New Mexico Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders

Description

How to fill out Resolution Of Directors To Dissolve Corporation With Submission Of Proposition To Stockholders?

If you have to complete, acquire, or printing legitimate document themes, use US Legal Forms, the greatest assortment of legitimate varieties, which can be found on the Internet. Utilize the site`s easy and hassle-free search to find the papers you will need. Numerous themes for business and person reasons are sorted by types and states, or search phrases. Use US Legal Forms to find the New Mexico Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders in just a handful of clicks.

When you are presently a US Legal Forms client, log in for your bank account and click the Obtain option to have the New Mexico Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders. You can even entry varieties you previously saved inside the My Forms tab of your own bank account.

If you work with US Legal Forms the first time, refer to the instructions listed below:

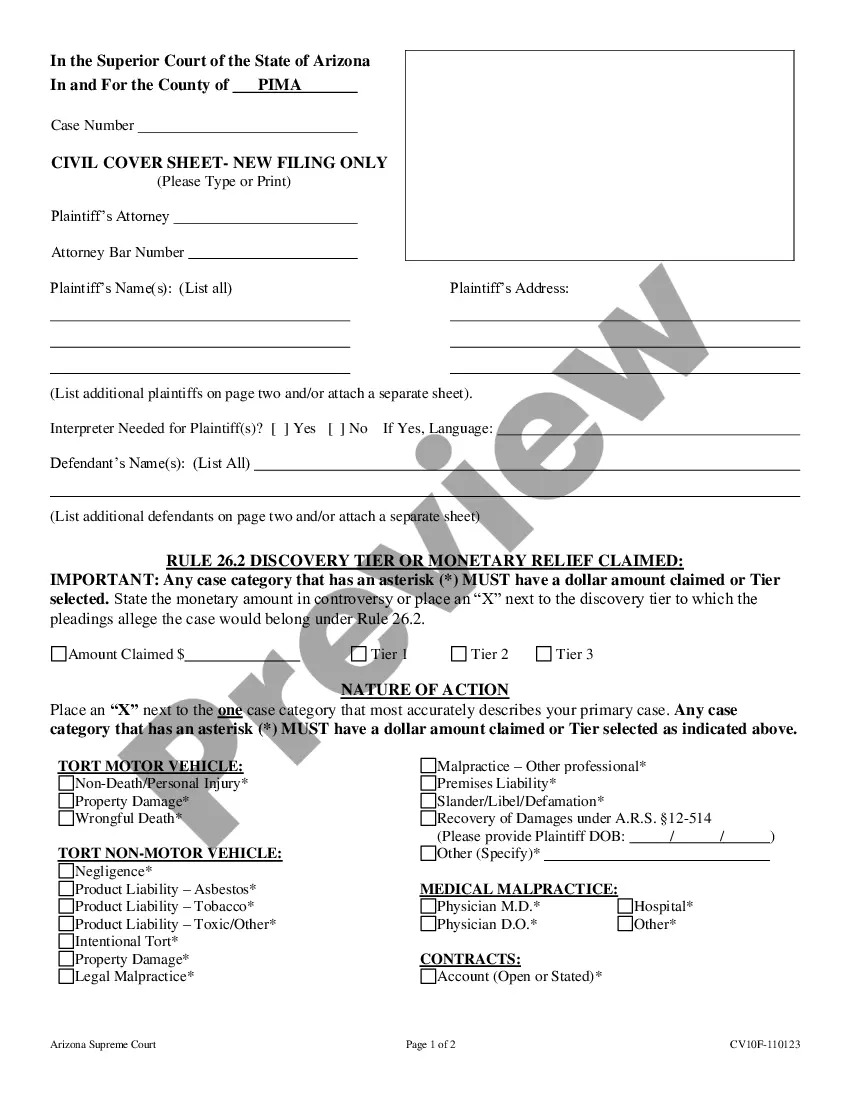

- Step 1. Ensure you have selected the form for that proper city/nation.

- Step 2. Take advantage of the Review solution to look over the form`s articles. Never overlook to read through the outline.

- Step 3. When you are not happy using the type, make use of the Lookup discipline towards the top of the display to find other variations of your legitimate type template.

- Step 4. Upon having discovered the form you will need, click on the Buy now option. Opt for the prices program you choose and put your qualifications to register for the bank account.

- Step 5. Procedure the transaction. You should use your credit card or PayPal bank account to accomplish the transaction.

- Step 6. Select the formatting of your legitimate type and acquire it on your own product.

- Step 7. Comprehensive, revise and printing or signal the New Mexico Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders.

Each legitimate document template you buy is the one you have eternally. You possess acces to each type you saved inside your acccount. Select the My Forms area and choose a type to printing or acquire once again.

Be competitive and acquire, and printing the New Mexico Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders with US Legal Forms. There are many skilled and state-certain varieties you can utilize for your personal business or person requirements.

Form popularity

FAQ

Step 6: Close the S Corp With the IRS S corporations also have several steps they must take to close their business with the IRS, including completing all tax filing obligations, filing Form 966 (Corporation Dissolution or Liquidation), and closing their IRS business accounts.

How to Dissolve an S-Corp in 8 Steps Vote to Dissolve the S-Corp. ... Cease Operating the Business. ... Wrap-Up Employee Obligations. ... Sort Liabilities and Debts. ... Liquidate and Distribute Assets Among Stakeholders. ... File Articles of Dissolution. ... Dissolve your S-Corporation with IRS.

Knowing how to dissolve an S corp involves several key steps, including the following: Vote to dissolve the corporation. Stop conducting business. Notify creditors. Liquidate assets. Settle claims. File a termination certificate. Finalize corporation taxes. Pay final expenses.

To dissolve your New Mexico corporation you must file both the Statement of Intent to Dissolve and the Articles of Dissolution. Each one requires a $50 filing fee. Payment must be made by check or money order. You may expedite processing of your dissolution by the PRC.

There is no direct Form 966 penalty for non-filing or late filing, but by not properly notifying the IRS of a dissolution or liquidation, it may result in collateral damage and other penalties.

A Standard Document to provide resolutions in writing of shareholders to dissolve the corporation under the Ontario Business Corporations Act (OBCA) without holding a meeting.

Finalizing the winding down process: Filing Form 966 is an essential step in formally closing down a corporation. By submitting this form, the corporation notifies the IRS about its intention to dissolve or liquidate, allowing for the finalization of the winding down process.

A shareholder resolution to dissolve corporation agreement is an authorization used when shareholders, during a formal meeting, agree to dissolve the corporation.