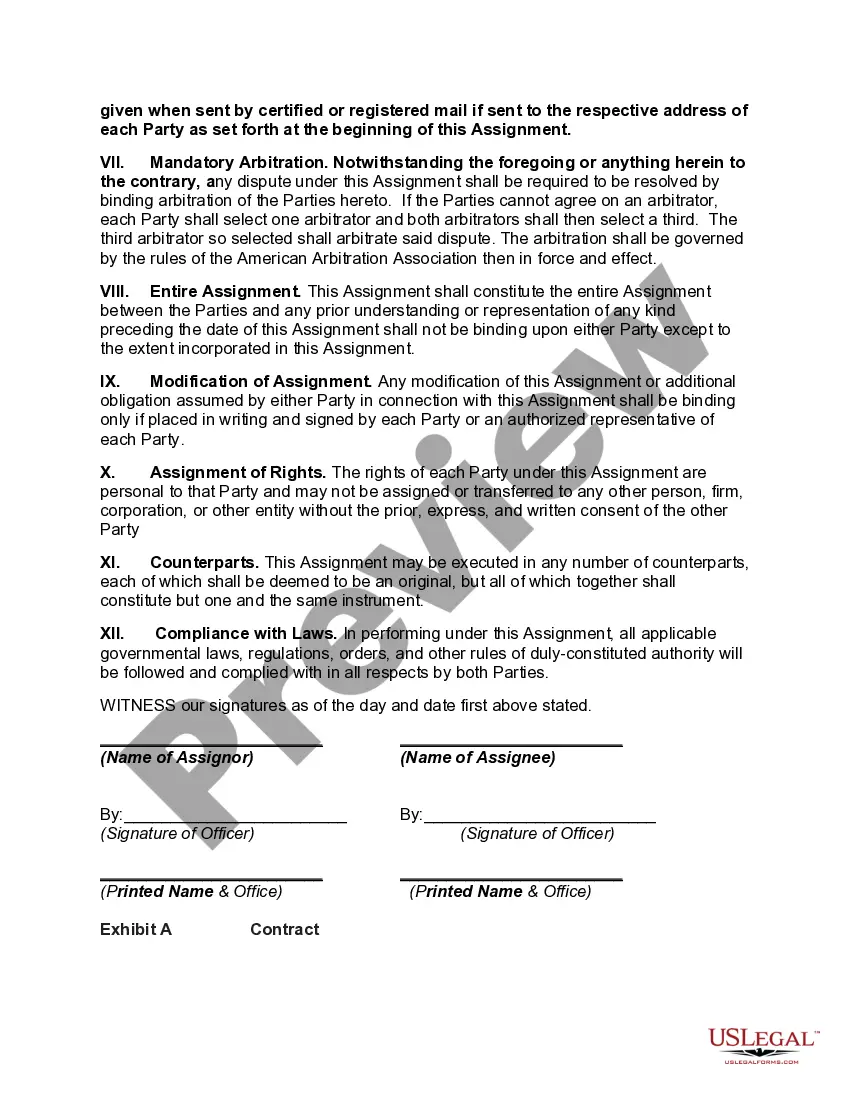

Title: An In-depth Look at New Mexico Assignment of Money Due or to Become Due under Contract Introduction: The New Mexico Assignment of Money Due or to Become Due under Contract is a legal process that involves the transfer of a party's rights to receive future payments, either as a debtor or a creditor, to another party. This assignment is performed to fulfill various financial or contractual obligations. In this article, we will delve into the details of this procedure, its uses, and the different types of New Mexico Assignment of Money Due or to Become Due under Contract. I. Understanding the New Mexico Assignment of Money Due or to Become Due under Contract: 1. Definition and Purpose: The New Mexico Assignment of Money Due or to Become Due under Contract refers to the legal transfer of a party's rights to receive financial compensation, future payments, or any other form of consideration from an existing contract. This assignment allows the parties involved to fulfill their obligations, manage debts, or access immediate funds. 2. Key Parties Involved: a. Assignor: The original party who possesses a right to receive money or other benefits under a contract. b. Assignee: The party to whom the assignment is made, and who acquires the right to receive the assigned money under the contract. c. Obliged: The party owing the money, who becomes liable to make payments to the assignee after the assignment. II. Uses and Benefits of New Mexico Assignment of Money Due or to Become Due under Contract: 1. Debt Management: Assigning money due or to become due under a contract can be used as a debt management strategy. By assigning the debt obligation to another party, the assignor can receive immediate funds, reducing financial burdens or fulfilling other obligations efficiently. 2. Financial Transactions: Prominent financial transactions, such as factoring or financing, involve the assignment of money due under contracts. This allows businesses to access immediate funds, enabling operational growth or meeting other financial requirements. 3. Risk Mitigation: Assigning money due or to become due under contracts can help manage business risks. By transferring the right to receive payments, businesses can safeguard themselves from potential non-payment or financial uncertainties. III. Types of New Mexico Assignment of Money Due or to Become Due under Contract: 1. Absolute Assignment: In this type of assignment, the assignor transfers all the rights and interest in the money due or to become due under a contract to the assignee. The assignee assumes complete control of the assigned money, becoming the new creditor. 2. Conditional Assignment: A conditional assignment involves the transfer of rights to receive money only when certain conditions are met. These conditions could include the occurrence of a specific event, meeting predetermined criteria, or the fulfillment of contractual obligations. 3. Partial Assignment: In a partial assignment, the assignor transfers only a portion of the money due or to become due under a contract to the assignee. The assignor retains ownership of the remaining balance, and payments related to the assigned funds are directed to the assignee. Conclusion: The New Mexico Assignment of Money Due or to Become Due under Contract enables parties to transfer their rights to receive future payments under contracts for various financial purposes. This legal mechanism offers flexibility, debt management solutions, and liquidity options. Understanding the different types of assignments and their implications is crucial for individuals and businesses engaging in such transactions. Consultation with legal professionals is advisable to ensure compliance with New Mexico laws and regulations.

New Mexico Assignment of Money Due or to Become Due under Contract

Description

How to fill out New Mexico Assignment Of Money Due Or To Become Due Under Contract?

Finding the right legitimate file web template can be quite a have difficulties. Naturally, there are a variety of templates accessible on the Internet, but how can you find the legitimate form you will need? Utilize the US Legal Forms web site. The support offers 1000s of templates, such as the New Mexico Assignment of Money Due or to Become Due under Contract, that can be used for company and private needs. Each of the varieties are checked by experts and fulfill federal and state requirements.

When you are previously signed up, log in to your account and click on the Download switch to obtain the New Mexico Assignment of Money Due or to Become Due under Contract. Make use of your account to check through the legitimate varieties you possess ordered previously. Visit the My Forms tab of the account and obtain another version of the file you will need.

When you are a fresh consumer of US Legal Forms, listed below are basic instructions for you to adhere to:

- First, make sure you have selected the proper form for the area/county. You can look over the shape using the Preview switch and read the shape description to ensure this is basically the right one for you.

- When the form is not going to fulfill your requirements, use the Seach industry to find the right form.

- Once you are certain the shape is acceptable, go through the Get now switch to obtain the form.

- Select the rates program you desire and enter the essential information and facts. Make your account and purchase the order utilizing your PayPal account or Visa or Mastercard.

- Opt for the document structure and download the legitimate file web template to your system.

- Comprehensive, change and printing and indicator the attained New Mexico Assignment of Money Due or to Become Due under Contract.

US Legal Forms is definitely the largest catalogue of legitimate varieties for which you can find numerous file templates. Utilize the service to download skillfully-made files that adhere to state requirements.

Form popularity

FAQ

For example, 'A' gets a contract to cut the grass from 'B's garden. 'A' might delegate the work to 'C' without actually assigning the contract to him. But 'A' will still control the work and receive the payment.

An assignment clause spells out which contractual obligations, rights, and duties may be transferred from one of the contractual parties to another party. The assignment may be in whole or in part, and the clause also details the conditions under which a party can assign these duties.

In business contracts, assignment refers to transferring an agreement's rights, obligations, and property to another party. For example, most commercial tenancy agreements include a clause allowing the tenant to assign their lease to a third party, and that third party becomes the new tenant.

Examples of Assigned duties in a sentence Assigned duties inspect work and investigate complaints related to housekeeping service etc and take corrective steps immediately. Assigned duties and responsibilities, including the needs and abilities of individual tenants for whom staff will be providing care.

How to Write (1) Effective Date Of Assignment. The date when this agreement becomes active must be established. ... (2) Name Of Assignor. ... (3) Mailing Address Of Assignor. ... (4) Assignee Name. ... (5) Assignee Mailing Address. ... (6) Details Of Assignment. ... (7) Fixed Payment. ... (8) No Payment.

An assignment of contract occurs when one party to an existing contract (the "assignor") hands off the contract's obligations and benefits to another party (the "assignee"). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights.

In order for an assignment of contract to occur, the original contract must be eligible. Some contracts may be written to disallow assignment or may require consent from one or both/all parties for assignment to occur. In addition, an assignment does not always remove full liability from the assignor.