New Mexico Monthly Retirement Planning

Description

How to fill out Monthly Retirement Planning?

If you want to aggregate, fetch, or print official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to locate the paperwork you need.

Various templates for businesses and personal purposes are sorted by categories and states, or tags and phrases.

Step 4. Once you have identified the form you need, click the Download now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to access the New Mexico Monthly Retirement Planning in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download option to find the New Mexico Monthly Retirement Planning.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to check the form’s details. Make sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other variations of your legal form template.

Form popularity

FAQ

Eligibility for PERA retirement in New Mexico typically includes employees of state and local government entities. Generally, full-time employees with a certain number of years of service can apply for benefits. For your New Mexico monthly retirement planning, ensure you confirm your eligibility status as it will impact your retirement income.

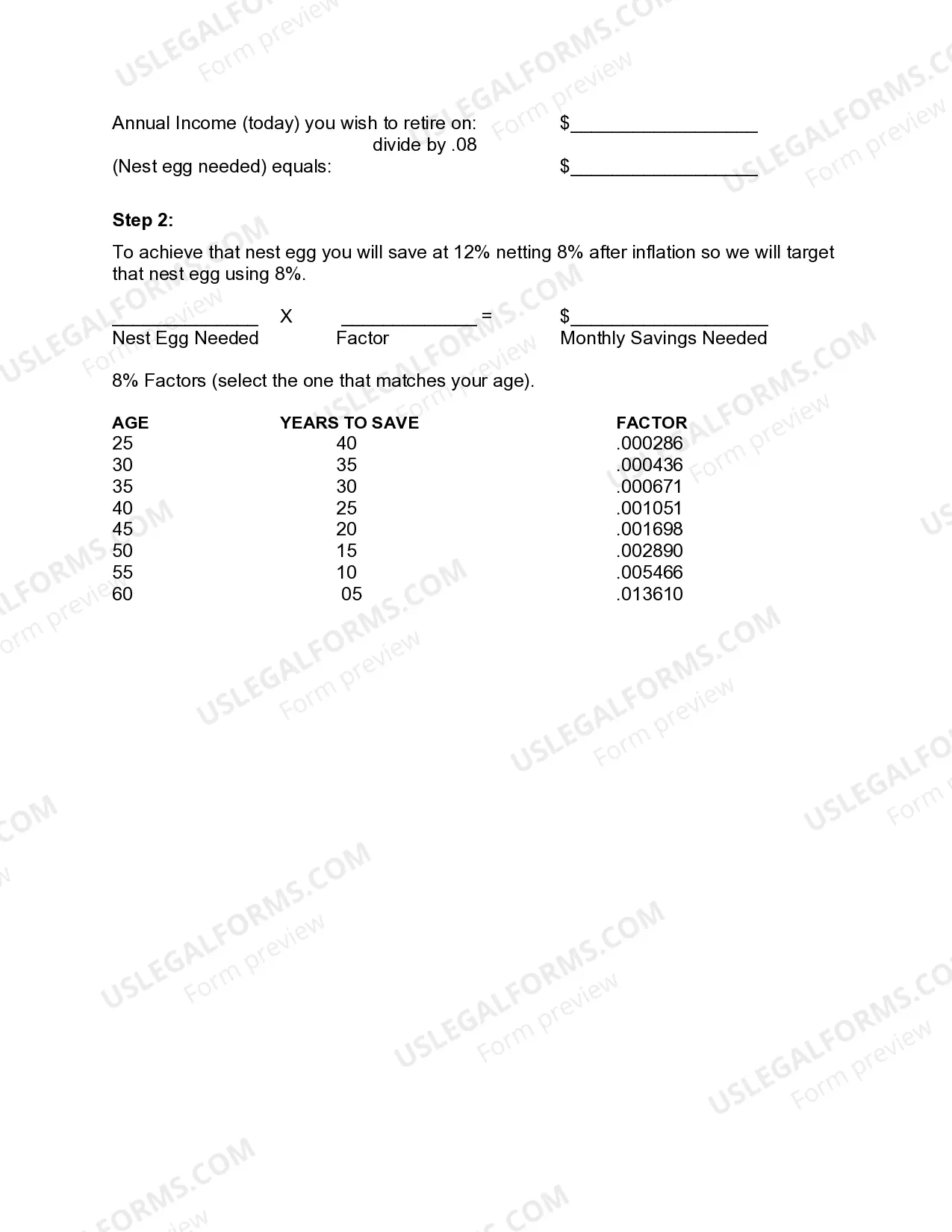

The 75-Year Rule helps individuals gauge how much to save for a retirement that can span decades. It suggests planning for your total retirement expenses to last at least 75 years, accounting for inflation and longevity. This concept is vital to your New Mexico Monthly Retirement Planning strategy, ensuring you have enough resources for a potentially lengthy retirement.

67 and 5 If you are at least 67 years old and have five or more years of earned service credit, you are eligible for retirement.

Unfortunately, pensions aren't portable like other retirement accounts. You can't simply transfer your account from one state to another, and you will likely lose service time. However, you may be able to retain at least some of your benefits depending on whether you're vested.

What is My Pension Based On? the member's PERA career for a TIER 1 member, and the monthly average of the highest 60 consecutive months of salary earned during a member's PERA career for a TIER 2 member. career. Generally, PERA members can earn up to 90 percent of their final average salary in most coverage plans.

TIER 2 General Members - Non-Public Safety Employees (State General Members and Municipal General Members) are vested after earning eight years of service credit.

The NMERB plan is a Defined Benefit Plan. When you are eligible to retire, you receive a gross monthly, lifetime benefit that is currently based on the following formula: Final Average Salary (FAS) x Years of Service x 2.35% pension factor (Tiers 1 thru 3)= Gross Annual Benefit.

You receive 2.5% of your highest average salary (HAS) for every year of service credit you've earned. Reduced Retirement: You are retiring in a shaded box on your PERA HAS table. This is also referred to as early retirement. The amount you receive is lower than what you would receive with a service retirement.

67 and 5 If you are at least 67 years old and have five or more years of earned service credit, you are eligible for retirement.

Retiring in New MexicoYou will contribute 10.9% of your salary to the plan, while your employer contributes an additional 9.4%. For example, if you earned a final average salary of $60,000 and worked for 28 years, your monthly pension amount would be $3,290.