Title: Understanding New Mexico Final Notice of Past Due Account: Exploring Different Types and Related Information Introduction: The New Mexico Final Notice of Past Due Account is an official document issued by creditors or collection agencies to individuals or businesses with outstanding debts in the state of New Mexico. This notice serves as a legal reminder to the debtor regarding their unpaid obligations and lays out the consequences of continued non-payment. Below, we delve into the details of this notice, including common types and key aspects associated with it. 1. Types of New Mexico Final Notice of Past Due Account: a) Personal Debt Final Notice: This type of notice is sent by companies or individuals to individuals who have personal debts, such as credit card bills, medical bills, or personal loans, which are overdue. b) Business Debt Final Notice: Businesses use this notice to notify other businesses or individuals of outstanding invoices or unpaid services. It applies to debts related to goods received, professional services rendered, or contractual obligations. 2. Purpose and Key Contents: a) Debt Notification: The notice begins by acknowledging the outstanding debt and provides the debtor with detailed information, including the original amount due, the creditor's contact details, and the due date of the payment. b) Account Status: The notice highlights that the account has reached its final stage and serves as a last warning before further action is taken. c) Consequences: It clearly states the consequences of non-payment, such as additional fees, interest charges, negative impact on credit score, possible legal action, or involvement of collection agencies to recover the debt. d) Timeline: The notice specifies a final deadline by which the debtor must settle the debt to avoid further complications or legal repercussions. e) Payment Options: It usually provides details on available payment methods and instructions, such as online payment portals, mailing address, or phone numbers to contact the creditor's representative. This section may also mention the possibility of negotiating a payment plan or seeking financial assistance. 3. Legal Compliance and Consumer Rights: a) Fair Debt Collection Practices Act (FD CPA): The New Mexico Final Notice of Past Due Account must comply with the FD CPA, which regulates debt collection practices at the federal level, ensuring fair treatment of consumers and preventing abusive or unethical practices. b) Validation of Debt: Debtors have the right to request a validation of the debt, which requires the creditor to provide evidence of the debt's authenticity and the creditor's legal rights to collect it. c) Dispute Resolution: Debtors can dispute the debt if they believe it is inaccurate, unfair, or beyond the statute of limitations. They should provide a written response within a specified timeframe to initiate the resolution process. Conclusion: The New Mexico Final Notice of Past Due Account plays a vital role in debt recovery. Understanding its purpose, different types, key contents, and consumer rights associated with it is crucial for debtors to navigate their financial obligations effectively. Responding to such notices promptly and seeking professional advice, if needed, can help ensure a smoother resolution of past due debts in compliance with applicable laws and regulations.

New Mexico Final Notice of Past Due Account

Description

How to fill out New Mexico Final Notice Of Past Due Account?

If you have to complete, obtain, or printing legal file templates, use US Legal Forms, the largest collection of legal varieties, which can be found on-line. Make use of the site`s simple and easy handy look for to find the paperwork you require. Various templates for enterprise and personal functions are sorted by groups and claims, or key phrases. Use US Legal Forms to find the New Mexico Final Notice of Past Due Account in just a few mouse clicks.

In case you are already a US Legal Forms buyer, log in to the account and click on the Acquire option to obtain the New Mexico Final Notice of Past Due Account. Also you can access varieties you previously acquired within the My Forms tab of your account.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for the appropriate city/country.

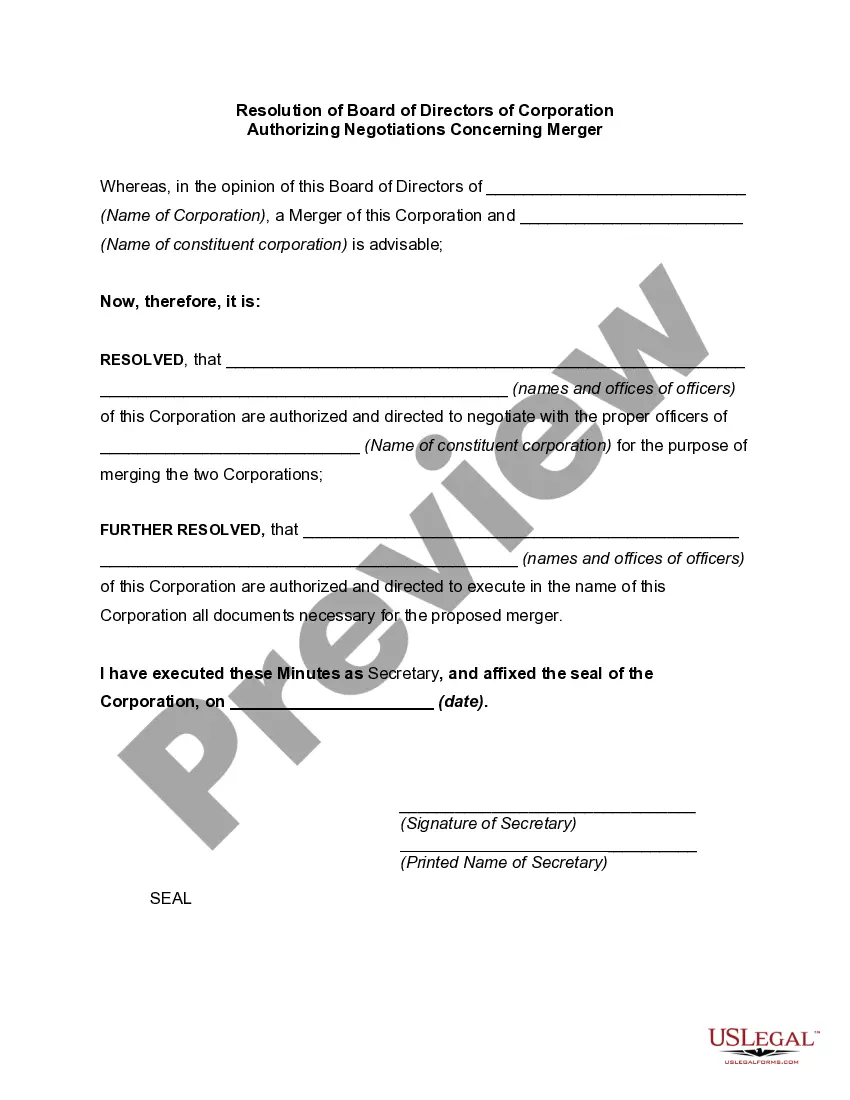

- Step 2. Utilize the Preview solution to check out the form`s content material. Do not neglect to read the explanation.

- Step 3. In case you are unhappy using the form, make use of the Search discipline towards the top of the screen to get other variations of the legal form template.

- Step 4. When you have found the shape you require, click the Get now option. Choose the pricing strategy you choose and put your references to register for the account.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal account to complete the deal.

- Step 6. Pick the formatting of the legal form and obtain it on your own device.

- Step 7. Comprehensive, modify and printing or sign the New Mexico Final Notice of Past Due Account.

Each and every legal file template you buy is yours for a long time. You may have acces to each and every form you acquired in your acccount. Click on the My Forms section and choose a form to printing or obtain once again.

Be competitive and obtain, and printing the New Mexico Final Notice of Past Due Account with US Legal Forms. There are millions of specialist and condition-distinct varieties you may use for your enterprise or personal needs.