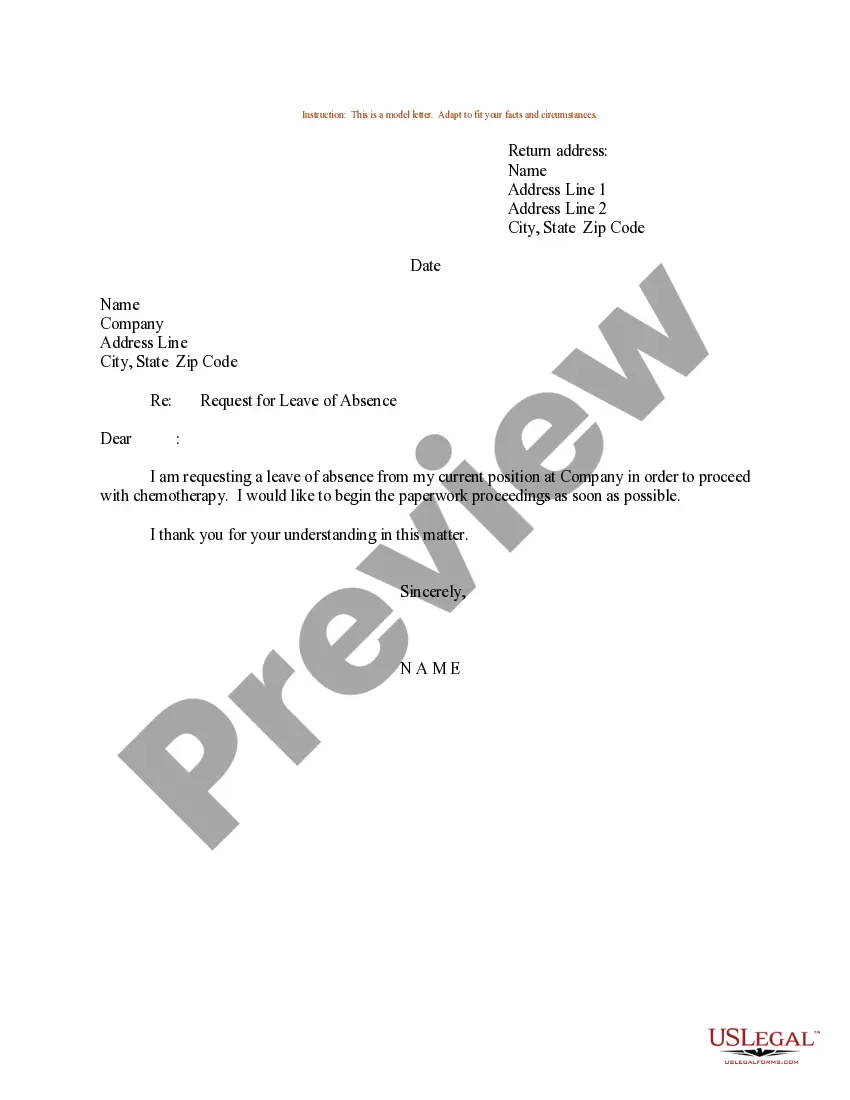

How to fill out New Mexico Partnership Agreement For Corporation?

US Legal Forms - one of many biggest libraries of lawful types in the United States - gives a wide range of lawful papers templates you may down load or print. Utilizing the internet site, you can get thousands of types for company and specific purposes, sorted by groups, says, or keywords and phrases.You can get the most recent models of types such as the New Mexico Partnership Agreement for Corporation within minutes.

If you already possess a subscription, log in and down load New Mexico Partnership Agreement for Corporation from your US Legal Forms collection. The Down load option will show up on each kind you see. You have accessibility to all earlier acquired types in the My Forms tab of your accounts.

In order to use US Legal Forms initially, listed here are simple guidelines to help you get started out:

- Be sure you have selected the right kind to your city/state. Go through the Review option to check the form`s content. Read the kind outline to actually have selected the proper kind.

- In case the kind does not satisfy your demands, use the Research area on top of the display screen to discover the one who does.

- When you are content with the shape, verify your option by clicking the Buy now option. Then, select the rates plan you want and provide your accreditations to register on an accounts.

- Procedure the transaction. Make use of your credit card or PayPal accounts to perform the transaction.

- Select the formatting and down load the shape on your own system.

- Make alterations. Fill up, modify and print and indicator the acquired New Mexico Partnership Agreement for Corporation.

Each and every design you put into your account does not have an expiration time which is the one you have permanently. So, if you want to down load or print yet another backup, just proceed to the My Forms section and then click on the kind you require.

Obtain access to the New Mexico Partnership Agreement for Corporation with US Legal Forms, by far the most considerable collection of lawful papers templates. Use thousands of professional and status-distinct templates that meet up with your small business or specific needs and demands.