Subject: New Mexico Sample Letter for Foreclosed Home of Estate — Comprehensive Description and Types Dear [Recipient's Name], I hope this letter finds you well. I am writing to provide you with a detailed description of what a New Mexico sample letter for a foreclosed home of an estate entails. Furthermore, I will outline the various types of foreclosure letters that are commonly utilized in this context. Foreclosure is an unfortunate event wherein a property is seized by a lender due to the homeowner's inability to make mortgage payments. In the case of an estate, it refers to the sensitivities and legal complexities surrounding the foreclosure of a deceased homeowner's property. Here, a New Mexico sample letter for foreclosed home of estate comes into play, which adheres to the state's specific guidelines and legal requirements. Typically, a New Mexico sample letter for foreclosed home of estate includes the following relevant elements: 1. Identification and contact information: The letter starts with the identification of the estate property and the name and contact details of the individual responsible for handling the foreclosure process. 2. Explanation of foreclosure: The letter provides a concise yet comprehensive explanation of the foreclosure process, highlighting the reasons and circumstances leading to this unfortunate event. 3. Legal documentation: This section outlines the necessary legal documents that must accompany the letter, such as copies of the deceased homeowner's death certificate, original mortgage agreement, and any relevant court orders or probate documents. 4. Timeline: The letter outlines the critical dates and deadlines associated with the foreclosure, such as the foreclosure sale date, redemption period, and any other pertinent timeframes. 5. Available options and resources: It is important to provide information about potential alternatives or resources available for the estate to recover the property, such as loan modification programs, payment plans, or professional assistance from real estate agents or attorneys specializing in foreclosures. 6. Contact information for further queries: The letter concludes by providing contact details of the person responsible for managing the foreclosure process. This ensures the recipient can easily get in touch to discuss any questions or concerns they may have. Regarding the various types of foreclosure letters pertaining to estates in New Mexico, they can be classified as follows: 1. Notice of Default (NOD): This type of letter is issued when the borrower (deceased homeowner's estate) fails to meet mortgage payment obligations, informing them about the default and providing a chance to rectify the situation. 2. Notice of Sale: This letter is sent to the estate once the lender has initiated foreclosure proceedings, notifying them of the impending sale date and the opportunity to redeem the property prior to the sale. 3. Notice to Quit: If the estate fails to pay off the outstanding balance or redeem the property within the prescribed period, a Notice to Quit is issued, urging them to vacate the premises within a specific timeframe. It is crucial to seek professional legal advice and guidance while dealing with foreclosures of estate properties in New Mexico. Such guidance ensures that all legal obligations and necessary actions are appropriately handled during this complex and challenging process. Should you require any further information on New Mexico sample letters for foreclosed homes of estates or need assistance with any foreclosure-related matters, please reach out to our office. Wishing you the best in navigating these unfortunate circumstances. Sincerely, [Your Name] [Your Title/Position] [Your Contact Information]

New Mexico Sample Letter for Foreclosed Home of Estate

Description

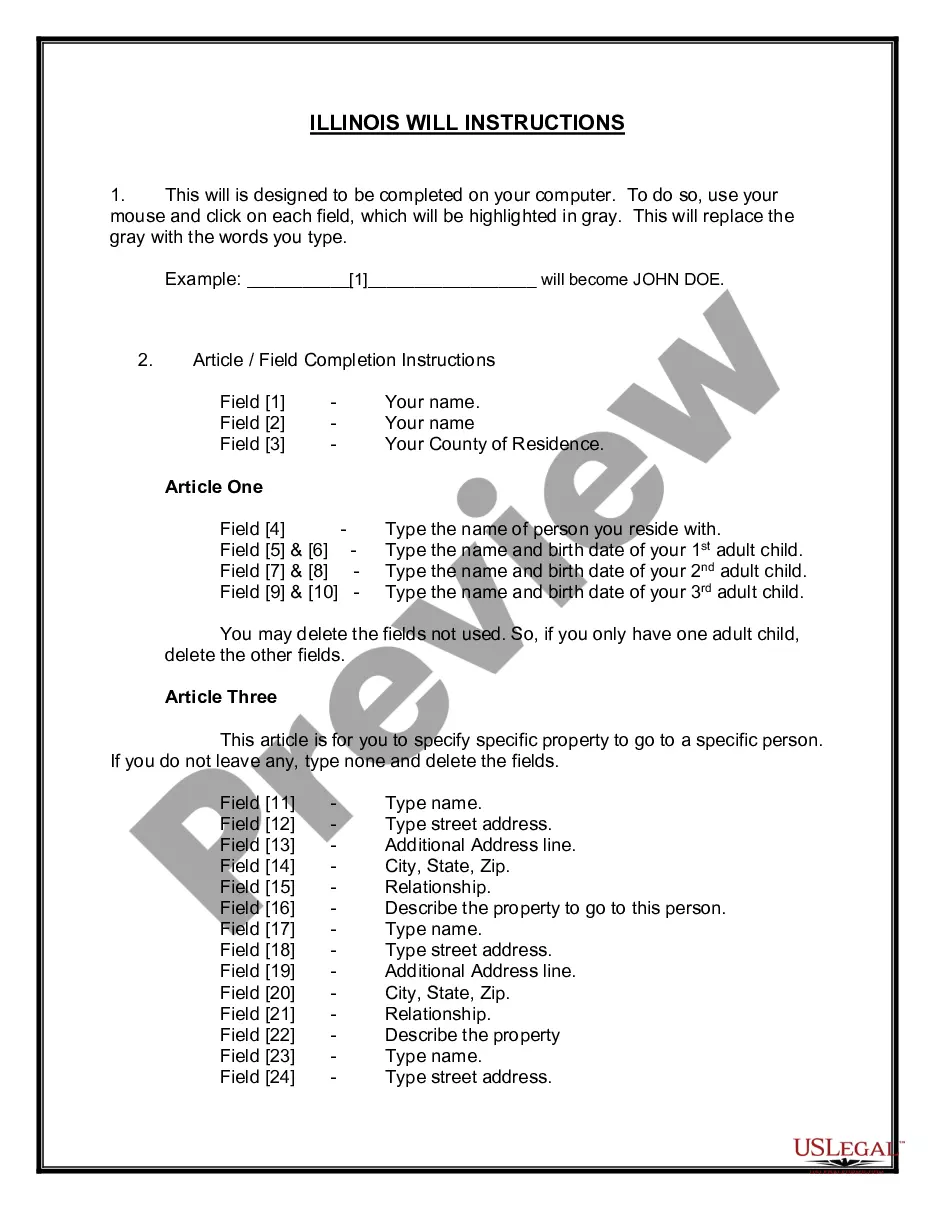

How to fill out New Mexico Sample Letter For Foreclosed Home Of Estate?

Choosing the best authorized file template can be a struggle. Naturally, there are a variety of themes accessible on the Internet, but how will you obtain the authorized type you need? Utilize the US Legal Forms web site. The support gives 1000s of themes, such as the New Mexico Sample Letter for Foreclosed Home of Estate, that can be used for organization and personal needs. Each of the kinds are checked out by specialists and fulfill state and federal needs.

In case you are presently authorized, log in to your profile and click the Acquire key to get the New Mexico Sample Letter for Foreclosed Home of Estate. Utilize your profile to check from the authorized kinds you may have ordered earlier. Check out the My Forms tab of your respective profile and have another version of your file you need.

In case you are a brand new customer of US Legal Forms, listed here are straightforward guidelines for you to follow:

- Initial, be sure you have selected the appropriate type for your area/region. It is possible to check out the shape while using Preview key and read the shape description to ensure it will be the right one for you.

- When the type will not fulfill your needs, make use of the Seach area to find the appropriate type.

- When you are positive that the shape would work, click on the Purchase now key to get the type.

- Pick the rates plan you desire and type in the essential info. Design your profile and pay for the order with your PayPal profile or credit card.

- Pick the submit formatting and acquire the authorized file template to your product.

- Comprehensive, edit and print out and indicator the acquired New Mexico Sample Letter for Foreclosed Home of Estate.

US Legal Forms is definitely the most significant collection of authorized kinds that you can see a variety of file themes. Utilize the company to acquire professionally-produced documents that follow express needs.

Form popularity

FAQ

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

The New Mexico Supreme Court has not set an expiration date for the state's moratorium. The court says the federal foreclosure moratorium expired last month, but the Federal Housing Administration announced that it was extending it through Sept.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Ways to Stop Foreclosure in New Mexico Declare Bankruptcy. Yes, bankruptcy is a way through which foreclosure can be stopped. ... Applying for Loan Modification. ... Reinstating Your Loan. ... Plan for Repayment. ... Refinancing. ... Sell Out Your Home. ... Short Sale. ... Deed In Lieu of Foreclosure.

New Mexico Foreclosure Procedures In New Mexico, foreclosures are usually judicial in nature. New Mexico's nonjudicial procedure is rarely used. A judicial foreclosure begins when the bank files a lawsuit with the court and serves it on the borrower. If the borrower fails to respond, the lender will win automatically.

Yes, New Mexico law allows a borrower to redeem a property within nine months of the foreclosure sale date. The borrower must pay the foreclosure sale price, costs, fees and interest in order to redeem the property.