The New Mexico Personal Financial Information Organizer is an essential tool designed to help individuals effectively manage their personal finances and keep track of important financial information. This organizer enables users to keep all of their financial documents, statements, and details in one centralized location for easy access and reference. One of the primary goals of this organizer is to simplify the process of managing personal financial information, ensuring that important records are organized, secured, and readily available whenever needed. By utilizing this tool, individuals can streamline their financial management tasks and make informed financial decisions based on accurate and up-to-date information. This organizer consists of various sections and categories, allowing users to categorize and store different types of financial information. Some common sections found in the New Mexico Personal Financial Information Organizer may include: 1. Personal Information: This section allows users to record personal details such as their name, address, contact information, Social Security number, and other identifying information. 2. Banking and Accounts: This section allows users to list their bank accounts, credit cards, loans, and other financial accounts. It includes details like account numbers, balances, interest rates, and contact information for each financial institution. 3. Insurance: This section helps individuals keep track of their insurance policies, including health, auto, homeowner's or renter's insurance, life insurance, and any other relevant coverage. It includes policy numbers, premium amounts, and contact information for insurance providers. 4. Investments: This section allows users to document their investment portfolio, including stocks, bonds, mutual funds, retirement accounts, and any other investment vehicles. It includes key information such as current value, purchase price, and contact details for investment firms. 5. Tax Records: This section helps individuals organize their tax-related documents, such as W-2 forms, 1099 statements, receipts, and other relevant records needed for tax preparation or auditing purposes. 6. Estate Planning: This section includes information related to wills, trusts, power of attorney, and any other estate planning documents. It helps users keep track of beneficiaries, executors, and legal professionals involved in the estate planning process. These are just some common sections found in the New Mexico Personal Financial Information Organizer. However, the organizer can be customized to meet individual requirements and preferences. It is essential to note that different variations of personal financial information organizers may exist, offered by various providers or designed for specific purposes or regions within New Mexico.

New Mexico Personal Financial Information Organizer

Description

How to fill out New Mexico Personal Financial Information Organizer?

You are able to commit time on the web looking for the lawful file web template which fits the federal and state requirements you will need. US Legal Forms provides a large number of lawful types that happen to be analyzed by experts. It is possible to down load or print the New Mexico Personal Financial Information Organizer from our service.

If you have a US Legal Forms bank account, you can log in and then click the Obtain option. Following that, you can total, change, print, or signal the New Mexico Personal Financial Information Organizer. Each and every lawful file web template you acquire is your own property permanently. To get an additional backup for any bought develop, proceed to the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms internet site the first time, stick to the straightforward recommendations beneath:

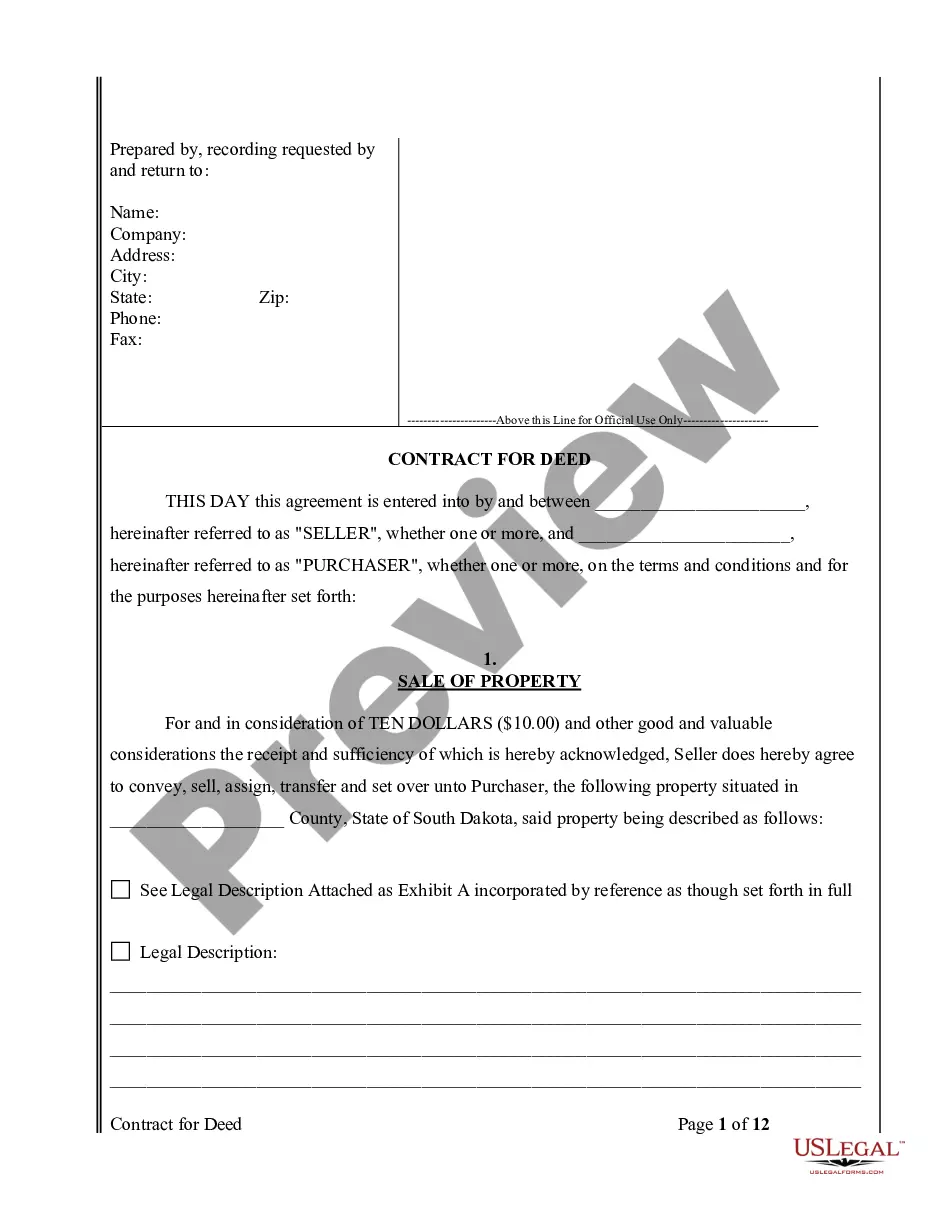

- Initial, ensure that you have chosen the best file web template to the area/area of your liking. Read the develop outline to make sure you have chosen the correct develop. If offered, use the Review option to search through the file web template too.

- In order to discover an additional edition in the develop, use the Research industry to obtain the web template that suits you and requirements.

- When you have discovered the web template you desire, just click Get now to move forward.

- Pick the costs strategy you desire, enter your accreditations, and sign up for your account on US Legal Forms.

- Total the purchase. You should use your bank card or PayPal bank account to cover the lawful develop.

- Pick the format in the file and down load it to the system.

- Make modifications to the file if needed. You are able to total, change and signal and print New Mexico Personal Financial Information Organizer.

Obtain and print a large number of file web templates using the US Legal Forms site, that offers the greatest selection of lawful types. Use specialist and status-particular web templates to tackle your company or personal requirements.