New Mexico: Breakdown of Savings for Budget and Emergency Fund When it comes to managing your finances in New Mexico, having a clear breakdown of your savings for both budgeting and emergency purposes is crucial. Allocating your savings appropriately ensures that you can comfortably cover your monthly expenses while also preparing for unexpected financial situations that may arise. This comprehensive guide will help you understand the various types of savings accounts you can establish in New Mexico, enabling you to effectively manage your budget and emergency fund. 1. Traditional Savings Account: A traditional savings account serves as the foundation for your budget and emergency fund in New Mexico. Regular savings accounts typically offer interest rates that help your money grow over time. This account is ideal for accumulating funds for both regular expenses and unforeseen circumstances. It provides easy access to your savings, so you can use the funds whenever necessary. 2. High-Yield Savings Account: A high-yield savings account is another option available in New Mexico for budgeting and emergency purposes. These accounts often come with higher interest rates than traditional savings accounts, hence allowing your savings to grow at a faster pace. While they offer similar easy accessibility, it is essential to compare different financial institutions to find the best interest rates and terms that suit your needs. 3. Certificate of Deposit (CD): A Certificate of Deposit, or CD, is a fixed-term savings account that offers higher interest rates than regular savings accounts. In New Mexico, you can choose from various CD options, such as six-month, one-year, or multi-year terms. Although CDs have limited accessibility, they are an excellent way to save for long-term goals while diversifying your financial portfolio. 4. Money Market Account: A money market account combines features of both a savings and checking account. This type of account typically offers higher interest rates than standard savings accounts, along with the ability to write checks or access the funds through an ATM. In New Mexico, money market accounts are advantageous for both budgeting and emergency situations, especially if you require immediate access to your savings. 5. 401(k) and Individual Retirement Accounts (IRAs): While not directly associated with emergency funds, it is crucial to consider retirement savings in your financial planning. In New Mexico, 401(k) plans and IRAs offer tax advantages, helping you save for the future. While these accounts are primarily designed for retirement, some offer penalty-free early withdrawals for emergencies. However, caution should be exercised as early withdrawals can impact your retirement savings. Maintaining a diversified savings portfolio in New Mexico is key to effective financial management. By considering these various account types and their respective advantages, you can ensure a well-structured breakdown of savings for both budgeting and emergency needs. Remember to evaluate your financial goals, risk tolerance, and liquidity requirements before selecting the most suitable savings options for your specific circumstances.

New Mexico Breakdown of Savings for Budget and Emergency Fund

Description

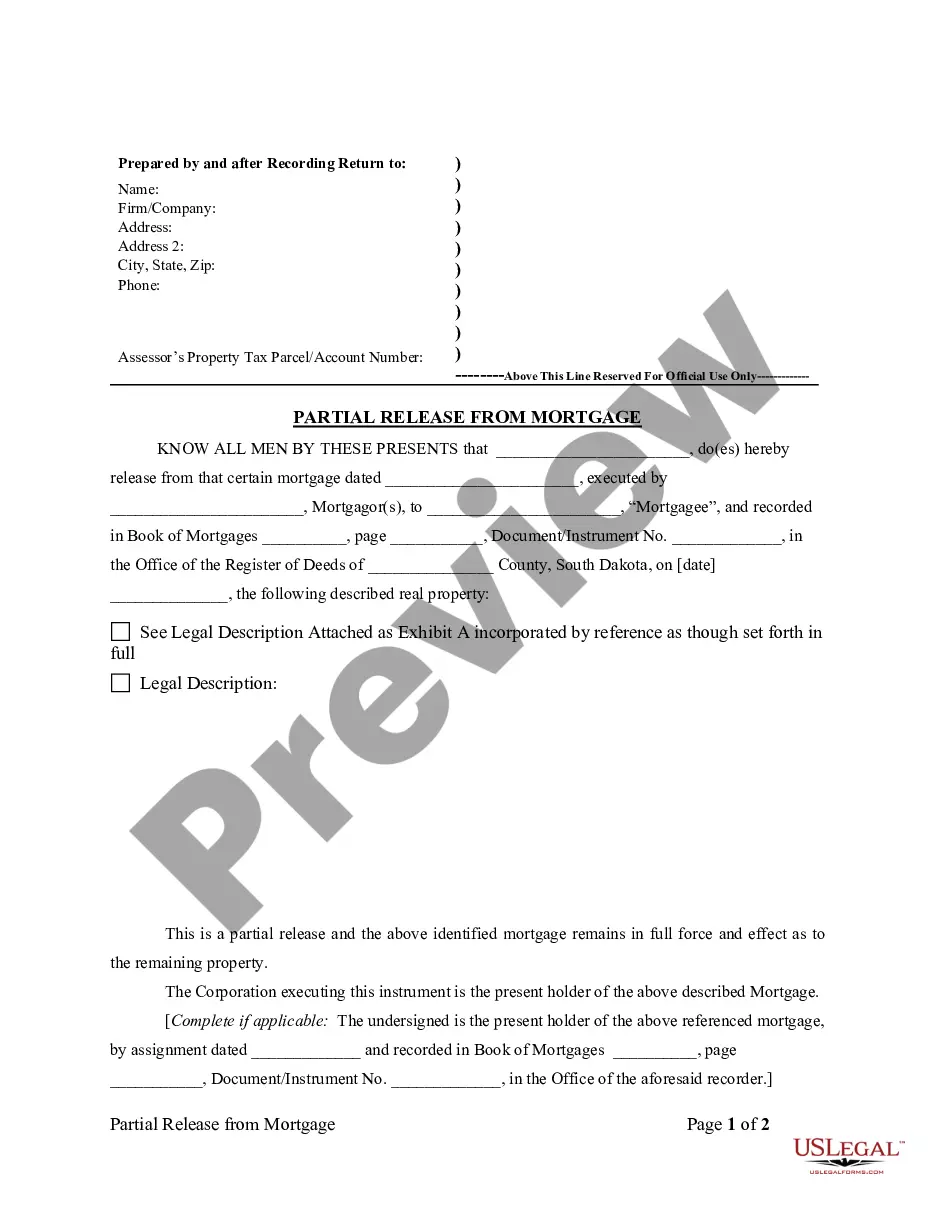

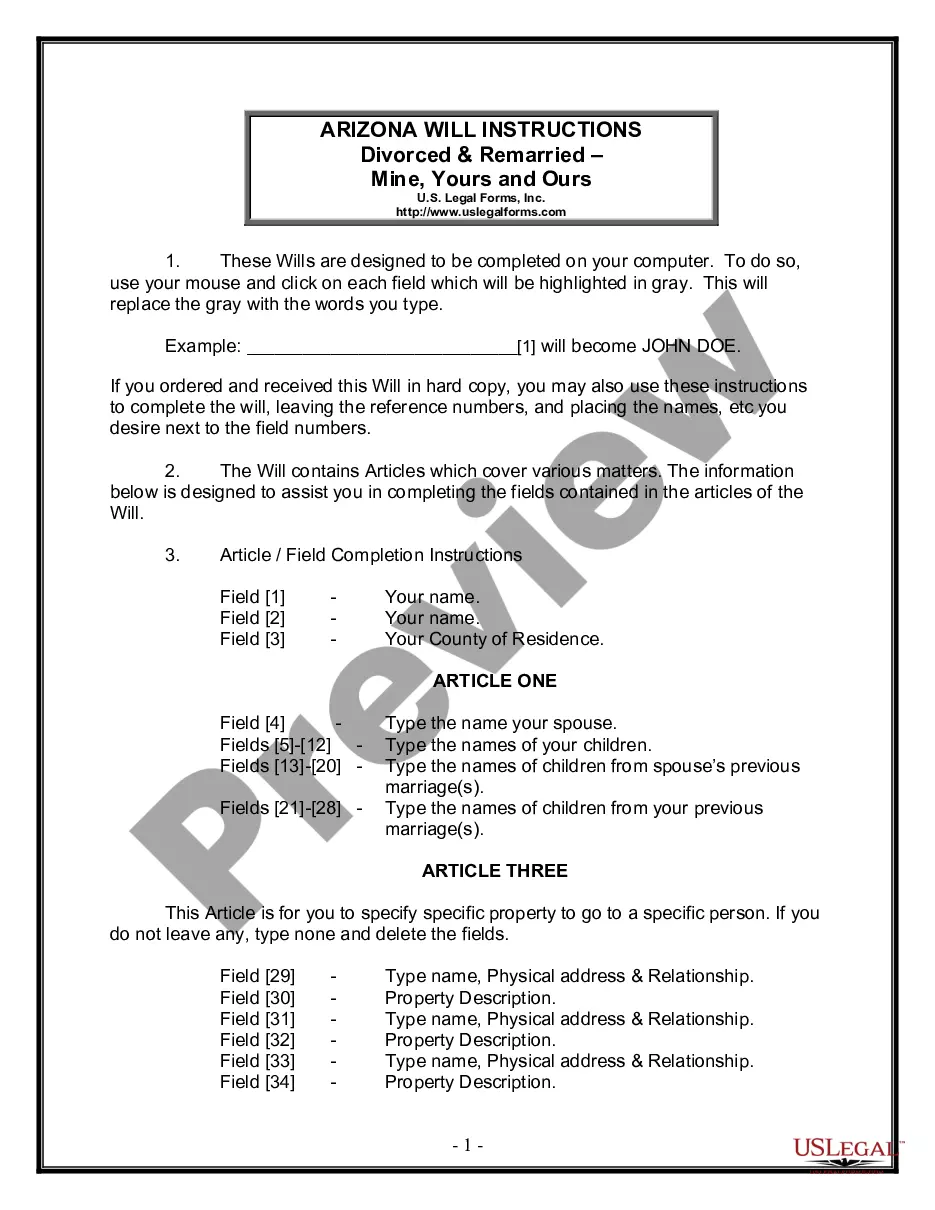

How to fill out New Mexico Breakdown Of Savings For Budget And Emergency Fund?

US Legal Forms - one of several largest libraries of legal forms in America - offers a wide range of legal papers web templates you are able to acquire or produce. Using the web site, you may get a huge number of forms for business and individual uses, categorized by groups, says, or key phrases.You will discover the most up-to-date versions of forms like the New Mexico Breakdown of Savings for Budget and Emergency Fund in seconds.

If you currently have a membership, log in and acquire New Mexico Breakdown of Savings for Budget and Emergency Fund from your US Legal Forms local library. The Obtain button will show up on every single develop you look at. You have access to all formerly delivered electronically forms within the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, here are straightforward guidelines to help you started:

- Be sure to have picked out the best develop for the city/area. Go through the Review button to examine the form`s articles. Look at the develop information to actually have chosen the right develop.

- In the event the develop does not suit your requirements, make use of the Research field at the top of the monitor to get the the one that does.

- When you are happy with the shape, verify your selection by simply clicking the Get now button. Then, select the prices program you favor and offer your qualifications to register for an accounts.

- Method the purchase. Make use of Visa or Mastercard or PayPal accounts to complete the purchase.

- Select the structure and acquire the shape on your gadget.

- Make alterations. Fill up, edit and produce and sign the delivered electronically New Mexico Breakdown of Savings for Budget and Emergency Fund.

Every single template you included with your bank account does not have an expiry day and is also yours eternally. So, if you want to acquire or produce an additional backup, just visit the My Forms segment and click on in the develop you will need.

Get access to the New Mexico Breakdown of Savings for Budget and Emergency Fund with US Legal Forms, the most substantial local library of legal papers web templates. Use a huge number of professional and express-specific web templates that fulfill your organization or individual needs and requirements.

Form popularity

FAQ

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

How much should you save each month? One popular guideline, the 50/30/20 budget, proposes spending 50% of your monthly take-home pay on necessities, 30% on wants and 20% on savings and debt repayment. For example, if you make $4,000 after taxes each month, that works out to $800 for savings and paying off debt.

But the national savings rate isn't as important as your personal savings rate. One common strategy for saving money is called the 50-30-20 rule: Spend 50 percent on needs, 30 percent on wants and put 20 percent toward savings and paying off debt.

Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment.

What is the 50/30/20 rule? The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

The rule of thumb is that individuals should have enough in an emergency fund to cover three to six months of living expenses. Add up essential living expenses for one month and multiply that amount by either three or six (this will depend on how much you're most comfortable having in case of emergency).

At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

For example: If your monthly budget is $3,000, here is how much should be in your emergency fund: 3 months: $9,000. 6 months: $18,000. 9 months: $27,000.