New Mexico Sample Letter for Insufficient Amount to Reinstate Loan

Description

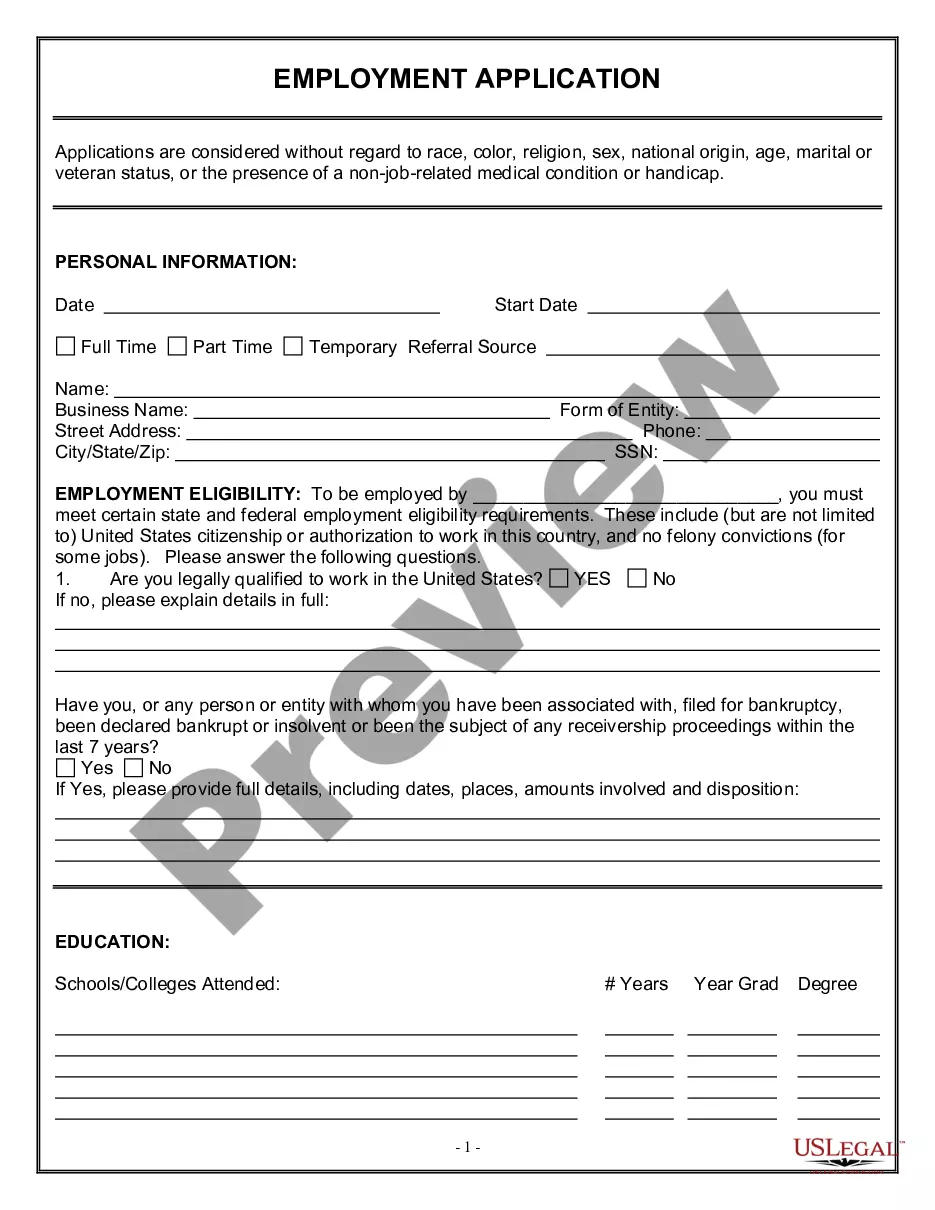

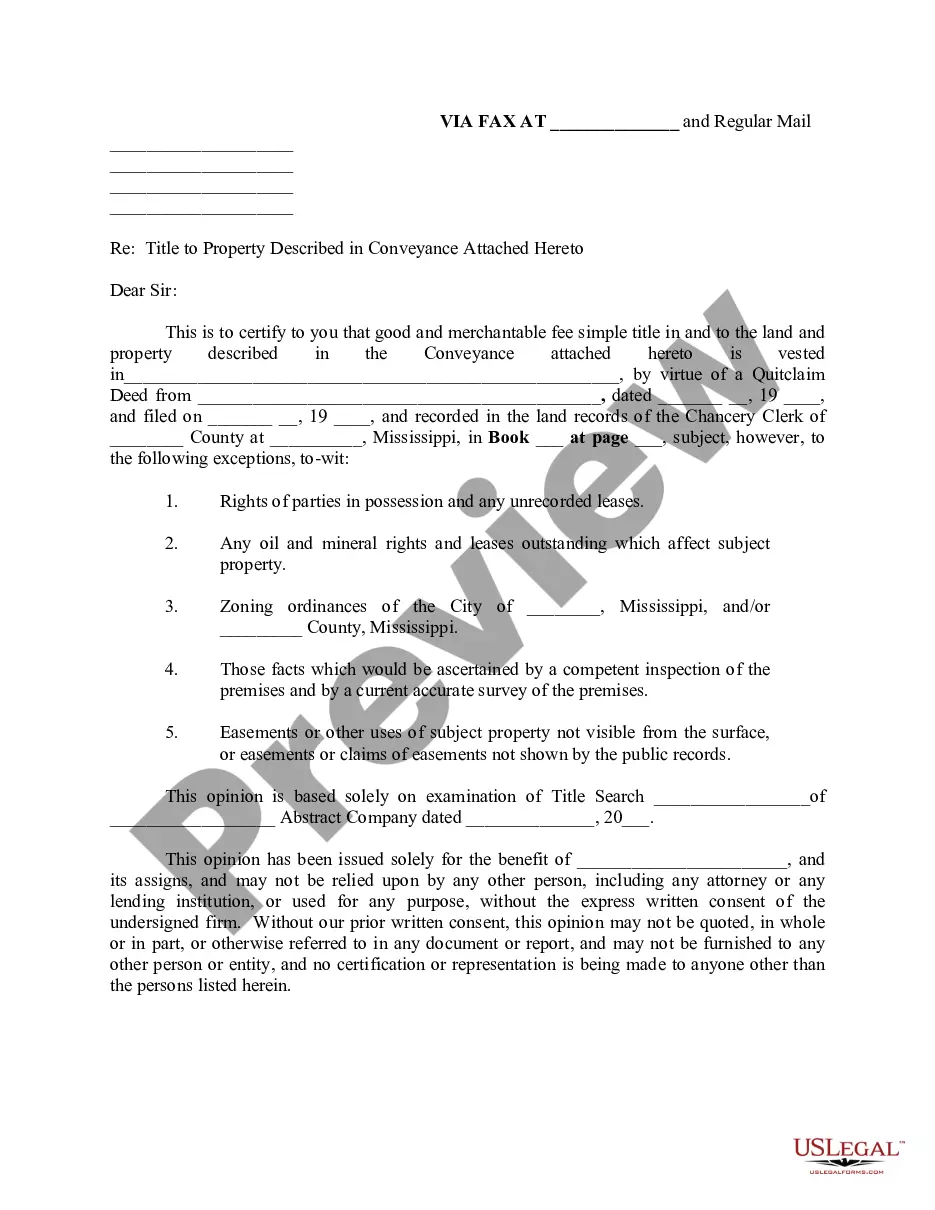

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

If you seek to be thorough, obtain, or create legal document formats, utilize US Legal Forms, the most extensive collection of legal templates accessible online.

Leverage the site's straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you have located the form you need, choose the Get now button. Select the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Employ US Legal Forms to locate the New Mexico Sample Letter for Insufficient Amount to Reinstate Loan in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Acquire button to obtain the New Mexico Sample Letter for Insufficient Amount to Reinstate Loan.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s details. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other versions in the legal document format.

Form popularity

FAQ

When writing a request for a release letter, be direct yet polite in your approach. Clearly state your reason for the request and mention any relevant details that may support your case. Utilize the New Mexico Sample Letter for Insufficient Amount to Reinstate Loan as a template to ensure you cover all critical points. Don't forget to include your contact details, making it easy for them to respond to your request.

To write a letter explaining financial hardship, start with a clear statement of your situation. Briefly describe your financial challenges, focusing on key details that explain why you are unable to meet your financial obligations. You can reference the New Mexico Sample Letter for Insufficient Amount to Reinstate Loan to guide your format and content. Remember to express willingness to discuss options and include your contact information.

Mortgage reinstatement, sometimes called loan reinstatement, is the process of restoring your mortgage after a mortgage default by paying the total amount past due. You will arrive at the point of a mortgage default after missing payments for several months.

In foreclosure, a house is sold as collateral after the homeowners default on their loan. Housing repossession is a more general term for when a mortgage lender or loan provider takes ownership of a property because the owners haven't paid their bills. It's a consequence of foreclosure.

Reinstating a loan stops a foreclosure because the borrower catches up on the defaulted payments. The borrower also has to pay any overdue fees and expenses incurred because of the default. Once the loan is reinstated, the borrower resumes making regular payments on the debt.

Negotiating a ReinstatementDefaulting property owners can also negotiate reinstatement of their mortgage loans with their lenders. Negotiating a reinstatement of a defaulted mortgage with that loan's lender is a bit more involved than simply paying all missed payments and late fees though.

You may be able to reinstate the loan by catching up on payments. However, you will need to repay all past due bills, including late fees and the costs a lender incurs from repossession.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

The deadline for reinstating your loan is 90 days after you were served with a foreclosure notice. By this deadline, you will be required to make up the missed payments and pay other fees and expenses.