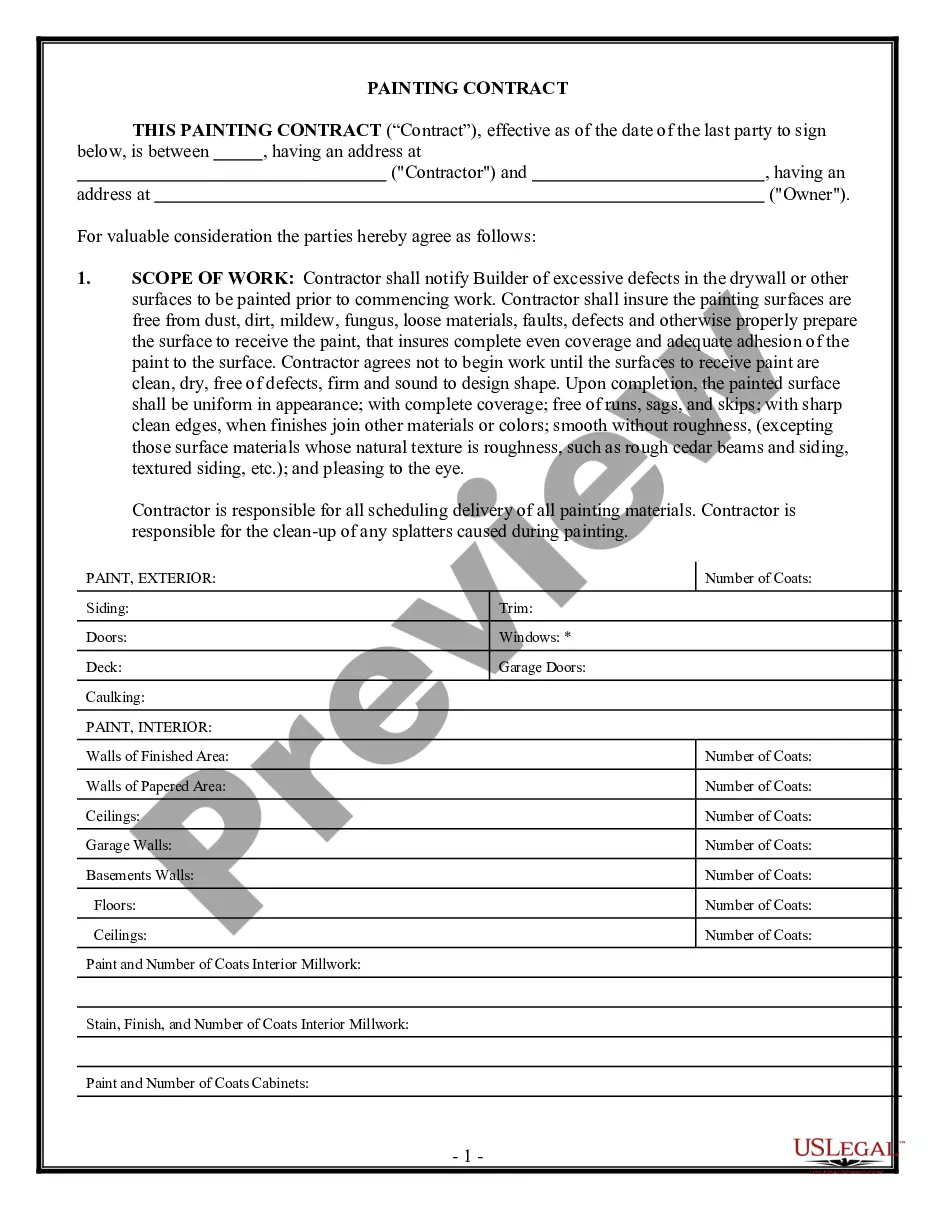

The New Mexico Expense Reimbursement Form for an Employee is a document used by organizations in the state of New Mexico to facilitate the reimbursement process for employees' business-related expenses. This form allows employees to be compensated for eligible expenses incurred while conducting official duties on behalf of their employer. By utilizing this form, employers ensure that their employees are properly reimbursed while adhering to the specific guidelines and policies set forth in the state of New Mexico. Keywords: New Mexico, expense reimbursement form, employee, business-related expenses, reimbursement process, official duties, employer, eligible expenses, guidelines, policies. There are several types of New Mexico Expense Reimbursement Forms for an Employee, namely: 1. General Expense Reimbursement Form: This form serves as a comprehensive reimbursement document that covers various types of employee expenses. It includes sections for accommodation, transportation, meals, entertainment, and other eligible business-related costs. 2. Travel Expense Reimbursement Form: This specific form is designed to handle expenses incurred during official travel. It includes additional sections for mileage reimbursement, lodging, airfare, car rental, and other travel-related costs. 3. Meal and Entertainment Expense Reimbursement Form: This form specifically focuses on employee expenses related to meals and entertainment during business activities. It includes fields to record the purpose of the expense, the individuals involved, and the amount spent. 4. Mileage Reimbursement Form: This form is utilized when employees utilize their personal vehicles for work-related purposes. It captures the mileage details, such as the start and end points, total miles driven, and the reimbursement rate per mile. 5. Miscellaneous Expense Reimbursement Form: This form covers various miscellaneous expenses that do not fall under the aforementioned categories. It allows employees to claim reimbursement for items such as office supplies, professional development, or other business-related expenses. Each form includes sections to record the employee's name, department, date of the expense, description of the expense, amount spent, and any supporting documentation required. Employees are usually required to attach original receipts or invoices to substantiate their claims. It is important for employees to familiarize themselves with their organization's specific reimbursement policies and guidelines, as well as any state-specific regulations regarding expense reimbursement in New Mexico. Overall, the New Mexico Expense Reimbursement Form for an Employee helps streamline the reimbursement process, ensuring that employees are fairly compensated for their business-related expenses while maintaining compliance with state guidelines and company policies.

New Mexico Expense Reimbursement Form for an Employee

Description

How to fill out New Mexico Expense Reimbursement Form For An Employee?

You can invest hours online attempting to find the legitimate document design which fits the state and federal requirements you want. US Legal Forms gives a huge number of legitimate varieties that happen to be analyzed by pros. It is possible to down load or produce the New Mexico Expense Reimbursement Form for an Employee from my services.

If you already possess a US Legal Forms profile, you may log in and click the Down load key. Following that, you may comprehensive, modify, produce, or signal the New Mexico Expense Reimbursement Form for an Employee. Every legitimate document design you buy is yours for a long time. To get yet another copy for any purchased type, proceed to the My Forms tab and click the corresponding key.

Should you use the US Legal Forms web site the first time, adhere to the basic guidelines listed below:

- Initial, make certain you have chosen the best document design for the region/metropolis of your choosing. See the type information to make sure you have chosen the proper type. If available, make use of the Preview key to check from the document design as well.

- If you would like discover yet another variation from the type, make use of the Look for industry to discover the design that meets your requirements and requirements.

- Once you have identified the design you need, click Purchase now to continue.

- Choose the rates prepare you need, type your accreditations, and sign up for your account on US Legal Forms.

- Full the financial transaction. You may use your bank card or PayPal profile to cover the legitimate type.

- Choose the formatting from the document and down load it to your device.

- Make modifications to your document if necessary. You can comprehensive, modify and signal and produce New Mexico Expense Reimbursement Form for an Employee.

Down load and produce a huge number of document templates utilizing the US Legal Forms web site, which offers the most important assortment of legitimate varieties. Use expert and express-distinct templates to handle your organization or specific requires.

Form popularity

FAQ

This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent. I am attaching a copy of the (cab booking/ hotel reservation/ ticket/ invoice/ boarding pass) for your reference.

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee's wages on Form W-2. Instead, report it in Form W-2 box 12 with code L.

Reimbursement is money paid to an employee or customer, or another party, as repayment for a business expense, insurance, taxes, or other costs. Business expense reimbursements include out-of-pocket expenses, such as those for travel and food.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

The expense reimbursement process allows employers to pay back employees who have spent their own money for business-related expenses. When employees receive an expense reimbursement, typically they won't be required to report such payments as wages or income.

An expense reimbursement form is submitted by employees whenever they need to be reimbursed for expenses that they paid for themselves on the company's behalf. Expenses noted on the form may include office supplies, travel, accommodations, etc.

Business expense reimbursements are not considered wages, and therefore are not taxable income (if your employer uses an accountable plan). An accountable plan is a plan that follows the Internal Revenue Service regulations for reimbursing workers for business expenses in which reimbursement is not counted as income.

How to create an expense reimbursement plan for your businessCreate an expense management policy.Make sure it's accountable.Determine which expenses are reimbursable.Specify needed documentation.Provide submission deadlines.Determine the mode of reimbursement.

As nouns the difference between refund and reimbursement is that refund is an amount of money returned while reimbursement is (businessmanagementaccounting) the act of compensating someone for an expense.

An employee reimbursement form is a standardized template an employee may use to report expenses paid on behalf of the company to receive reimbursement. The exact reimbursable items will be strictly up to the agreement between the employer and employee.