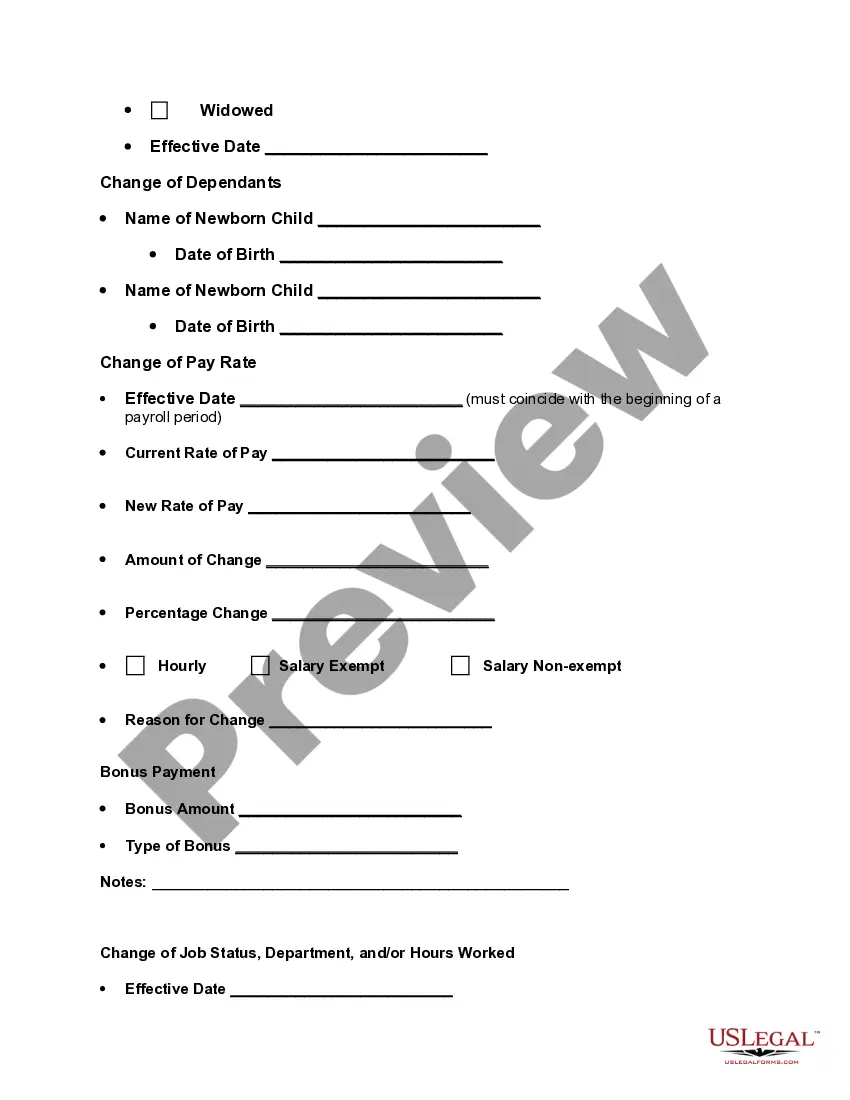

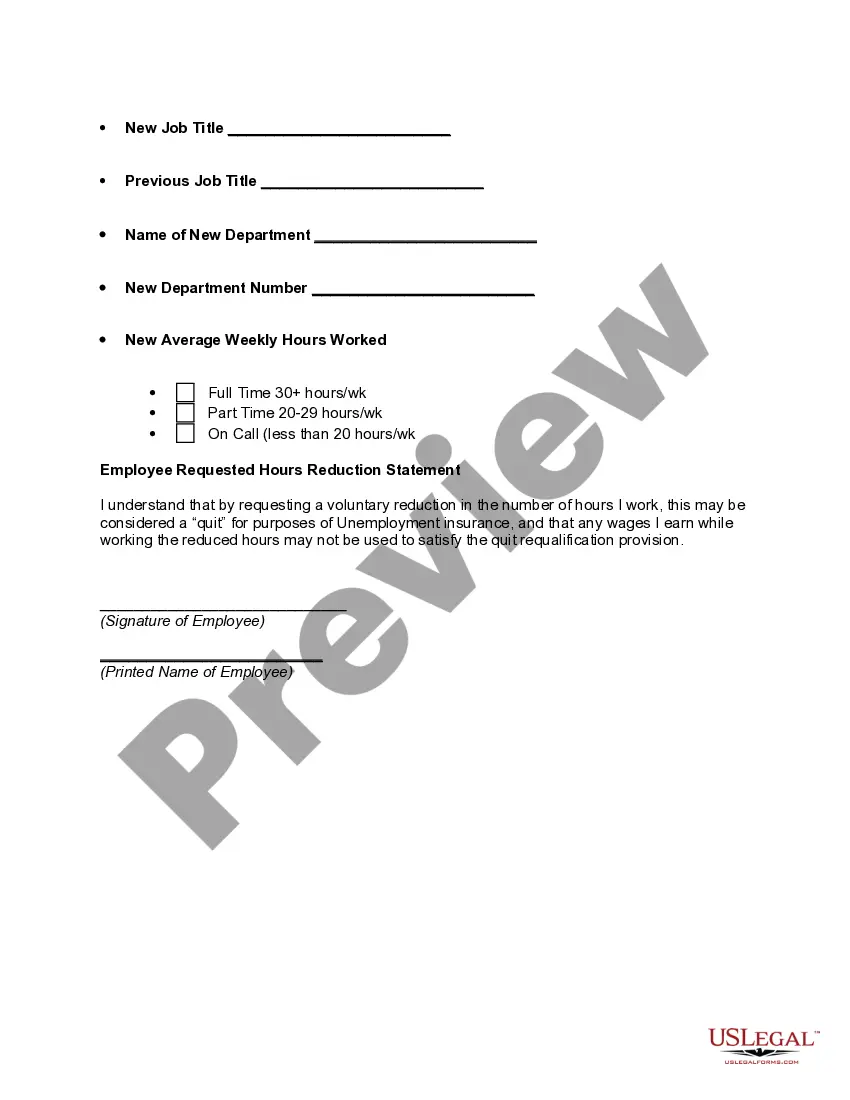

The New Mexico Personnel Change Form is an essential document used by organizations or employers operating in the state of New Mexico to record and authorize any alterations or updates in their employees' information. By submitting this form, employers ensure that accurate details are maintained, promoting efficient administration and compliance with state labor laws. The personnel change form captures various types of modifications related to an employee's status or information. Some key fields on this form include: 1. Personal Information: The form captures essential employee details such as full name, employee ID, contact information, and job title. 2. Employment Status Change: This section involves changes related to an employee's employment status, including promotions, transfers, demotions, terminations, or resignations. 3. Compensation and Benefits: Employers can also modify an employee's compensation structure, wage/salary adjustments, bonuses, commission rates, or benefit packages. This ensures accurate recording and helps with managing payroll efficiently. 4. Tax Withholding: Employers can use this section to update employees' tax withholding information, including changes in exemptions, adjustments, allowances, or filing status updates. 5. Personal Information Update: Any changes pertaining to an employee's personal information, such as address, emergency contact details, name change, marital status, or dependents, can be recorded in this section. 6. Time Off and Leaves: In this section, employers can document changes related to an employee's time off or leave balances, modifications in vacation accrual rates, maternity/paternity leaves, sick leaves, or other types of authorized absences. Other possible types of personnel change forms specific to New Mexico may include: 1. New Hire Personnel Change Form: This form focuses on capturing essential details of newly hired employees, including personal information, employment status, compensation, benefits, tax withholding, and other relevant information required during the onboarding process. 2. Separation Personnel Change Form: Used when an employee leaves the organization, this form documents the final employment status, reason for separation, final compensation details, return of company property, and any other relevant elements related to the termination process. 3. Promotion Personnel Change Form: Designed to formally record and authorize promotions within the organization, this form captures details regarding the employee's previous and new positions, effective date, salary adjustments, and any change in benefits or responsibilities resulting from the promotion. By utilizing the New Mexico Personnel Change Form and its different variations, employers can maintain accurate employee records, ensure legal compliance, and streamline their HR and payroll processes to create a seamless work environment.

New Mexico Personnel Change Form

Description

How to fill out New Mexico Personnel Change Form?

US Legal Forms - one of several biggest libraries of authorized types in the States - offers a variety of authorized papers layouts you are able to obtain or printing. Using the website, you can find 1000s of types for company and person functions, categorized by types, states, or keywords and phrases.You can find the most up-to-date variations of types much like the New Mexico Personnel Change Form in seconds.

If you already possess a subscription, log in and obtain New Mexico Personnel Change Form through the US Legal Forms collection. The Acquire button can look on each develop you look at. You gain access to all earlier acquired types inside the My Forms tab of the accounts.

In order to use US Legal Forms for the first time, listed here are simple instructions to help you started off:

- Be sure you have chosen the correct develop for the metropolis/region. Click on the Preview button to review the form`s articles. Read the develop description to ensure that you have selected the right develop.

- In case the develop does not fit your requirements, make use of the Search industry near the top of the display screen to get the one which does.

- In case you are pleased with the form, confirm your choice by visiting the Get now button. Then, pick the pricing prepare you like and provide your accreditations to register to have an accounts.

- Method the purchase. Use your charge card or PayPal accounts to perform the purchase.

- Pick the formatting and obtain the form on your product.

- Make modifications. Fill up, change and printing and sign the acquired New Mexico Personnel Change Form.

Every single design you put into your bank account lacks an expiry date and is also your own property eternally. So, in order to obtain or printing another duplicate, just visit the My Forms area and then click in the develop you require.

Gain access to the New Mexico Personnel Change Form with US Legal Forms, by far the most comprehensive collection of authorized papers layouts. Use 1000s of specialist and express-certain layouts that meet up with your company or person demands and requirements.