New Mexico Notice of Special Stockholders' Meeting to Consider Recapitalization: A Comprehensive Overview In the business world, recapitalization are common strategies employed by companies to restructure their financials, bolster operations, or drive growth. This article will delve into a detailed description of what a New Mexico Notice of Special Stockholders' Meeting to Consider Recapitalization entails, shedding light on its significance and various types. A New Mexico Notice of Special Stockholders' Meeting serves as a formal notification to the stockholders of a company operating in New Mexico regarding an important gathering that will address the potential recapitalization of the organization. Recapitalization refers to the restructuring of a company's capitalization structure, which includes its equity, debt, and other financial instruments. The primary goal of a Notice of Special Stockholders' Meeting to Consider Recapitalization is to inform stockholders about the proposed changes, seek their approval or input, and enable them to make informed decisions that align with their interests. This meeting provides a platform for open discussions, presentations, voting, and consensus-building on the chosen recapitalization strategy. Now, let's explore some common types of New Mexico Notice of Special Stockholders' Meeting to Consider Recapitalization: 1. Debt Recapitalization: This type of recapitalization involves altering the company's debt structure, which may include refinancing existing debts or issuing new debt instruments. The goal is often to reduce interest payments, extend payment terms, or enhance financial stability. 2. Equity Recapitalization: Here, the company modifies its equity structure by issuing new stock, buying back existing shares, or converting debt into equity. This approach allows for changes in ownership percentages, injection of fresh capital, or redistribution of voting power among stockholders. 3. Leveraged Recapitalization: Also known as a leveraged buyout (LBO), this type involves acquiring a company largely with borrowed funds. The resulting debt burden is typically serviced with the target company's cash flows or by selling off assets. It aims to create value through operational improvements or strategic repositioning. 4. Asset Recapitalization: In this variation, the company focuses on changing its asset composition or reallocation. It may involve the divestiture of underperforming assets to raise capital, the acquisition of complementary assets to enhance business operations, or the transfer of assets to subsidiaries for better financial efficiency. 5. Structural Recapitalization: This type entails significant changes in the company's organizational structure, such as mergers, acquisitions, spin-offs, or reorganizations. It allows for streamlining operations, focusing on core business areas, or separating non-core business units to increase shareholder value. In conclusion, a New Mexico Notice of Special Stockholders' Meeting to Consider Recapitalization serves as a crucial communication tool for companies planning strategic financial restructuring. By providing stockholders with relevant information and facilitating their involvement in decision-making, these meetings ensure a transparent and democratic process. Whether it's debt, equity, leveraged, asset, or structural recapitalization, each type caters to unique objectives and challenges, ultimately aiming to improve the company's financial position and enhance shareholder value.

New Mexico Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

How to fill out New Mexico Notice Of Special Stockholders' Meeting To Consider Recapitalization?

You may devote hours on the Internet attempting to find the legitimate record template that suits the state and federal requirements you want. US Legal Forms gives 1000s of legitimate varieties which are reviewed by professionals. You can easily obtain or produce the New Mexico Notice of Special Stockholders' Meeting to Consider Recapitalization from your support.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Acquire key. Following that, it is possible to total, edit, produce, or signal the New Mexico Notice of Special Stockholders' Meeting to Consider Recapitalization. Every single legitimate record template you purchase is the one you have forever. To acquire one more duplicate of any bought develop, go to the My Forms tab and click on the related key.

If you work with the US Legal Forms site the first time, keep to the basic instructions under:

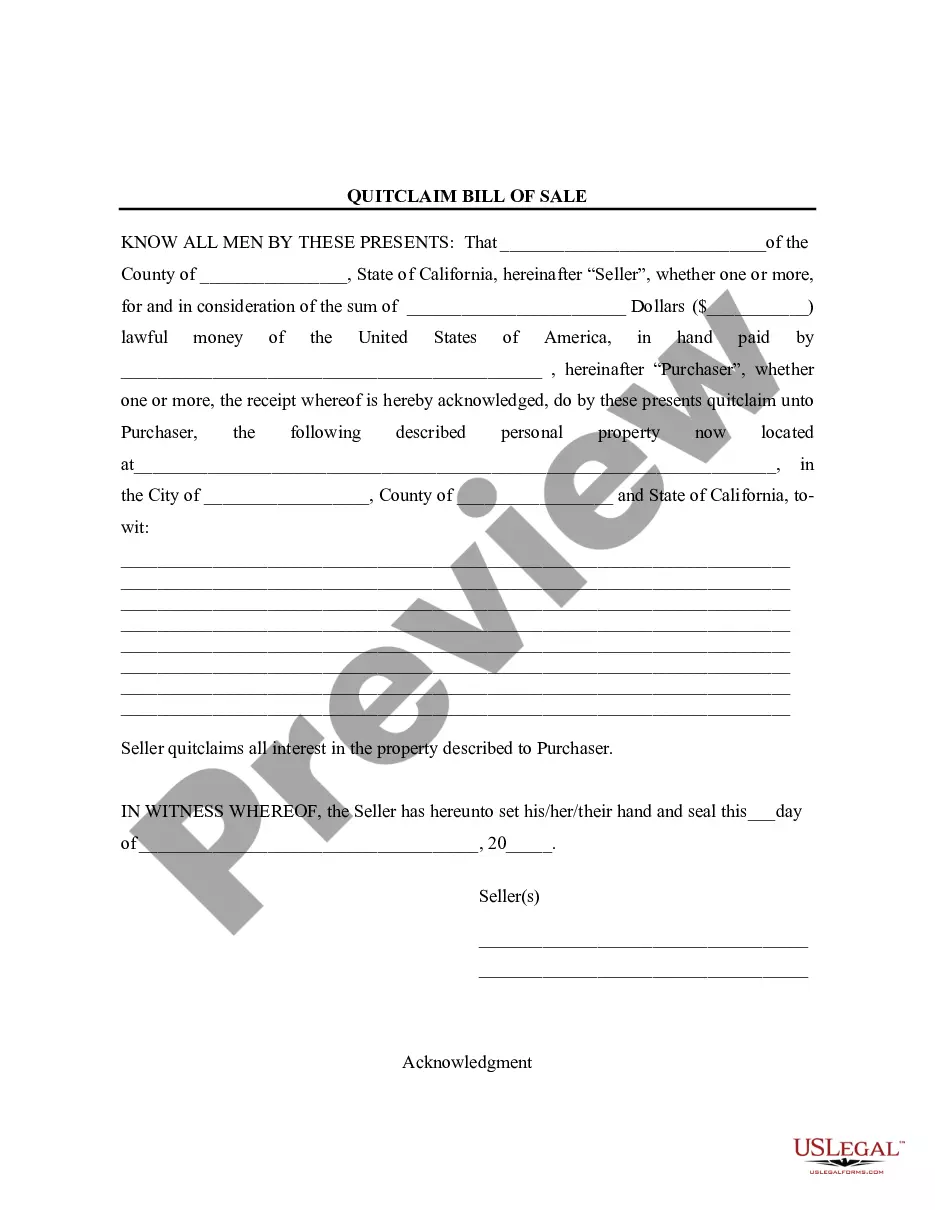

- Initial, make sure that you have chosen the right record template for that state/town that you pick. Look at the develop explanation to make sure you have picked the appropriate develop. If available, take advantage of the Review key to appear with the record template at the same time.

- In order to find one more model in the develop, take advantage of the Look for discipline to get the template that fits your needs and requirements.

- After you have discovered the template you need, click on Purchase now to move forward.

- Find the rates program you need, type your references, and sign up for your account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal accounts to pay for the legitimate develop.

- Find the formatting in the record and obtain it in your product.

- Make alterations in your record if necessary. You may total, edit and signal and produce New Mexico Notice of Special Stockholders' Meeting to Consider Recapitalization.

Acquire and produce 1000s of record templates while using US Legal Forms web site, which offers the most important variety of legitimate varieties. Use professional and state-specific templates to tackle your company or person needs.